- United States

- /

- Software

- /

- NasdaqCM:GRRR

What Gorilla Technology Group (GRRR)'s $1.4 Billion AI Data Center Deal Means For Shareholders

Reviewed by Sasha Jovanovic

- Gorilla Technology Group reported record third-quarter results, with revenue rising to US$26.48 million and announcing a breakthrough US$1.4 billion AI data center contract in Southeast Asia, expanding its project pipeline to over US$7 billion.

- This combination of robust operational delivery and sizeable new contracts is fueling optimism about the company’s growth potential across AI infrastructure and enterprise markets.

- We’ll explore how the major AI data center contract announcement could reshape Gorilla Technology’s investment narrative and outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Gorilla Technology Group Investment Narrative Recap

To be a Gorilla Technology Group shareholder, you have to believe the company will execute consistently on multiyear AI infrastructure and public sector projects, converting its growing contract pipeline into recurring revenue while navigating the risks of project delays and market volatility. The recent record Q3 results and US$1.4 billion AI data center contract meaningfully strengthen the near-term revenue outlook but do not fully offset key risks, especially the potential for significant timing uncertainties and cash flow swings from large contracts.

Among recent company announcements, the US$1.4 billion three-year contract with Freyr to build AI-powered data centers in Southeast Asia stands out as highly relevant. This contract anchors Gorilla’s US$7 billion pipeline and is expected to start contributing revenue from early 2026, underscoring new revenue visibility and supporting the company’s plans for operating cash flow positivity.

By contrast, investors should still closely monitor the risk that large, long-duration contracts, while impressive, bring heightened exposure to project delays and unpredictable payment timing, as these factors...

Read the full narrative on Gorilla Technology Group (it's free!)

Gorilla Technology Group's narrative projects $201.8 million revenue and $57.2 million earnings by 2028. This requires 29.3% yearly revenue growth and a $132.1 million earnings increase from -$74.9 million.

Uncover how Gorilla Technology Group's forecasts yield a $36.50 fair value, a 174% upside to its current price.

Exploring Other Perspectives

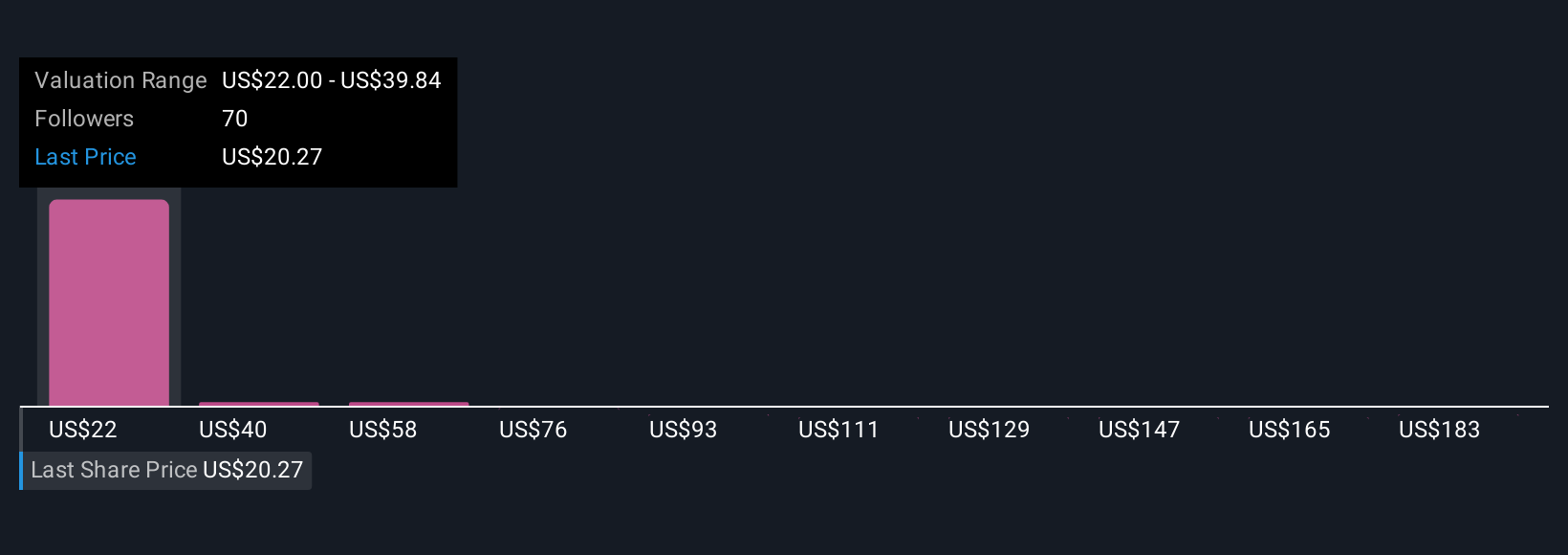

Twenty-three fair value estimates from the Simply Wall St Community range from US$22 to US$200.36 per share, showing wide disagreement. Against this, recurring revenue from AI and smart city contracts remains the most important theme for Gorilla's long-term performance, keep exploring the range of views.

Explore 23 other fair value estimates on Gorilla Technology Group - why the stock might be a potential multi-bagger!

Build Your Own Gorilla Technology Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gorilla Technology Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Gorilla Technology Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gorilla Technology Group's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GRRR

Gorilla Technology Group

Provides solutions in security, network, business intelligence, and Internet of Things (IoT) technology in Taiwan and the United Kingdom.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives