- United States

- /

- Software

- /

- NasdaqGS:GTLB

A Fresh Look at GitLab (GTLB) Valuation as AI Reshapes DevSecOps and Compliance

GitLab (GTLB) just published its Global DevSecOps report, spotlighting the real-world impact of AI on software development. The study explores how faster coding brings new compliance hurdles and fragmented workflows.

See our latest analysis for GitLab.

GitLab’s latest report builds on a run of product launches and business updates, but investors have had a bumpy ride lately. Despite upbeat news about recurring revenue and platform growth, the 1-year total shareholder return is -22.4%, reflecting shifting confidence and a reassessment of growth risks. Short-term price momentum has picked up with a 12% share price return over the last 90 days, indicating that sentiment could be turning a corner.

Curious where else tech innovation might lead to outsized gains? It might be a great time to see what’s next in the sector with our See the full list for free.

With shares still trading at a discount to analyst price targets despite strong product momentum, investors are left to consider whether the market is offering a genuine entry point or if it is already factoring in all of GitLab’s coming growth.

Most Popular Narrative: 20.7% Undervalued

GitLab’s most widely followed narrative sees fair value notably higher than the last close price of $46.53, suggesting the market could be too cautious given its future prospects. With recent platform strength and discounted pricing, the story is underpinned by projected revenue and margin expansion, but also hinges on ambitious long-term execution.

GitLab's expansion of AI-driven capabilities across its DevSecOps platform, including the upcoming Duo Agent Platform with hybrid usage-based monetization, is expected to capture increased demand for automation and developer productivity tools. This could potentially accelerate revenue growth and expand margins as high-value features command premium pricing and upsell opportunities.

Want to know what underpins this bold valuation call? The narrative’s assumptions hint at a strategic push for both sales and margin gains using next-gen technology and platform leverage, along with strong expectations for future growth. Find out which numbers drive this optimistic view behind the headline fair value.

Result: Fair Value of $58.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from tech giants and GitLab's slowing new customer growth could quickly challenge even the most optimistic forecasts for long-term expansion.

Find out about the key risks to this GitLab narrative.

Another View: Market Multiple Tells a Different Story

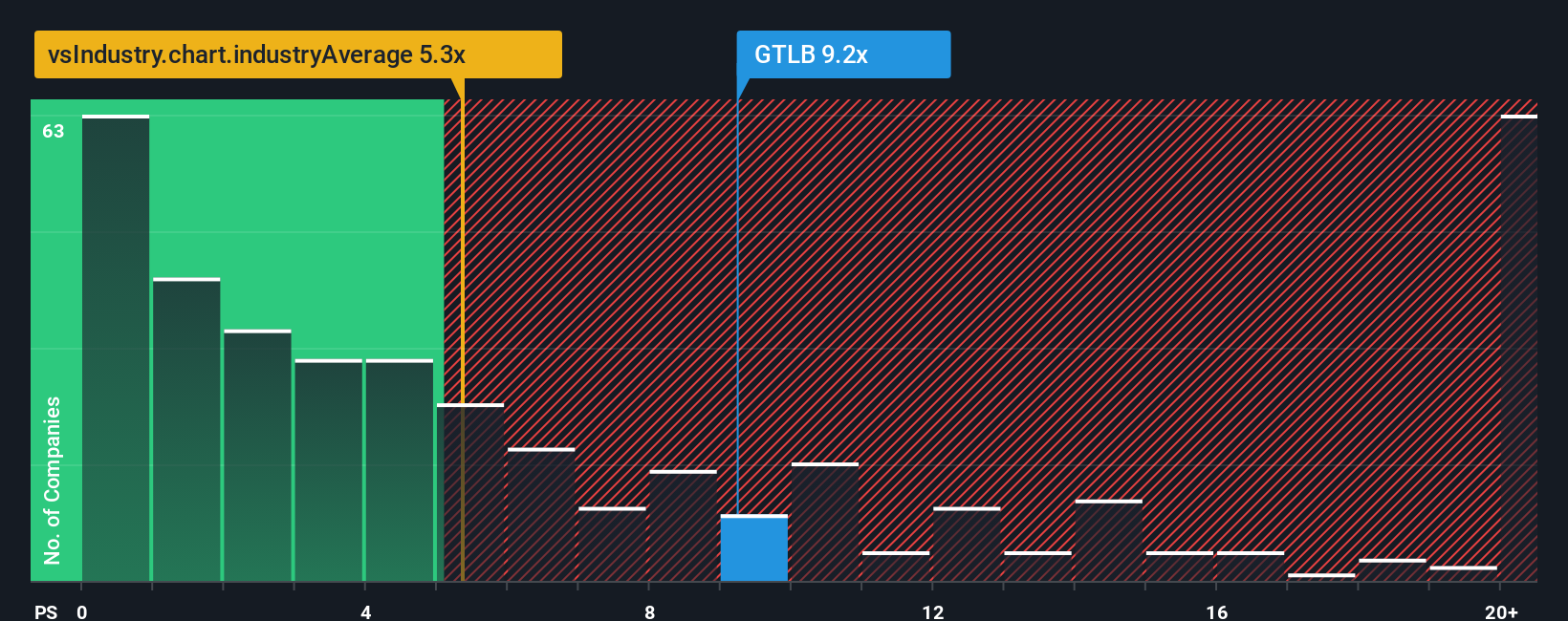

Looking from a different angle, GitLab actually trades at a higher price-to-sales ratio than both its peer average and the broader US Software industry. The ratios stand at 9x compared to 8.4x and 4.9x, respectively. While our estimated fair ratio is 9.9x, this premium suggests the stock still carries valuation risk if the market’s enthusiasm fades. Is the market getting ahead of itself, or could growth deliver on this pricing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GitLab Narrative

If you see things differently, or would rather dig into the numbers yourself, you can craft your own GitLab story in just a few minutes with Do it your way.

A great starting point for your GitLab research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunities pass you by when there are standout stocks across the market waiting for your attention. Get ahead and seize the moment by using these powerful screeners:

- Capture explosive growth potential by reviewing these 3575 penny stocks with strong financials. These stocks balance affordable entry prices with strong underlying business fundamentals.

- Tap into the frontier of healthcare breakthroughs and see which companies are shaping tomorrow’s medicine with these 32 healthcare AI stocks.

- Power up your portfolio with steady yields by exploring these 15 dividend stocks with yields > 3%. These have consistently delivered reliable income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTLB

GitLab

Develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

This strategic transformation of TTE? Significant re-rating potential

Q3 Outlook modestly optimistic

Okamoto Machine Tool Works focus on profitability

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.