- United States

- /

- Software

- /

- NasdaqGS:DOCU

Can DocuSign’s (DOCU) New AI Partnership Rethink Its Strategy for Customer Loyalty and Differentiation?

Reviewed by Sasha Jovanovic

- On October 16, 2025, Socure announced a partnership with DocuSign to embed its advanced identity verification and risk-based authentication capabilities into the DocuSign Identify platform, making real-time global fraud detection and streamlined user verification available to DocuSign’s vast user base.

- This development allows organizations using DocuSign to shift away from traditional, cumbersome authentication methods, instead utilizing machine learning-driven tools to enhance security while reducing friction for legitimate users worldwide.

- Let’s explore how the integration of Socure’s AI-powered identity solutions could shape DocuSign’s ongoing efforts to boost customer retention and platform differentiation.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

DocuSign Investment Narrative Recap

At the heart of the DocuSign investment thesis is the belief that digital agreement management will continue gaining traction worldwide, driving consistent recurring revenue growth and ongoing customer expansion. While the recently announced Socure integration meaningfully reinforces DocuSign's security credentials, its immediate impact on core short-term catalysts, such as accelerating revenue from upsell and international growth, remains incremental; underlying risks around competitive pressure and slowing top-line growth persist.

Among recent announcements, the September partnership with CLEAR is especially relevant, as it further extends DocuSign’s focus on secure digital verification, echoing the Socure development. By layering advanced biometric options onto its platform, DocuSign is increasing authentication choices and appealing to security-conscious buyers, supporting efforts to enhance customer retention and platform appeal even as core eSignature markets mature.

However, with heightened competition and growth in the core market slowing, investors should consider...

Read the full narrative on DocuSign (it's free!)

DocuSign's outlook anticipates $3.8 billion in revenue and $359.8 million in earnings by 2028. This is based on an expected annual revenue growth rate of 7.3% and an earnings increase of $78.8 million from the current $281.0 million.

Uncover how DocuSign's forecasts yield a $93.16 fair value, a 30% upside to its current price.

Exploring Other Perspectives

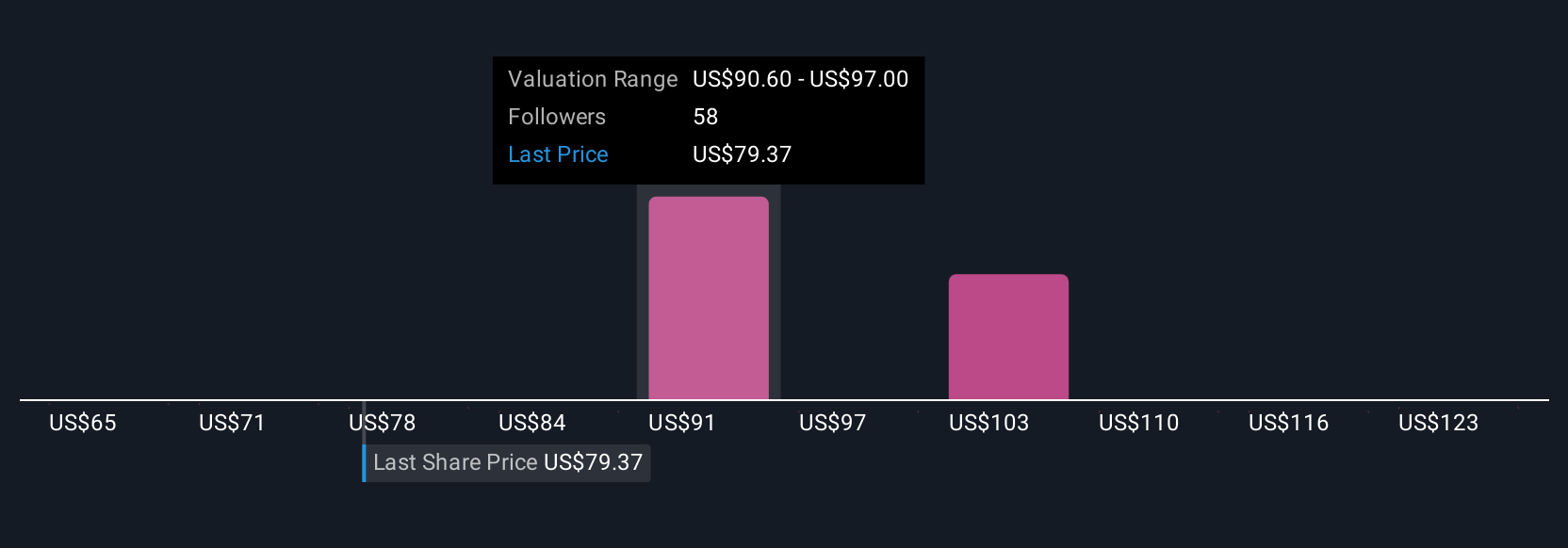

Six Simply Wall St Community fair value estimates for DocuSign range from US$77 to US$118, reflecting a wide spectrum of investor outlooks. With revenue growth lagging the broader US market, the path to higher future returns is debated, considering several perspectives is key.

Explore 6 other fair value estimates on DocuSign - why the stock might be worth just $77.00!

Build Your Own DocuSign Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DocuSign research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DocuSign research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DocuSign's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives