- United States

- /

- Software

- /

- NasdaqGS:INTA

Increases to CEO Compensation Might Be Put On Hold For Now at Intapp, Inc. (NASDAQ:INTA)

Key Insights

- Intapp's Annual General Meeting to take place on 18th of November

- Salary of US$501.0k is part of CEO John Hall's total remuneration

- Total compensation is 35% above industry average

- Intapp's total shareholder return over the past three years was 89% while its EPS grew by 64% over the past three years

Performance at Intapp, Inc. (NASDAQ:INTA) has been reasonably good and CEO John Hall has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 18th of November. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

See our latest analysis for Intapp

Comparing Intapp, Inc.'s CEO Compensation With The Industry

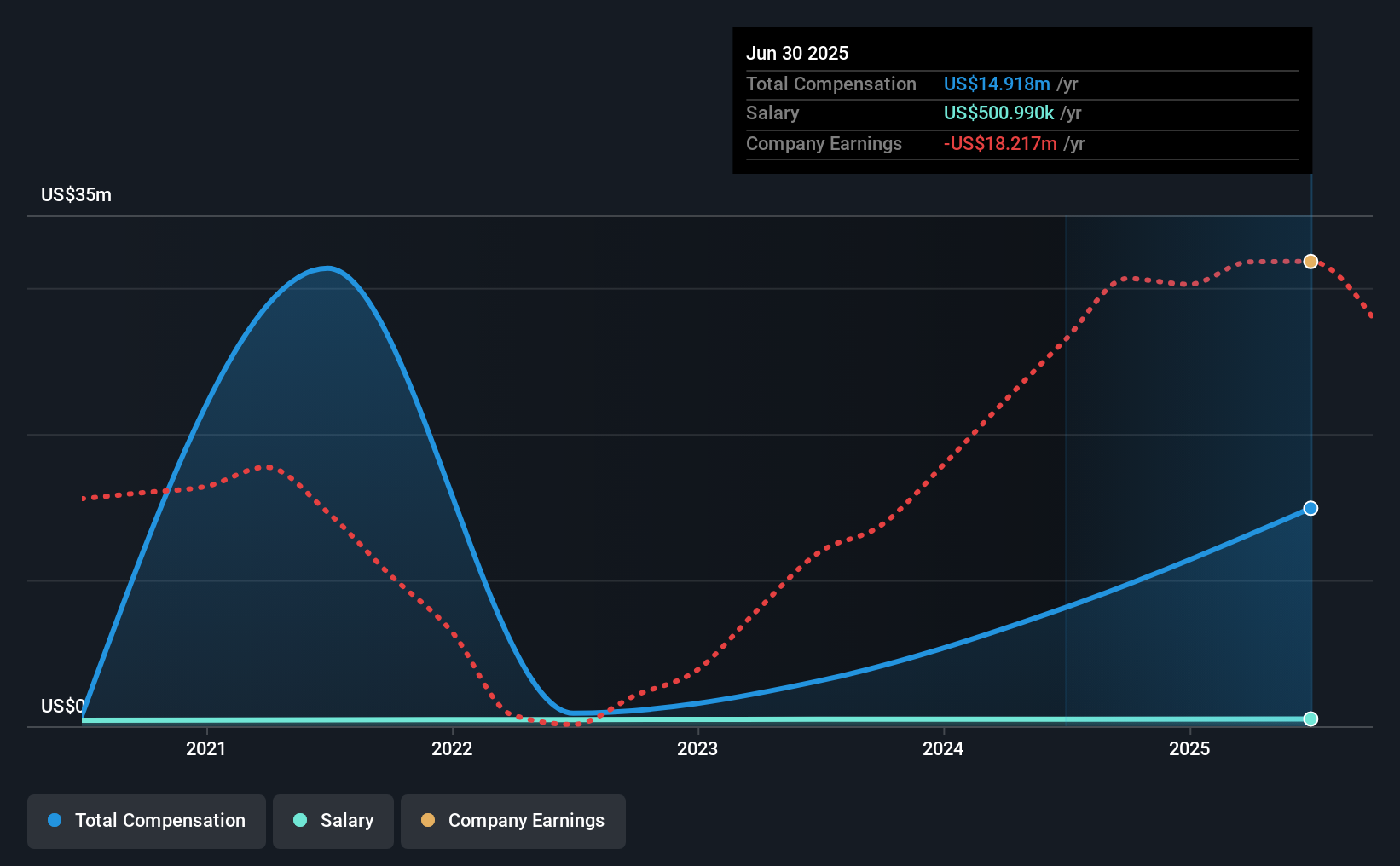

According to our data, Intapp, Inc. has a market capitalization of US$3.1b, and paid its CEO total annual compensation worth US$15m over the year to June 2025. We note that's an increase of 84% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$501k.

On examining similar-sized companies in the American Software industry with market capitalizations between US$2.0b and US$6.4b, we discovered that the median CEO total compensation of that group was US$11m. This suggests that John Hall is paid more than the median for the industry. What's more, John Hall holds US$228m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | US$501k | US$486k | 3% |

| Other | US$14m | US$7.6m | 97% |

| Total Compensation | US$15m | US$8.1m | 100% |

Talking in terms of the industry, salary represented approximately 11% of total compensation out of all the companies we analyzed, while other remuneration made up 89% of the pie. A high-salary is usually a no-brainer when it comes to attracting the best executives, but Intapp paid John Hall a nominal salary to the CEO over the past 12 months, instead focusing on non-salary compensation. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Intapp, Inc.'s Growth Numbers

Intapp, Inc. has seen its earnings per share (EPS) increase by 64% a year over the past three years. It achieved revenue growth of 17% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Intapp, Inc. Been A Good Investment?

Most shareholders would probably be pleased with Intapp, Inc. for providing a total return of 89% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Intapp primarily uses non-salary benefits to reward its CEO. Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

Whatever your view on compensation, you might want to check if insiders are buying or selling Intapp shares (free trial).

Important note: Intapp is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:INTA

Intapp

Through its subsidiary, Integration Appliance, Inc., provides AI-powered solutions in the United States, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives