- United States

- /

- Professional Services

- /

- NasdaqGS:EXLS

Does ExlService Holdings (NASDAQ:EXLS) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that ExlService Holdings, Inc. (NASDAQ:EXLS) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out the opportunities and risks within the US IT industry.

How Much Debt Does ExlService Holdings Carry?

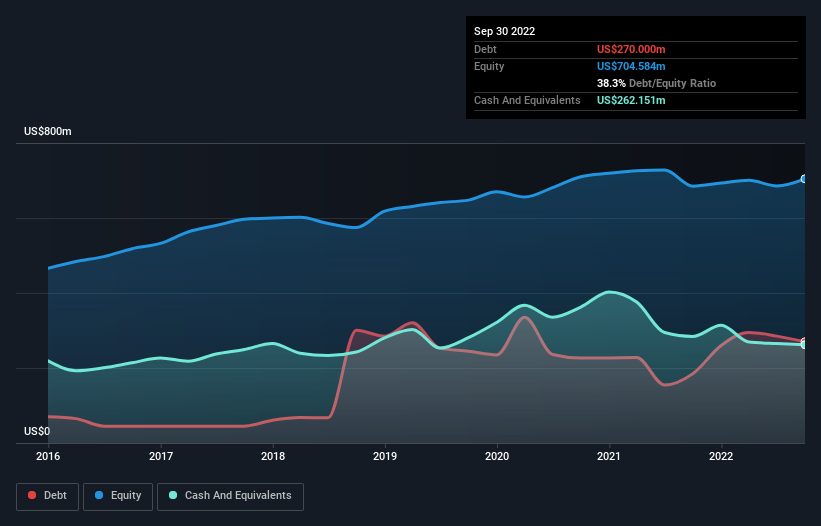

The image below, which you can click on for greater detail, shows that at September 2022 ExlService Holdings had debt of US$270.0m, up from US$185.0m in one year. However, it does have US$262.2m in cash offsetting this, leading to net debt of about US$7.85m.

How Strong Is ExlService Holdings' Balance Sheet?

The latest balance sheet data shows that ExlService Holdings had liabilities of US$287.0m due within a year, and liabilities of US$327.2m falling due after that. Offsetting these obligations, it had cash of US$262.2m as well as receivables valued at US$271.4m due within 12 months. So it has liabilities totalling US$80.6m more than its cash and near-term receivables, combined.

This state of affairs indicates that ExlService Holdings' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the US$6.07b company is short on cash, but still worth keeping an eye on the balance sheet. But either way, ExlService Holdings has virtually no net debt, so it's fair to say it does not have a heavy debt load!

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With debt at a measly 0.035 times EBITDA and EBIT covering interest a whopping 144 times, it's clear that ExlService Holdings is not a desperate borrower. So relative to past earnings, the debt load seems trivial. And we also note warmly that ExlService Holdings grew its EBIT by 13% last year, making its debt load easier to handle. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if ExlService Holdings can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, ExlService Holdings actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Happily, ExlService Holdings's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Considering this range of factors, it seems to us that ExlService Holdings is quite prudent with its debt, and the risks seem well managed. So we're not worried about the use of a little leverage on the balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for ExlService Holdings that you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if ExlService Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EXLS

ExlService Holdings

Operates as a data analytics, and digital operations and solutions company in the United States and internationally.

Excellent balance sheet with moderate growth potential.