- United States

- /

- Software

- /

- NasdaqGM:FIVN

Assessing Five9 (FIVN) Valuation After Expanded Google Cloud Enterprise CX AI Partnership

Expanded Google Cloud partnership reframes Five9’s AI story

Five9 (FIVN) is back in focus after expanding its partnership with Google Cloud, rolling out a joint Enterprise CX AI solution that ties Five9’s Intelligent CX Platform to Google’s Gemini Enterprise and Vertex AI.

The launch comes as the stock trades near recent lows and SaaS peers face sector headwinds. It gives investors fresh information to weigh around Five9’s role in AI driven customer experience software and how that might relate to its current valuation.

See our latest analysis for Five9.

The expanded Google Cloud deal comes after a weaker period for the stock, with a 1-day share price return of 1.09% doing little to offset a 30-day share price return of 4.78% and a 1-year total shareholder return of 58.25%. Recent momentum has been fading even as Five9 leans harder into AI themed customer experience offerings.

If this AI partnership has you rethinking where you want exposure, it could be a good moment to scan 34 AI infrastructure stocks as a curated way to find other AI infrastructure names on your radar.

After a long stretch of weak returns and a share price near recent lows, and with AI headlines back in the story, is Five9 quietly trading at a discount, or is the market already baking in the next leg of growth?

Most Popular Narrative: 48.3% Undervalued

The most followed narrative on Five9 pegs fair value at $32.38 versus a last close of $16.75, framing a wide gap that this new Google Cloud partnership now sits inside.

Increasing upsell and cross-sell momentum within the installed enterprise base (highest-ever installed base bookings in Q2), combined with a shift toward AI-augmented and bundled product offerings, is laying the foundation for sequential revenue growth and higher average contract values as these bookings layer into revenue over coming quarters and into 2026.

Want to see what kind of revenue mix, margin lift, and future earnings multiple need to line up to support that fair value gap? The narrative outlines a detailed approach to subscription growth, profitability expansion, and how much of that is tied to partners like Google Cloud versus Five9’s own CX platform.

Result: Fair Value of $32.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh the risk that larger competitors, fast moving AI tech, or tighter data rules could squeeze margins and challenge this upside case.

Find out about the key risks to this Five9 narrative.

Another View: Multiples Paint a Tougher Picture

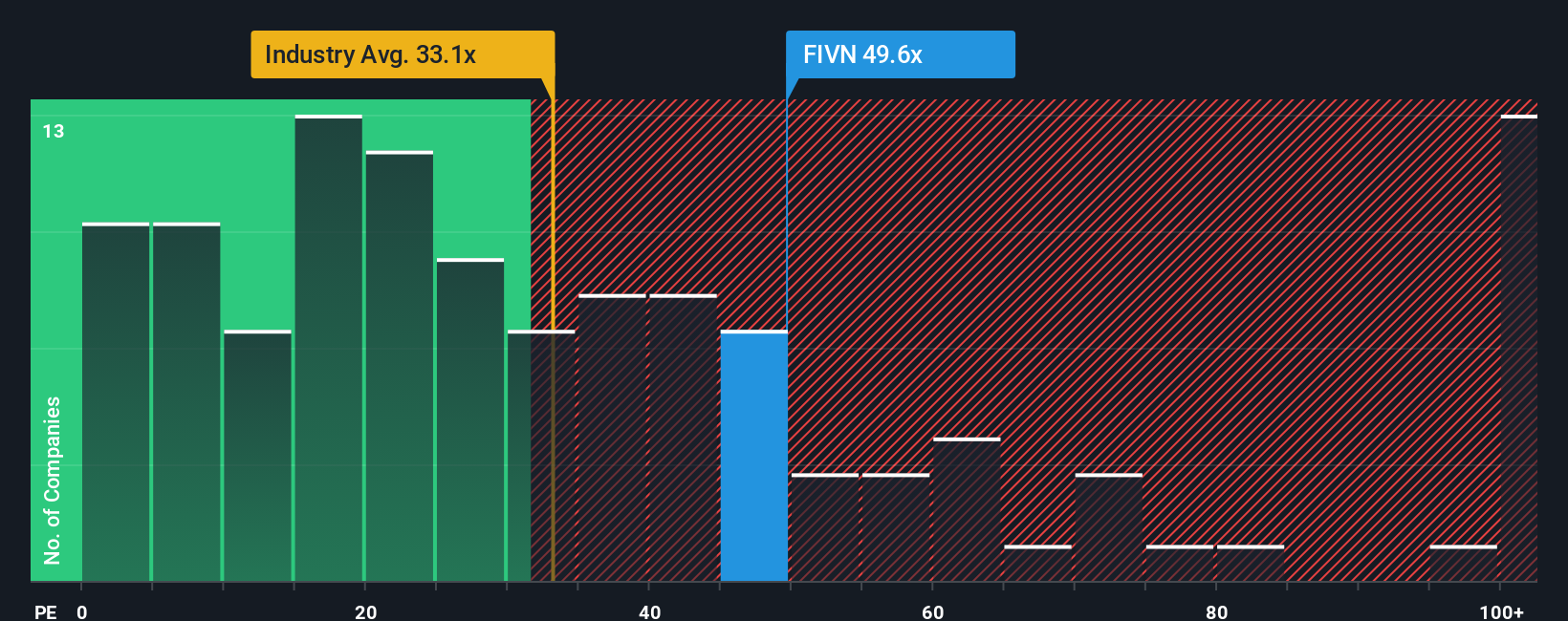

The AI driven fair value work points to a large discount, but the current P/E ratio of 41.9x tells a different story. It is higher than both the US Software industry at 26.4x and peers at 21.4x, as well as the 32x fair ratio, which suggests valuation risk if expectations reset.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five9 Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a full Five9 view yourself in just a few minutes: Do it your way.

A great starting point for your Five9 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Five9 has sharpened your thinking, do not stop here, you will miss useful angles if you skip other opportunities that share similar quality traits.

- Spot potential bargains early by scanning our screener containing 23 high quality undiscovered gems that filter for strong fundamentals before they show up on most radar screens.

- Prioritise resilience by checking out 84 resilient stocks with low risk scores that highlight companies with lower risk scores for steadier portfolio building blocks.

- Focus on financial strength by reviewing solid balance sheet and fundamentals stocks screener (45 results) that surface businesses with balance sheets built to handle tougher conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FIVN

Five9

Provides intelligent cloud software for contact centers in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.