- United States

- /

- Software

- /

- NasdaqGS:GEN

Could Norton's New Deepfake Protection Shift Gen Digital's (GEN) Edge in AI Security?

Reviewed by Simply Wall St

- In late July 2025, Gen Digital introduced AI-powered deepfake protection in its Norton Genie AI Assistant for Norton 360 mobile apps, offering early access in select countries to help users detect and respond to manipulated audio and video content on platforms such as YouTube.

- This product launch marks an expansion of Gen Digital's cybersecurity capabilities to address the fast-evolving threat landscape posed by generative AI scams and deepfakes, responding to heightened consumer and regulatory concerns around digital trust.

- We'll examine how the launch of Norton's deepfake protection tool could influence Gen Digital's long-term growth prospects and market positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Gen Digital Investment Narrative Recap

The biggest belief an investor must hold in Gen Digital today is that integrating advanced AI features like deepfake protection will keep its Cyber Safety platform ahead of rising global threats and competition, driving ongoing customer demand and stickiness. This recent launch ties directly to the short-term catalyst of accelerating demand for AI-driven cybersecurity, while the largest risk remains potential integration challenges, and costs, stemming from new technologies and acquisitions. At this stage, the product launch appears additive to long-term differentiation, but does not outweigh the scale of risks tied to broader earnings variables.

Recent executive changes also stand out, particularly with CEO Vincent Pilette taking on the additional role of Board Chair. Effective leadership continuity could help manage the complexities of innovation rollouts and strategic integrations, supporting critical catalysts like market expansion and operational synergies amid evolving industry demands.

However, in contrast to the innovation story, investors should remain mindful of potential acquisition integration risks that could unexpectedly affect...

Read the full narrative on Gen Digital (it's free!)

Gen Digital's outlook anticipates $5.3 billion in revenue and $1.3 billion in earnings by 2028. This reflects an annual revenue growth rate of 10.2% and a $657 million increase in earnings from the current $643.0 million.

Uncover how Gen Digital's forecasts yield a $33.22 fair value, a 16% upside to its current price.

Exploring Other Perspectives

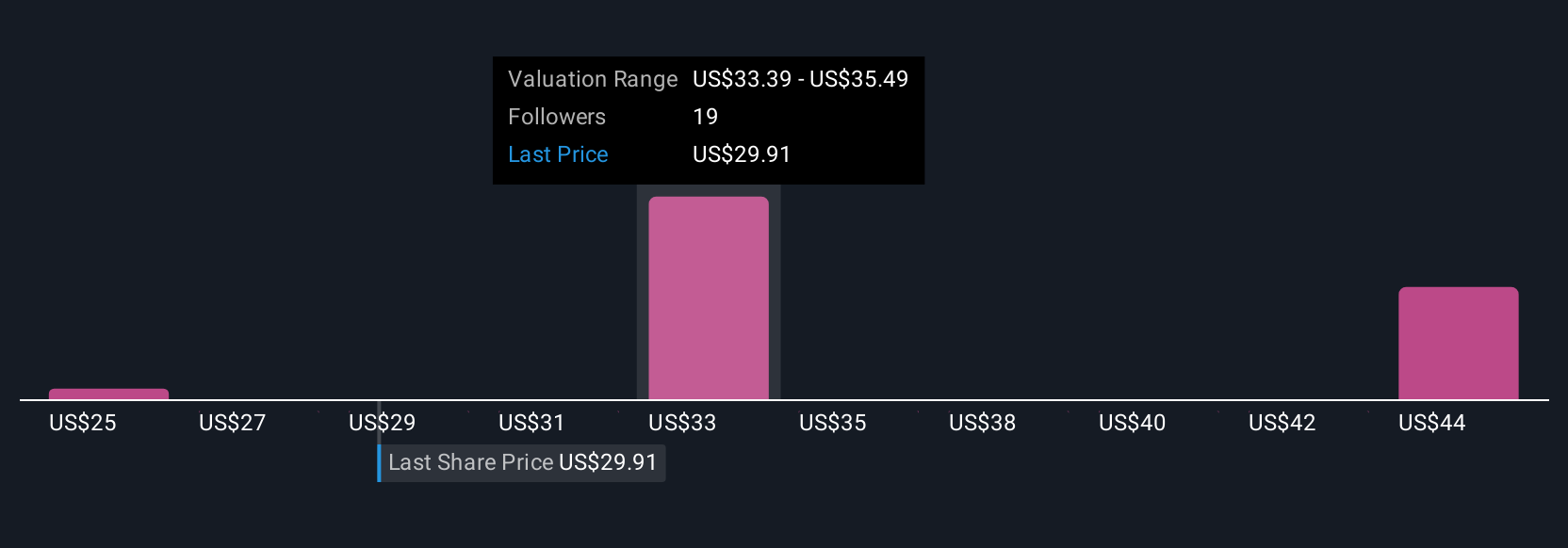

Two fair value estimates from the Simply Wall St Community put Gen Digital between US$33.22 and US$43.95 per share. With the product-driven catalyst of enhanced AI security, there are still widely differing views on future growth and risks to the company's trajectory.

Explore 2 other fair value estimates on Gen Digital - why the stock might be worth just $33.22!

Build Your Own Gen Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gen Digital research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Gen Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gen Digital's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEN

Gen Digital

Engages in the provision of cyber safety solutions for or individuals, families, and small businesses.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives