- United States

- /

- Software

- /

- NasdaqCM:DUOT

When Will Duos Technologies Group, Inc. (NASDAQ:DUOT) Become Profitable?

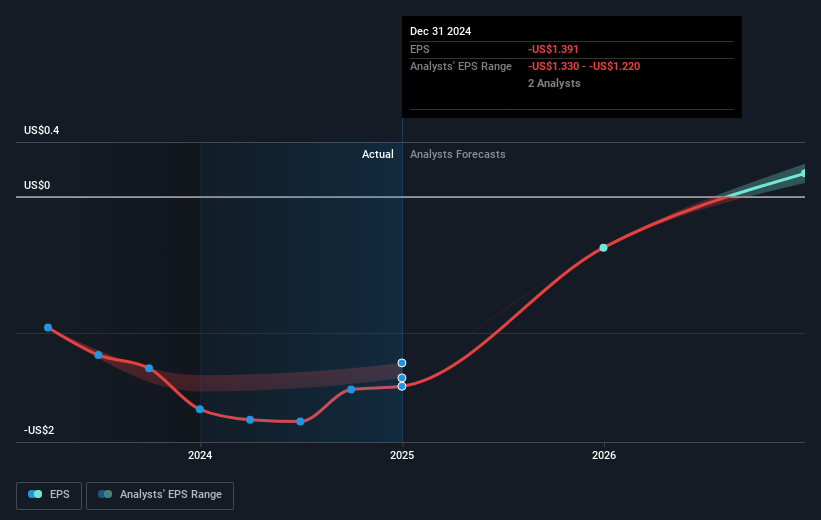

With the business potentially at an important milestone, we thought we'd take a closer look at Duos Technologies Group, Inc.'s (NASDAQ:DUOT) future prospects. Duos Technologies Group, Inc. designs, develops, deploys, and operates intelligent technology solutions in North America. The US$76m market-cap company announced a latest loss of US$11m on 31 December 2024 for its most recent financial year result. The most pressing concern for investors is Duos Technologies Group's path to profitability – when will it breakeven? We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

According to the 2 industry analysts covering Duos Technologies Group, the consensus is that breakeven is near. They anticipate the company to incur a final loss in 2025, before generating positive profits of US$2.1m in 2026. The company is therefore projected to breakeven just over a year from now. What rate will the company have to grow year-on-year in order to breakeven on this date? Using a line of best fit, we calculated an average annual growth rate of 112%, which is rather optimistic! Should the business grow at a slower rate, it will become profitable at a later date than expected.

Underlying developments driving Duos Technologies Group's growth isn’t the focus of this broad overview, but, keep in mind that typically a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

Check out our latest analysis for Duos Technologies Group

One thing we would like to bring into light with Duos Technologies Group is its relatively high level of debt. Typically, debt shouldn’t exceed 40% of your equity, which in Duos Technologies Group's case is 79%. Note that a higher debt obligation increases the risk around investing in the loss-making company.

Next Steps:

There are too many aspects of Duos Technologies Group to cover in one brief article, but the key fundamentals for the company can all be found in one place – Duos Technologies Group's company page on Simply Wall St. We've also compiled a list of relevant aspects you should further examine:

- Historical Track Record: What has Duos Technologies Group's performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Duos Technologies Group's board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DUOT

Duos Technologies Group

Designs, develops, deploys, and operates intelligent technology solutions in North America.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.