- United States

- /

- IT

- /

- NasdaqGM:GDS

GDS Holdings Limited's (NASDAQ:GDS) P/S Is Still On The Mark Following 31% Share Price Bounce

GDS Holdings Limited (NASDAQ:GDS) shares have continued their recent momentum with a 31% gain in the last month alone. The annual gain comes to 120% following the latest surge, making investors sit up and take notice.

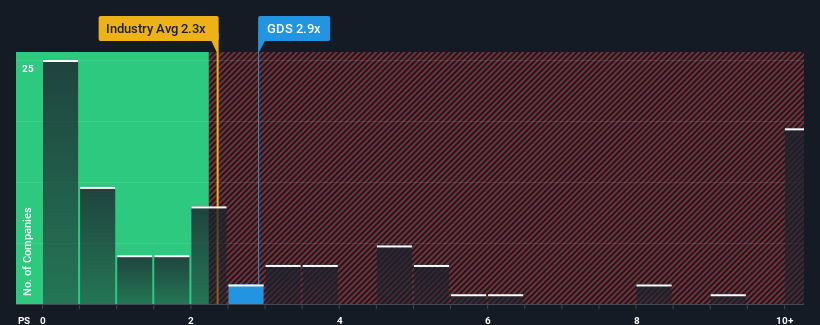

Following the firm bounce in price, when almost half of the companies in the United States' IT industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider GDS Holdings as a stock probably not worth researching with its 2.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for GDS Holdings

What Does GDS Holdings' Recent Performance Look Like?

Recent revenue growth for GDS Holdings has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on GDS Holdings will help you uncover what's on the horizon.How Is GDS Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, GDS Holdings would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.1% last year. This was backed up an excellent period prior to see revenue up by 57% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 12% per annum growth forecast for the broader industry.

In light of this, it's understandable that GDS Holdings' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

GDS Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into GDS Holdings shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 2 warning signs for GDS Holdings you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives