- United States

- /

- IT

- /

- NasdaqCM:GDYN

After Leaping 33% Grid Dynamics Holdings, Inc. (NASDAQ:GDYN) Shares Are Not Flying Under The Radar

Grid Dynamics Holdings, Inc. (NASDAQ:GDYN) shares have continued their recent momentum with a 33% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 78%.

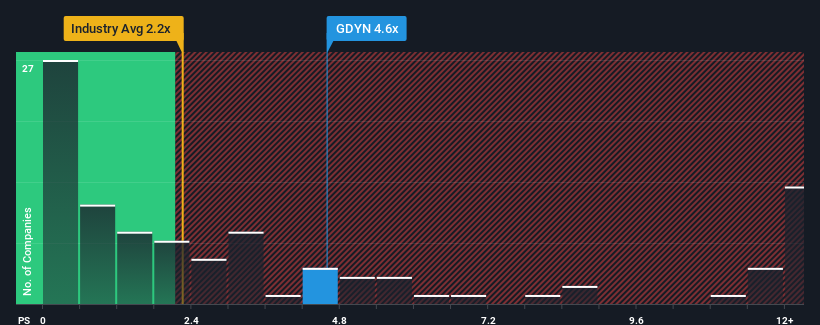

After such a large jump in price, given around half the companies in the United States' IT industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Grid Dynamics Holdings as a stock to avoid entirely with its 4.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Grid Dynamics Holdings

How Has Grid Dynamics Holdings Performed Recently?

With revenue growth that's inferior to most other companies of late, Grid Dynamics Holdings has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Grid Dynamics Holdings.Is There Enough Revenue Growth Forecasted For Grid Dynamics Holdings?

The only time you'd be truly comfortable seeing a P/S as steep as Grid Dynamics Holdings' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 4.1% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 88% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 19% during the coming year according to the six analysts following the company. That's shaping up to be materially higher than the 10% growth forecast for the broader industry.

In light of this, it's understandable that Grid Dynamics Holdings' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Grid Dynamics Holdings' P/S?

The strong share price surge has lead to Grid Dynamics Holdings' P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Grid Dynamics Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the IT industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Grid Dynamics Holdings, and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GDYN

Grid Dynamics Holdings

Provides technology consulting, platform and product engineering, and analytics services in North America, Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion