- United States

- /

- Software

- /

- NasdaqGS:GTLB

GitLab (GTLB): Evaluating the Stock’s Value After Strong Earnings, CFO Exit, and Cautious Guidance

Reviewed by Simply Wall St

If you are following GitLab (GTLB), this past week probably had you double-checking your portfolio. The company delivered impressive second-quarter results, with revenue jumping 29% year-over-year and earnings comfortably ahead of estimates. However, within hours of announcing these numbers, GitLab revealed that CFO Brian Robins is stepping down. This move, combined with their cautious revenue outlook for the next quarter, sent the stock down sharply and rattled investor confidence.

It is an interesting twist for a company that has managed to post consistent growth even as competitive pressures in software development intensify. So far this year, GitLab shares are down 19% and trailing last year’s performance as well. Market momentum has faded: the stock gave up 6% in the past three months, even though it surged 13% over the last month before these latest announcements. Leadership turnover, paired with signals of slowing revenue growth, are clearly weighing on how investors price GitLab’s long-term potential.

After this run of volatility, is GitLab a bargain for growth-focused investors, or are markets already pricing in everything management hopes to deliver?

Most Popular Narrative: 26% Undervalued

The most widely followed narrative suggests GitLab shares are undervalued by more than a quarter. This view hinges on forecasts of strong revenue growth, emerging AI integrations, and assumptions about future profitability levels eventually reaching industry standards.

GitLab's expansion of AI-driven capabilities across its DevSecOps platform, including the upcoming Duo Agent Platform with hybrid usage-based monetization, is expected to capture increased demand for automation and developer productivity tools. This could accelerate revenue growth and expand margins as high-value features command premium pricing and upsell opportunities.

Curious about why analysts think GitLab could be trading far below its true potential? The narrative’s bullish view leans on a bold vision of future growth and profit margins that rival the sector’s biggest names. Wondering which performance milestones and market shifts could make or break these high expectations? Discover the projections that have Wall Street buzzing.

Result: Fair Value of $61.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition and execution risks related to leadership changes could easily disrupt GitLab's optimistic growth outlook and threaten long-term margin improvement.

Find out about the key risks to this GitLab narrative.Another Perspective: Market-Based View

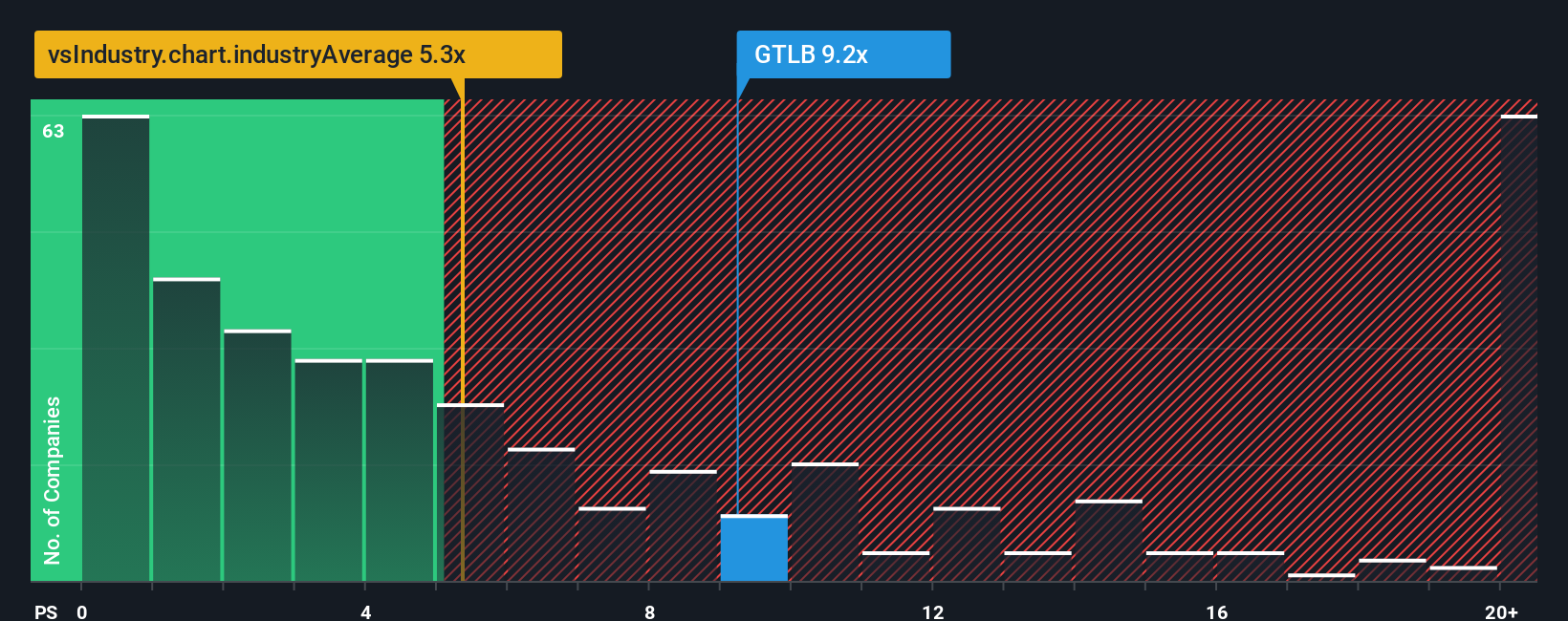

Looking through the lens of market pricing, GitLab’s valuation appears high compared to the broader software sector. This approach questions how much future profit is already built into today’s share price, which sparks debate among investors.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GitLab Narrative

If these perspectives do not align with your own, or you want to investigate the numbers firsthand, you can easily craft your own analysis of GitLab in just minutes. Do it your way.

A great starting point for your GitLab research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Now is the perfect time to broaden your portfolio with handpicked stock ideas. Let the Simply Wall Street Screener help you spot untapped potential and keep you ahead of the crowd.

- Uncover value gems trading below their true worth by checking out undervalued stocks based on cash flows. These options could strengthen your holdings.

- Spot companies that are shaking up artificial intelligence and positioning themselves at the forefront of tomorrow’s tech by browsing AI penny stocks.

- Access opportunities among rising stars with both affordable stock prices and robust financials inside penny stocks with strong financials, so you never miss the next breakout.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:GTLB

GitLab

Develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Dentsply Sirona Stock: Dental Technology Built for Cycles, Not Headlines

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion