We note that the Intellicheck, Inc. (NASDAQ:IDN) CFO & COO, Jeffrey Ishmael, recently sold US$84k worth of stock for US$2.28 per share. It wasn't a huge sale, but it did reduce their holding by 14%. This does not instill confidence.

View our latest analysis for Intellicheck

The Last 12 Months Of Insider Transactions At Intellicheck

Notably, that recent sale by CFO & COO Jeffrey Ishmael was not the only time they sold Intellicheck shares this year. They previously made an even bigger sale of -US$102k worth of shares at a price of US$3.95 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is US$2.29. So it may not shed much light on insider confidence at current levels.

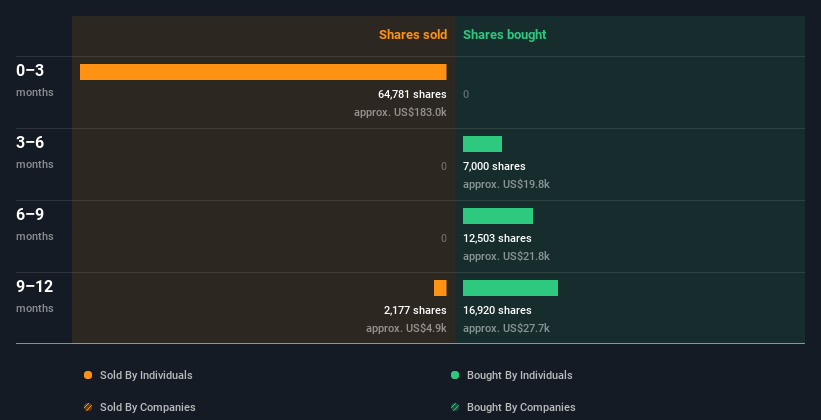

Over the last year, we can see that insiders have bought 36.42k shares worth US$69k. But insiders sold 66.96k shares worth US$191k. In total, Intellicheck insiders sold more than they bought over the last year. They sold for an average price of about US$2.86. We are not joyful about insider selling. But we note that the selling, on average, was at well above the recently traded price of US$2.29. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. From our data, it seems that Intellicheck insiders own 7.0% of the company, worth about US$3.0m. Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

What Might The Insider Transactions At Intellicheck Tell Us?

An insider hasn't bought Intellicheck stock in the last three months, but there was some selling. Despite some insider buying, the longer term picture doesn't make us feel much more positive. When you consider that most companies have higher levels of insider ownership, we're a little wary. So we're not rushing to buy, to say the least. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Intellicheck. Every company has risks, and we've spotted 3 warning signs for Intellicheck you should know about.

But note: Intellicheck may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:IDN

Intellicheck

A technology company, provides on-demand digital identity validation solutions for KYC, fraud, and age verification needs in North America.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026