- United States

- /

- Software

- /

- NasdaqGS:HUT

Does the Recent Digital Asset Expansion Make Hut 8 a Smart Pick in 2025?

Reviewed by Bailey Pemberton

- Wondering whether Hut 8 stock is actually a good value right now? You are not alone, and we are here to break down what makes this company a standout or a stay-away from a valuation perspective.

- Hut 8’s share price has surged by an impressive 99.0% year-to-date and is up 73.9% over the past year, but the last month saw a -14.0% decline, which may have shifted perceptions around risk or opportunity.

- Recent news has been buzzing about Hut 8’s strategic initiatives to expand its digital asset infrastructure, which has caught the interest of growth-focused investors. Industry analysts are also taking note of broader optimism in the cryptocurrency and blockchain sectors, fueling some of the volatility seen in the stock.

- When it comes to valuation, Hut 8 scores just 1 out of 6 on our undervaluation checks. This is a signal to dig deeper into the metrics. We will explore several approaches to valuation below, but keep reading for a perspective that goes beyond the standard methods.

Hut 8 scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hut 8 Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting them to today's dollar value. This approach helps investors gauge what a company is truly worth based on its ability to generate cash, rather than on market hype or sentiment.

For Hut 8, the most recent reported Free Cash Flow (FCF) is -$239.8 million, indicating the business currently invests more cash than it generates. Analyst estimates project that FCF could turn positive by 2028, reaching $85.1 million, with continued increases forecast in the following years. Over the next decade, cash flows are estimated to steadily climb, reaching as high as $442.7 million by 2035. Most estimates beyond five years are extrapolated from current and near-term analyst inputs.

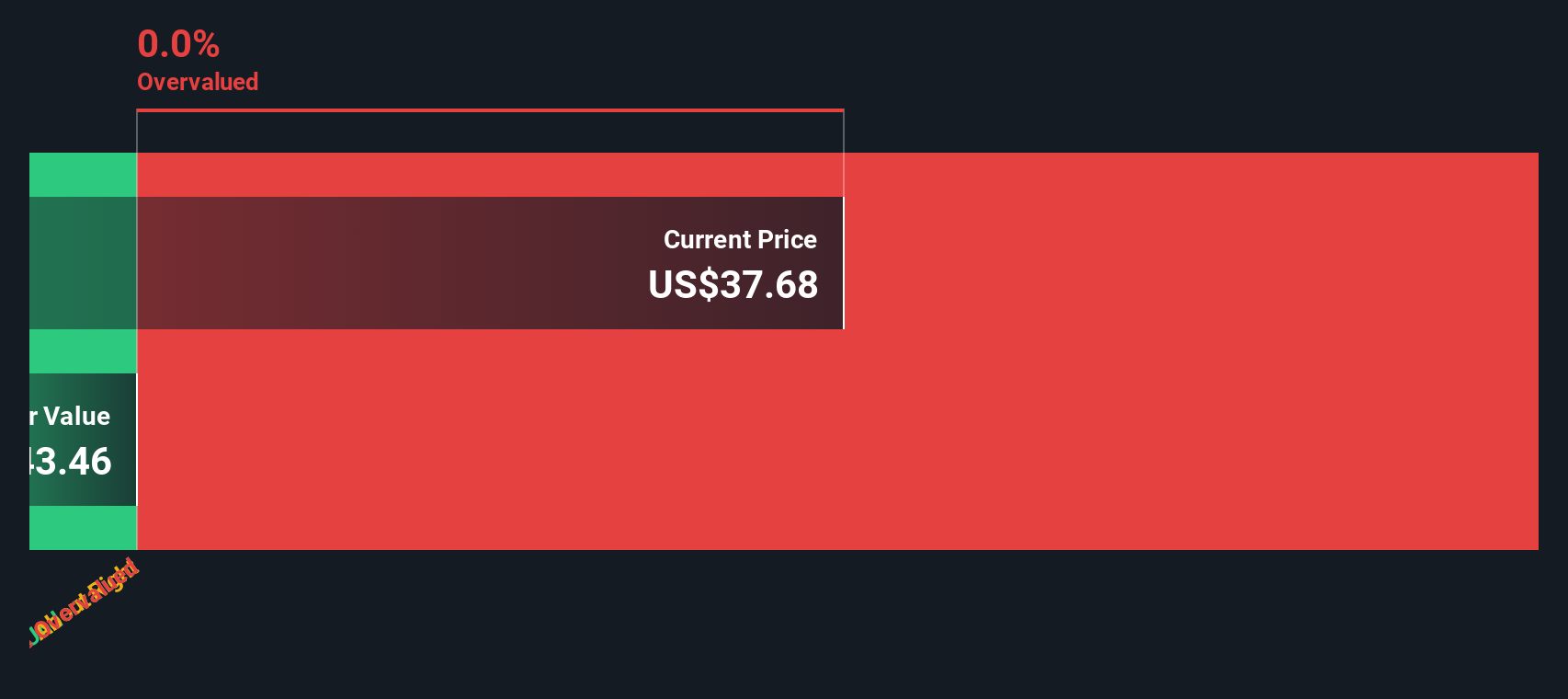

Based on these projections, Hut 8’s DCF-derived intrinsic value per share is $25.05. This figure is 73.9% lower than the current share price, which may indicate the stock is significantly overvalued using this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hut 8 may be overvalued by 73.9%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

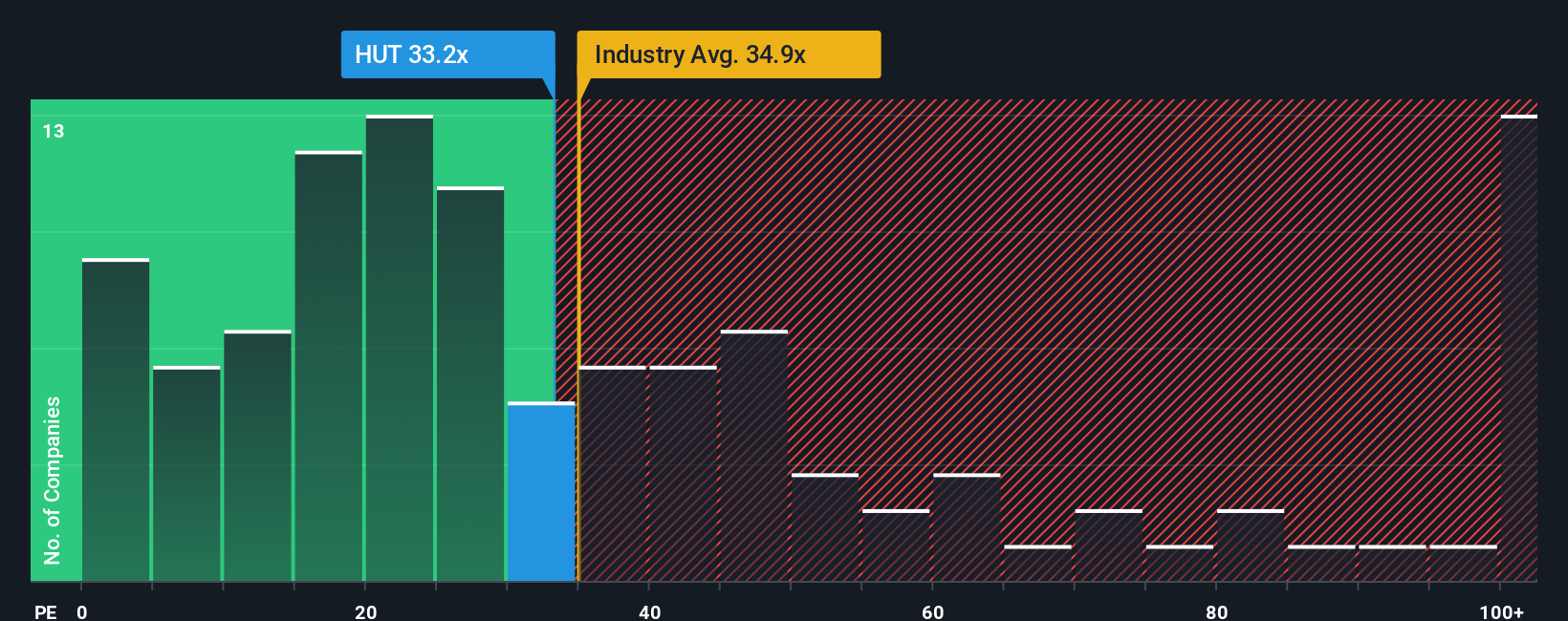

Approach 2: Hut 8 Price vs Earnings

Price-to-Earnings (PE) ratio is a favored valuation metric for profitable companies because it directly reflects how much investors are willing to pay for each dollar of current earnings. A "normal" or "fair" PE ratio is influenced by several factors, most notably investor expectations for a company's growth and the risks associated with that growth. Generally, companies with higher expected earnings growth and lower risks tend to command higher PE multiples, while lower-growth or riskier stocks trade at lower ratios.

Hut 8 currently trades at a PE ratio of 23.1x. To put this into perspective, the average PE ratio among peers is significantly lower at -18.3x, which may reflect negative earnings among competitors. Meanwhile, the broader software industry holds an average PE of 32.0x. By these broad benchmarks, Hut 8 appears reasonably valued within its sector, though industry averages do not always account for company-specific factors.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. The Fair Ratio, calculated as 7.9x for Hut 8, takes a more nuanced approach by factoring in the company’s unique earnings growth prospects, profit margins, industry norms, market capitalization, and the specific risks it faces. Unlike generic industry or peer comparisons, the Fair Ratio offers a tailored standard that reflects what would actually be a reasonable multiple for Hut 8 given all relevant variables.

Comparing Hut 8’s actual PE ratio of 23.1x to its Fair Ratio of 7.9x, the stock currently trades well above what would be considered fair value by these standards. This may indicate that investors are pricing in more growth or less risk than the underlying fundamentals support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hut 8 Narrative

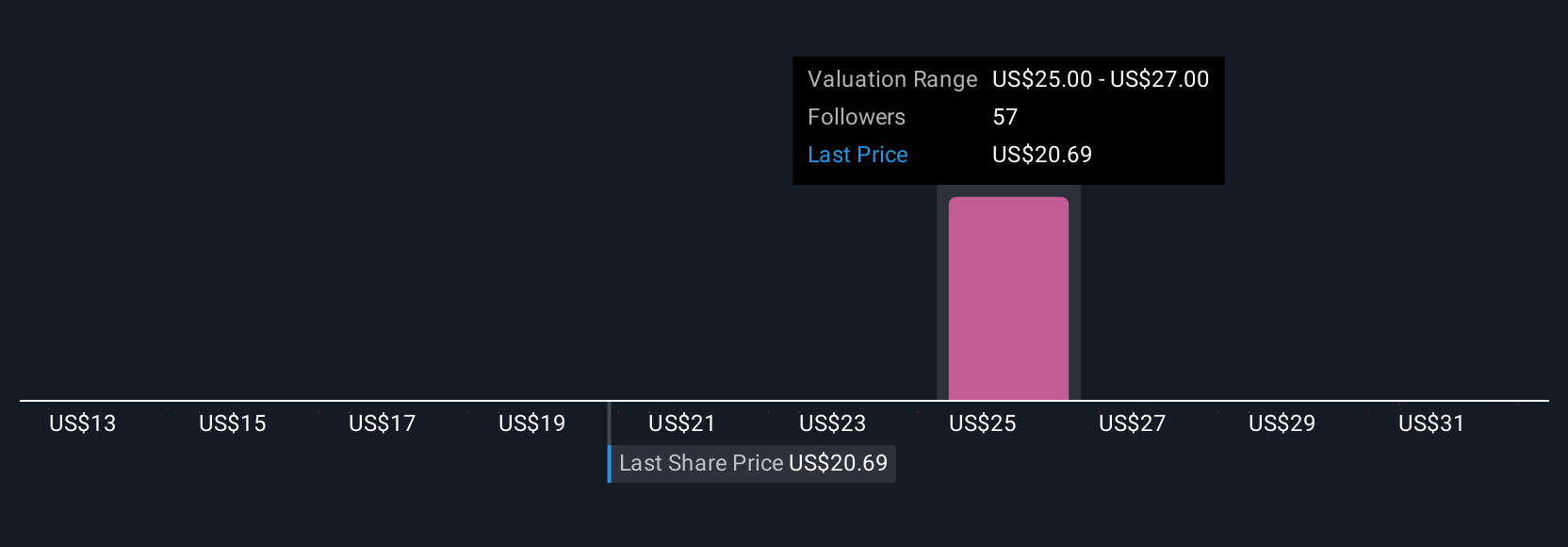

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized storyline for a company, anchoring your assumptions about future revenue, earnings, and profit margins to a fair value you believe reflects reality, rather than just market momentum or industry averages.

Instead of relying on static ratios or backward-looking figures, Narratives help you connect Hut 8’s evolving business story to dynamic forecasts, making it easy to link what you believe will happen to what the stock might actually be worth. On Simply Wall St’s Community page, millions of investors use Narratives to compare their fair value estimates to the current share price and evaluate buy or sell decisions accordingly.

What makes Narratives especially powerful is how they update in real time when new headlines, earnings reports, or regulatory changes are announced, ensuring your outlook is always based on the freshest information. For Hut 8, for example, some investors build bullish Narratives around large AI infrastructure deals and a consensus analyst price target as high as $33.00, while others focus on regulatory threats or earnings volatility, putting their fair value as low as $23.00. By crafting and following your own Narrative, you can make smarter, more informed investment decisions that truly reflect your understanding and conviction in Hut 8’s future.

Do you think there's more to the story for Hut 8? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUT

Hut 8

Operates as a vertically integrated operator of energy infrastructure and Bitcoin miners in North America.

Slight risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026