- United States

- /

- Software

- /

- NasdaqCM:GRRR

Investors Give Gorilla Technology Group Inc. (NASDAQ:GRRR) Shares A 30% Hiding

Gorilla Technology Group Inc. (NASDAQ:GRRR) shares have retraced a considerable 30% in the last month, reversing a fair amount of their solid recent performance. For any long-term shareholders, the last month ends a year to forget by locking in a 80% share price decline.

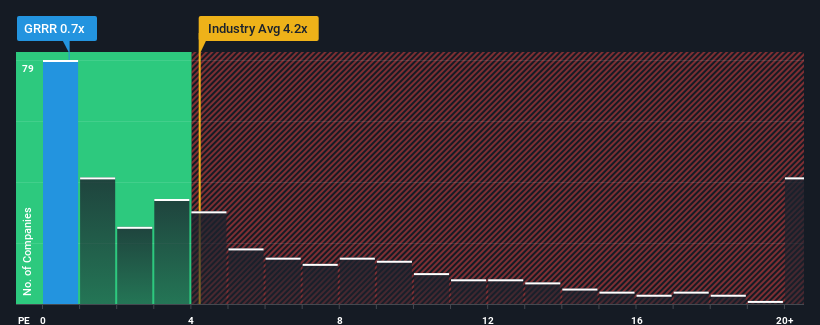

Following the heavy fall in price, Gorilla Technology Group may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.2x and even P/S higher than 10x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Gorilla Technology Group

What Does Gorilla Technology Group's Recent Performance Look Like?

Recent times have been advantageous for Gorilla Technology Group as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Gorilla Technology Group.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Gorilla Technology Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 189%. The strong recent performance means it was also able to grow revenue by 42% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 22% over the next year. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Gorilla Technology Group's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Shares in Gorilla Technology Group have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Gorilla Technology Group currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Gorilla Technology Group (at least 2 which make us uncomfortable), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GRRR

Gorilla Technology Group

Provides solutions in security, network, business intelligence, and Internet of Things (IoT) technology in Taiwan and the United Kingdom.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives