- United States

- /

- Software

- /

- NasdaqGS:GEN

How Gen Digital's (GEN) AI-Powered Threat Response Is Shaping Its Cybersecurity Investment Narrative

Reviewed by Sasha Jovanovic

- Gen Digital recently released its Q3 2025 Threat Report, revealing the emergence of 140,000 AI-generated phishing sites, an 82% surge in data breaches, and the widespread use of AI in scam text campaigns, while also announcing the discovery of a flaw in Midnight Ransomware and the launch of a free decryptor tool for victims.

- This report highlights the growing sophistication of cyber threats driven by generative AI and underscores Gen's active role in safeguarding consumers by promptly responding with practical cybersecurity solutions.

- We'll examine how Gen Digital's proactive release of a ransomware decryptor may reshape its investment narrative and industry positioning.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Gen Digital Investment Narrative Recap

At its core, the Gen Digital investment story depends on whether an investor believes the company can continuously deliver innovative cybersecurity solutions in response to a rapidly escalating threat environment, as highlighted by the Q3 2025 Threat Report. The urgent rise of AI-driven cyberattacks reinforces demand for Gen's offerings but also intensifies the need for substantial, ongoing R&D, making cost control a pivotal short-term catalyst and R&D spend management the key risk to margins and profit growth moving forward.

The release of a free decryptor tool for the Midnight Ransomware is a clear-cut example of Gen Digital's hands-on approach to high-profile cybersecurity events, directly supporting its platform's value proposition at a time when enterprises and individuals are facing more sophisticated threats. This move aligns closely with Gen's focus on AI-powered protection and could strengthen perceptions of its leadership while also raising expectations for rapid response and continuous innovation.

But on the other hand, investors should also consider the ongoing pressure created by increasing R&D costs and the possibility that...

Read the full narrative on Gen Digital (it's free!)

Gen Digital's outlook anticipates $5.3 billion in revenue and $1.2 billion in earnings by 2028. This reflects a 7.7% annual revenue growth rate and a $603 million increase in earnings from the current $597 million.

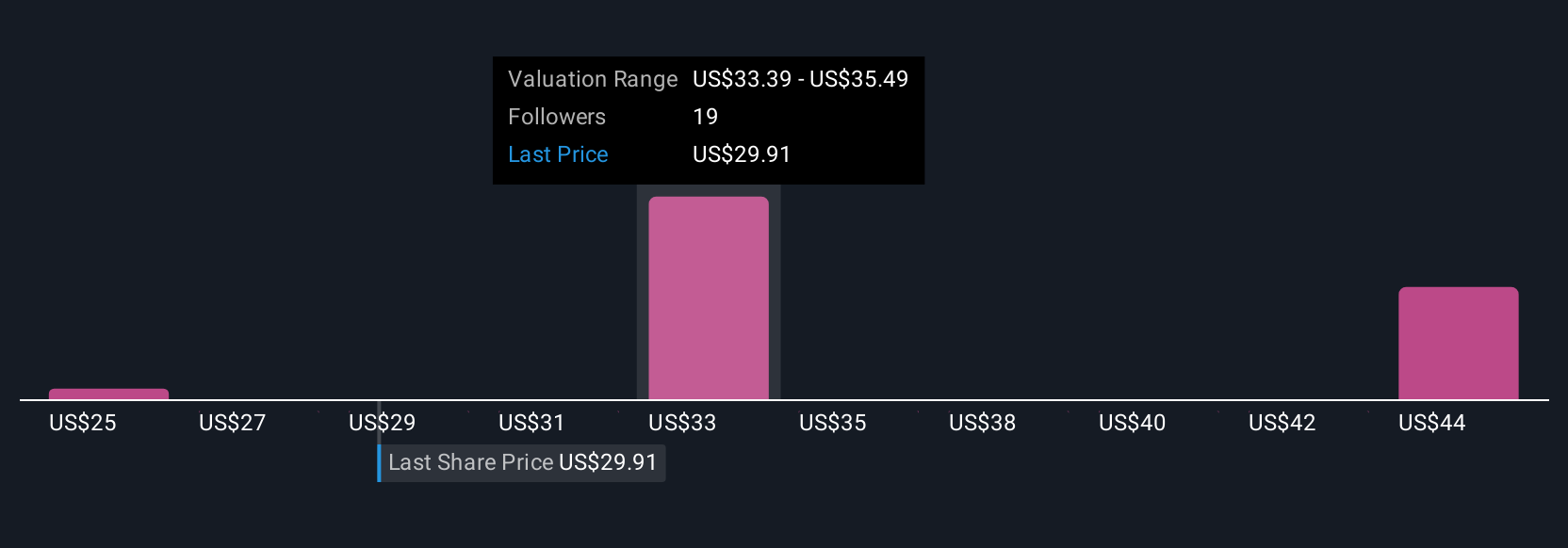

Uncover how Gen Digital's forecasts yield a $33.74 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Five individual fair value estimates from the Simply Wall St Community range from US$25.00 to US$34.12 per share. With ever-expanding AI-fueled cyber threats pushing Gen’s need for higher R&D investment, you can see how market outlook and risk appetite can influence very different views on value.

Explore 5 other fair value estimates on Gen Digital - why the stock might be worth as much as 31% more than the current price!

Build Your Own Gen Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gen Digital research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gen Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gen Digital's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEN

Gen Digital

Engages in the provision of cyber safety solutions for or individuals, families, and small businesses.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives