- United States

- /

- Software

- /

- NasdaqCM:EGAN

eGain Corporation (NASDAQ:EGAN) May Have Run Too Fast Too Soon With Recent 27% Price Plummet

eGain Corporation (NASDAQ:EGAN) shares have had a horrible month, losing 27% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 18% in that time.

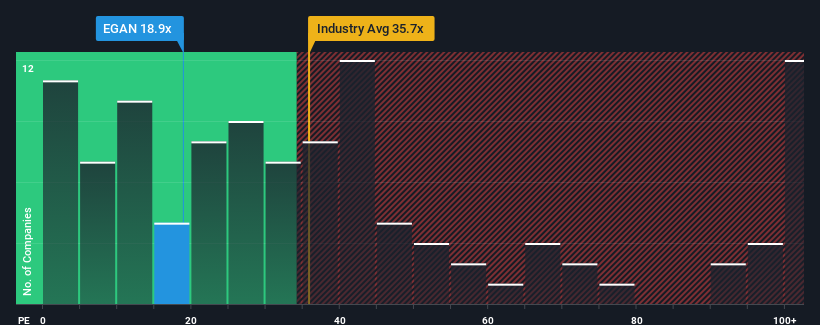

Although its price has dipped substantially, it's still not a stretch to say that eGain's price-to-earnings (or "P/E") ratio of 18.9x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 18x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been pleasing for eGain as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for eGain

How Is eGain's Growth Trending?

eGain's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 282%. EPS has also lifted 19% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 90% during the coming year according to the dual analysts following the company. Meanwhile, the broader market is forecast to expand by 15%, which paints a poor picture.

In light of this, it's somewhat alarming that eGain's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On eGain's P/E

With its share price falling into a hole, the P/E for eGain looks quite average now. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that eGain currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for eGain with six simple checks on some of these key factors.

If you're unsure about the strength of eGain's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EGAN

eGain

Engages in the development, license, implementation, and support of its customer service infrastructure software solutions in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives