- United States

- /

- Software

- /

- NasdaqGS:GTLB

Why We're Not Concerned Yet About GitLab Inc.'s (NASDAQ:GTLB) 28% Share Price Plunge

GitLab Inc. (NASDAQ:GTLB) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 15% in that time.

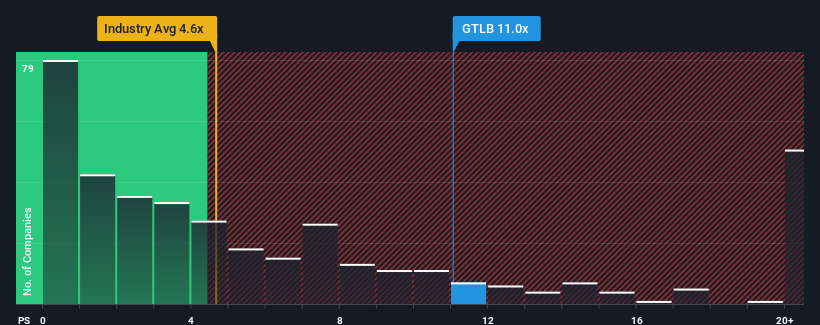

In spite of the heavy fall in price, GitLab may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 11x, when you consider almost half of the companies in the Software industry in the United States have P/S ratios under 4.7x and even P/S lower than 1.9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for GitLab

How GitLab Has Been Performing

Recent times have been advantageous for GitLab as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on GitLab will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For GitLab?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like GitLab's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 31% gain to the company's top line. Pleasingly, revenue has also lifted 201% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 24% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 21% per year, which is noticeably less attractive.

In light of this, it's understandable that GitLab's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does GitLab's P/S Mean For Investors?

A significant share price dive has done very little to deflate GitLab's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of GitLab's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware GitLab is showing 3 warning signs in our investment analysis, and 1 of those is concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GTLB

GitLab

Develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion