Stock Analysis

Ashu Roy became the CEO of eGain Corporation (NASDAQ:EGAN) in 1997, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for eGain

How Does Total Compensation For Ashu Roy Compare With Other Companies In The Industry?

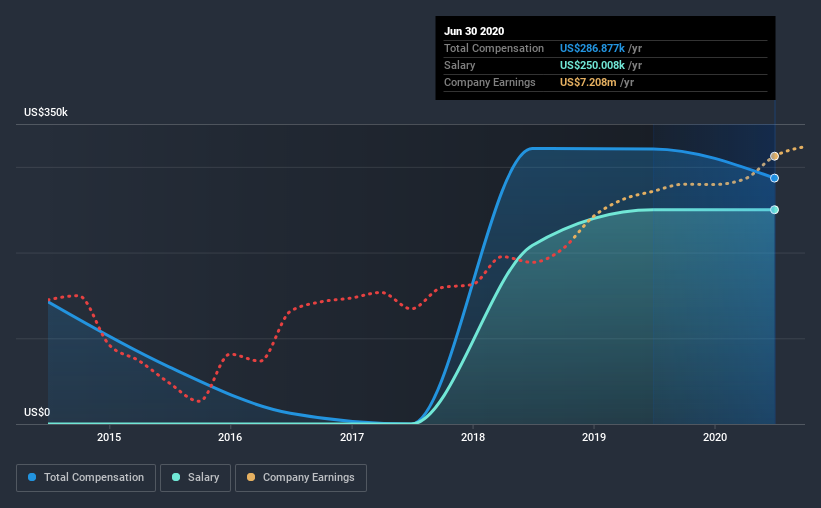

Our data indicates that eGain Corporation has a market capitalization of US$354m, and total annual CEO compensation was reported as US$287k for the year to June 2020. Notably, that's a decrease of 11% over the year before. In particular, the salary of US$250.0k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between US$200m and US$800m, we discovered that the median CEO total compensation of that group was US$1.1m. This suggests that Ashu Roy is paid below the industry median. What's more, Ashu Roy holds US$101m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$250k | US$250k | 87% |

| Other | US$37k | US$71k | 13% |

| Total Compensation | US$287k | US$321k | 100% |

Talking in terms of the industry, salary represented approximately 13% of total compensation out of all the companies we analyzed, while other remuneration made up 87% of the pie. eGain pays out 87% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at eGain Corporation's Growth Numbers

Over the past three years, eGain Corporation has seen its earnings per share (EPS) grow by 103% per year. It achieved revenue growth of 8.6% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has eGain Corporation Been A Good Investment?

Boasting a total shareholder return of 232% over three years, eGain Corporation has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

As previously discussed, Ashu is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. Considering robust EPS growth, we believe Ashu to be modestly paid. Given the strong history of shareholder returns, the shareholders are probably very happy with Ashu's performance.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 1 warning sign for eGain that investors should look into moving forward.

Switching gears from eGain, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading eGain or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether eGain is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:EGAN

eGain

Develops, licenses, implements, and supports customer service infrastructure software solutions in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and good value.