- United States

- /

- Software

- /

- NasdaqGS:DMRC

Shareholders May Be A Bit More Conservative With Digimarc Corporation's (NASDAQ:DMRC) CEO Compensation For Now

Key Insights

- Digimarc's Annual General Meeting to take place on 7th of June

- CEO Riley McCormack's total compensation includes salary of US$375.0k

- The overall pay is comparable to the industry average

- Digimarc's three-year loss to shareholders was 20% while its EPS grew by 9.2% over the past three years

Shareholders of Digimarc Corporation (NASDAQ:DMRC) will have been dismayed by the negative share price return over the last three years. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 7th of June. They could also influence management through voting on resolutions such as executive remuneration. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Digimarc

How Does Total Compensation For Riley McCormack Compare With Other Companies In The Industry?

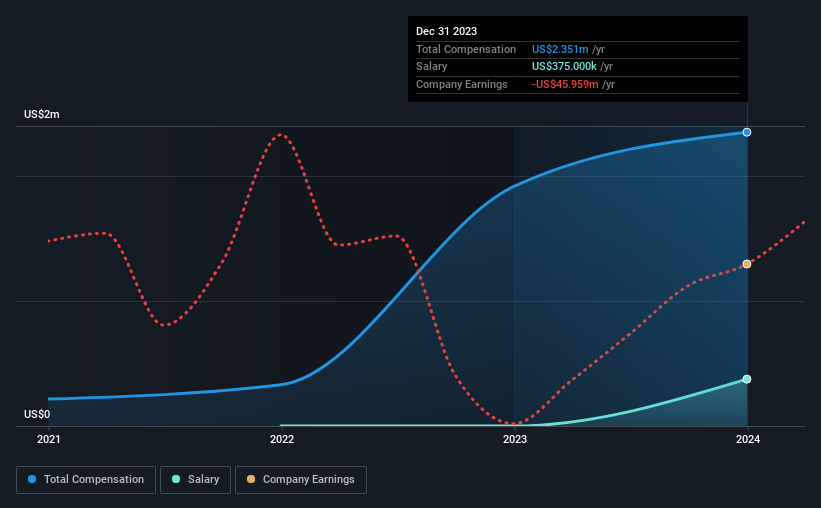

At the time of writing, our data shows that Digimarc Corporation has a market capitalization of US$562m, and reported total annual CEO compensation of US$2.4m for the year to December 2023. We note that's an increase of 23% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$375k.

On examining similar-sized companies in the American Software industry with market capitalizations between US$200m and US$800m, we discovered that the median CEO total compensation of that group was US$2.4m. From this we gather that Riley McCormack is paid around the median for CEOs in the industry. Furthermore, Riley McCormack directly owns US$102m worth of shares in the company, implying that they are deeply invested in the company's success.

On an industry level, around 16% of total compensation represents salary and 84% is other remuneration. Although there is a difference in how total compensation is set, Digimarc more or less reflects the market in terms of setting the salary. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Digimarc Corporation's Growth Numbers

Digimarc Corporation's earnings per share (EPS) grew 9.2% per year over the last three years. It achieved revenue growth of 21% over the last year.

We would argue that the modest growth in revenue is a notable positive. And the modest growth in EPS isn't bad, either. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Digimarc Corporation Been A Good Investment?

With a three year total loss of 20% for the shareholders, Digimarc Corporation would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Digimarc that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DMRC

Digimarc

Provides digital watermarking solutions in the United States and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.