- United States

- /

- Software

- /

- NasdaqGM:FIVN

Five9 (FIVN): Evaluating Valuation After Earnings Beat, Cautious Outlook, and New Share Buyback Plan

Reviewed by Simply Wall St

Five9 (FIVN) grabbed market attention after its third-quarter earnings beat estimates, driven by strong enterprise AI growth. However, a cautious revenue forecast for next quarter and a new share buyback plan quickly shifted the conversation to future prospects.

See our latest analysis for Five9.

Despite an impressive streak of AI-driven growth and record third-quarter results, Five9’s shares have lost momentum, dropping nearly 51% year-to-date with a one-year total shareholder return of -46%. The recent dip following cautious revenue guidance and a new buyback plan has fueled debate over whether investor sentiment is starting to shift or if growth concerns are taking center stage.

If this shift in sentiment has you looking for fresh ideas, now is a perfect moment to explore fast growing stocks with high insider ownership.

With shares trading at a steep discount to analysts’ average price targets and management signaling confidence with a major buyback, investors may be wondering if the market is overlooking Five9’s potential or if slower growth is already fully priced in.

Most Popular Narrative: 45.5% Undervalued

Five9’s fair value is set far higher than yesterday’s closing price, based on upbeat growth, margin, and earnings expectations from the strongest narrative on the stock. As investors debate the dip, let’s look at what could move the needle next.

Ongoing large customer wins and multi-year contract expansions that emphasize Five9 as a single, comprehensive CX platform for both core and AI solutions demonstrate sustained demand for scalable, cloud-native contact center offerings. This supports continued enterprise revenue growth and improved dollar-based net retention rates.

Want to know which assumptions drive this bullish scenario? There is a bold set of analyst projections behind the fair value; hint: it is not just optimistic earnings. The full narrative breaks down growth, margins, and just how high the future profit multiple could go. See the details that set this story apart.

Result: Fair Value of $36.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition or upcoming leadership changes could undermine Five9’s growth trajectory and challenge the optimistic fair value outlook reflected by analysts.

Find out about the key risks to this Five9 narrative.

Another View: Is the Market Pricing In Too Much Optimism?

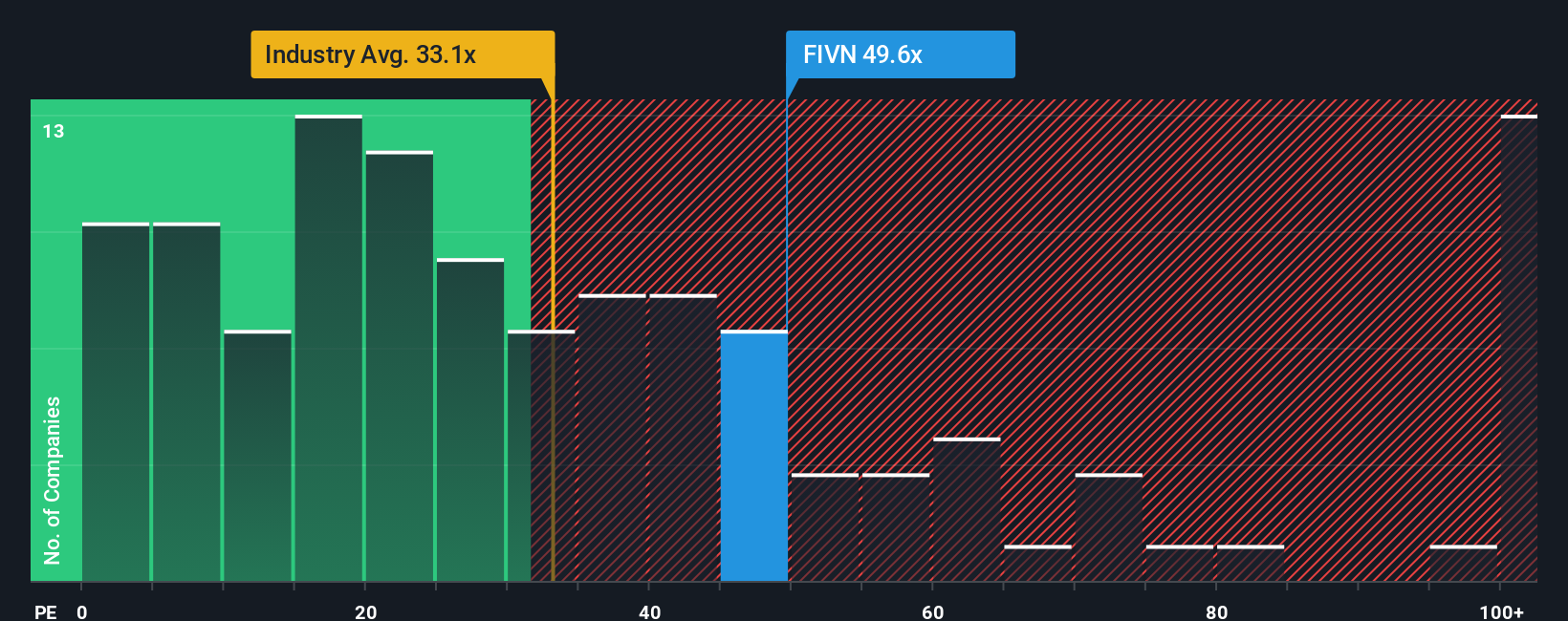

From a price-to-earnings perspective, Five9 trades at 49.6 times earnings. This is well above the US Software industry average of 33.1 times and the peer group’s 33.2 times. Even compared to a fair ratio of 39.6 times, the current premium suggests the market is already factoring in plenty of future success. Could this make shares vulnerable if expectations are missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five9 Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can shape your own narrative with just a few clicks. Do it your way.

A great starting point for your Five9 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Give your portfolio an edge by tapping into real opportunities the market might be missing. Waiting could mean missing out on tomorrow’s biggest winners.

- Capture the momentum of game-changing innovation with these 25 AI penny stocks, designed for artificial intelligence breakthroughs reshaping multiple industries.

- Tap into growth potential as blockchain and digital assets transform markets by selecting from these 82 cryptocurrency and blockchain stocks, leading the evolution in finance and technology.

- Start your search for stable cash flow by analyzing these 16 dividend stocks with yields > 3%, built for income seekers looking for reliable payouts above 3% yield.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FIVN

Five9

Provides intelligent cloud software for contact centers in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives