- United States

- /

- Software

- /

- NasdaqCM:GRRR

Why Gorilla Technology Group (GRRR) Is Up 18.5% After $1.4 Billion AI Data Center Deal Announcement

Reviewed by Simply Wall St

- On September 20, 2025, Freyr Singapore announced a US$1.4 billion contract with Gorilla Technology Group to build and operate AI-powered data centers in Indonesia, Malaysia, and Thailand, with work commencing in Indonesia in late 2025 as part of a US$300 million first phase.

- This large-scale agreement positions Gorilla as the main operator, sets up the companies to pursue additional data center opportunities worth US$2.5 billion and highlights growing regional demand for advanced AI infrastructure.

- We now assess how this major multi-year contract win could reshape Gorilla Technology Group’s investment narrative and future project pipeline.

Find companies with promising cash flow potential yet trading below their fair value.

Gorilla Technology Group Investment Narrative Recap

For Gorilla Technology Group, investors need to believe in the company’s ability to capture multi-year, high-value AI infrastructure contracts in rapidly growing Southeast Asian markets. The newly announced US$1.4 billion contract as principal operator, while significantly raising Gorilla’s short-term revenue visibility and elevating its industry profile, does not eliminate near-term risks tied to execution in emerging markets, particularly project delays and payment uncertainty, which remain the biggest threats to stable operating cash flow and revenue recognition. The contract may smoothen Gorilla’s path to recurring revenues, but project milestones and successful early delivery are critical to shifting the biggest risk narrative for the stock.

Against this backdrop, Gorilla’s July 2025 follow-on equity offering, which raised US$104.99 million, remains highly relevant. The fresh capital improves the company’s ability to support large-scale project bonds and upfront requirements for contracts like the Freyr deal, but ongoing dilution continues to be a concern for shareholders even as new contracts drive higher revenue opportunities.

By contrast, investors should be aware that even as contract wins grow, project timelines and milestone payments can...

Read the full narrative on Gorilla Technology Group (it's free!)

Gorilla Technology Group's outlook anticipates $201.8 million in revenue and $57.2 million in earnings by 2028. This projection is based on a 29.3% annual revenue growth rate and a $132.1 million increase in earnings from the current level of -$74.9 million.

Uncover how Gorilla Technology Group's forecasts yield a $36.50 fair value, a 70% upside to its current price.

Exploring Other Perspectives

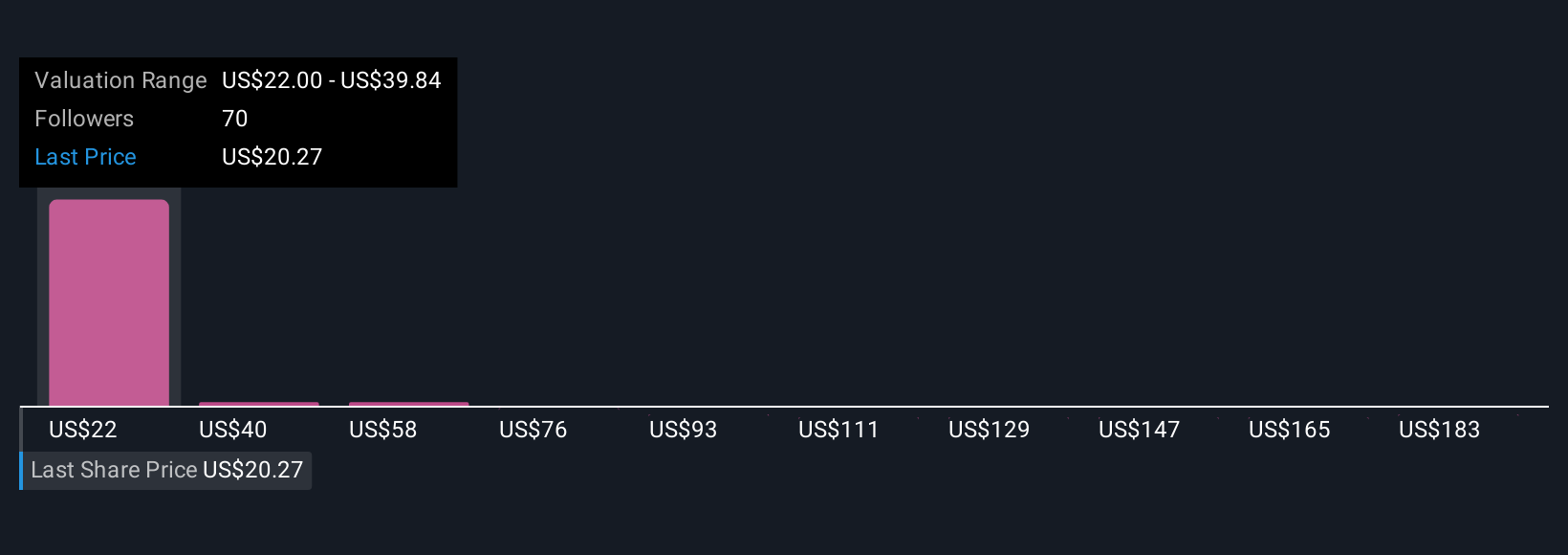

Twenty-one perspectives from the Simply Wall St Community put Gorilla’s fair value between US$22 and US$200.36 per share. While high multi-year contract growth offers excitement, the threat of execution risk in project delivery periods still looms and invites a wide range of views on future performance.

Explore 21 other fair value estimates on Gorilla Technology Group - why the stock might be worth just $22.00!

Build Your Own Gorilla Technology Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gorilla Technology Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Gorilla Technology Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gorilla Technology Group's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GRRR

Gorilla Technology Group

Provides solutions in security, network, business intelligence, and Internet of Things (IoT) technology in Taiwan and the United Kingdom.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success