- United States

- /

- Software

- /

- NasdaqGS:GTLB

Did GitLab's (GTLB) Strong ARR Growth and High Margins Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- GitLab recently reported that its annual recurring revenue grew at an average rate of 30.9% year on year and its gross margin remains around 88.5%, highlighting robust customer engagement and continued efficiency in its SaaS business model.

- These results suggest that GitLab's DevSecOps platform is strengthening its appeal among organizations seeking a single, integrated solution for software development, security, and operations.

- We'll consider how GitLab's impressive revenue growth and exceptional gross margin affect the company's longer-term investment case.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

GitLab Investment Narrative Recap

To be a GitLab shareholder, you need to believe in the company's ability to extend its high-margin, integrated platform advantage in the crowded DevSecOps market. While the recent news of accelerating annual recurring revenue and healthy gross margins reiterates GitLab’s customer stickiness, it doesn’t immediately address the near-term risk of slowing new customer growth, which remains a critical challenge to sustainable momentum.

Among recent announcements, the launch of the GitLab Duo Agent Platform stands out for its potential to accelerate adoption of AI-driven DevSecOps capabilities, directly tying into revenue growth and client expansion. By enhancing the product’s value proposition and monetization options, this move aligns with GitLab’s efforts to deepen engagement with enterprise accounts and attract new business.

Yet, in contrast, investors should pay close attention to execution risks tied to recent executive turnover and how this could disrupt...

Read the full narrative on GitLab (it's free!)

GitLab's narrative projects $1.4 billion revenue and $189.5 million earnings by 2028. This requires 21.6% yearly revenue growth and a $176.5 million earnings increase from $13.0 million today.

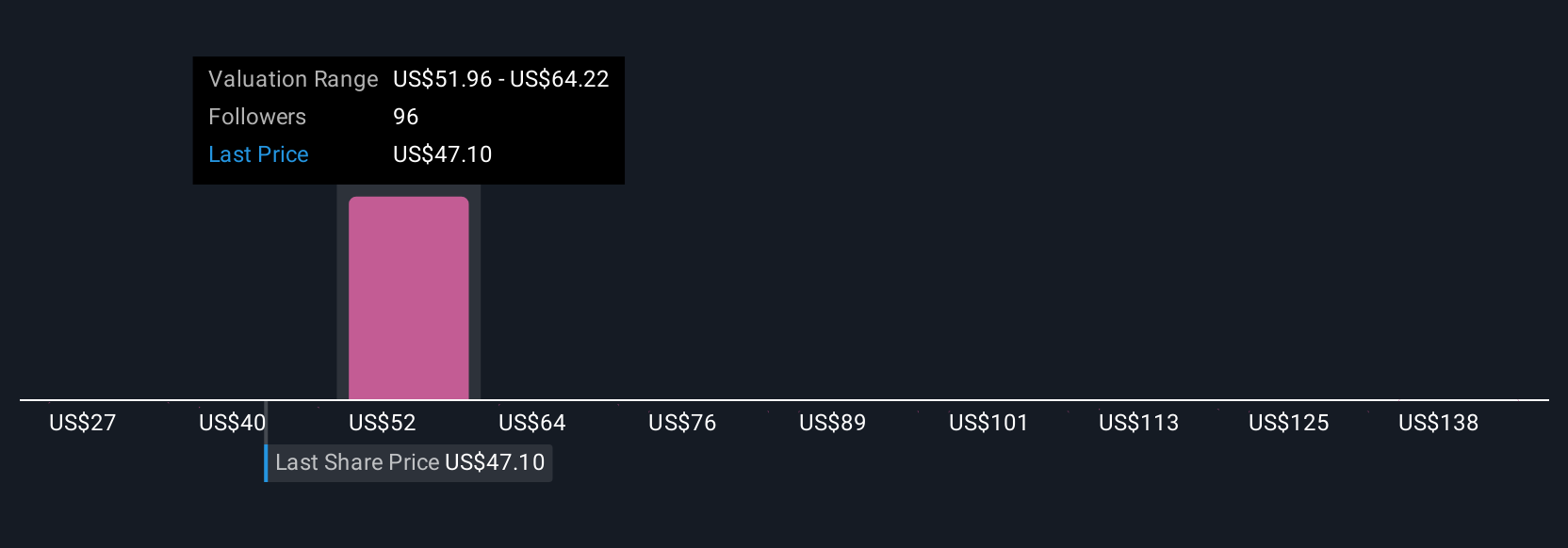

Uncover how GitLab's forecasts yield a $58.64 fair value, a 26% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community produced 22 fair value estimates for GitLab shares, spanning US$27.92 to US$150 per share. With current news highlighting robust customer retention, it's evident that opinions vary greatly and you’ll want to weigh these different viewpoints for yourself.

Explore 22 other fair value estimates on GitLab - why the stock might be worth over 3x more than the current price!

Build Your Own GitLab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GitLab research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free GitLab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GitLab's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTLB

GitLab

Develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives