- United States

- /

- Software

- /

- NasdaqGS:DMRC

Digimarc (DMRC): High Valuation Persists Despite Forecast for Three More Years of Losses

Reviewed by Simply Wall St

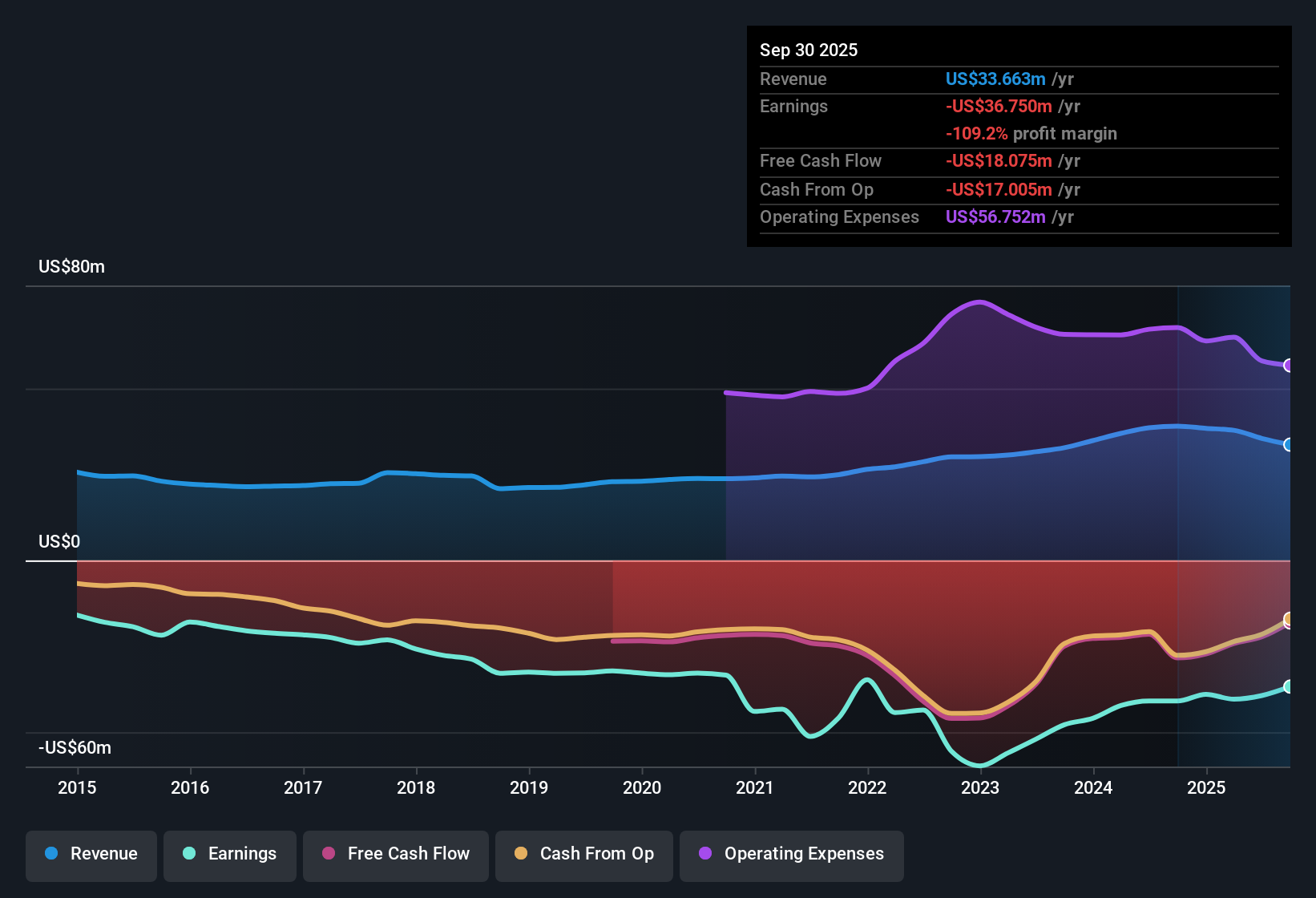

Digimarc (DMRC) remains unprofitable and is forecast to stay in the red for at least the next three years. The company has managed to trim its losses by about 1.6% per year over the past five years. Revenue is expected to grow at a modest 5.6% per year, which trails the broader US market’s growth rate of 10.3% per year. Investors will keep a close eye on whether Digimarc can turn incremental improvements into long-term strength, especially as its valuation stays elevated at a Price-to-Sales Ratio of 6.2x, a level well above both peer and industry averages.

See our full analysis for Digimarc.Next up, we will put these numbers side by side with the most widely followed narratives for Digimarc to see which expectations hold up, and where the results might shift the conversation.

See what the community is saying about Digimarc

Operating Losses Narrow, but Profit Still Years Away

- Digimarc has trimmed its losses by about 1.6% per year over the past five years. However, profitability is not expected within the next three years according to current forecasts.

- Analysts' consensus view points to ongoing cost controls and strategic shifts toward high-margin, recurring revenue streams as potential drivers for future margin improvement.

- Recent cost-reduction efforts and AI-based product enhancements are seen as helping operating leverage, but so far these changes have not delivered positive net earnings.

- The dependence on successful expansion into product authentication and digital watermarking is central to hopes for reversing negative margins. Analysts highlight this as key to any long-term earnings turnaround.

Contract Concentration and Revenue Instability Threaten Growth

- The company faces a confirmed likely loss of $3 million in annual legacy revenue from a major contract. This compounds the impact of previous contract expirations and heavy customer concentration.

- Analysts' consensus view flags these contract losses and ongoing reliance on a small number of major deals as major risk points.

- With prior $5.8 million and $3.5 million annual contracts also expired, the business remains exposed to revenue shocks from further renegotiations.

- Slow adoption cycles for new solutions, such as gift card fraud prevention, are cited as another headwind that could delay hoped-for growth in recurring SaaS revenues and positive cash flow.

Valuation Elevated Despite Profit and Growth Challenges

- Digimarc trades at a Price-to-Sales Ratio of 6.2x, notably higher than the peer average of 4x and the Software industry average of 5.2x, even as it remains unprofitable and revenue is forecast to underperform the US market.

- Analysts' consensus view observes that despite the slow revenue outlook and absence of profits, the current share price of $9.73 sits far below the consensus analyst price target of $15.00.

- This implies a 54% upside according to consensus, though the gap relies heavily on a return to growth and future profitability that have yet to materialize.

- The premium valuation remains a key point of debate and underscores the market’s divided view on whether incremental improvements will justify the elevated multiples.

See what market observers are saying as the consensus narrative drives new perspectives on Digimarc. 📊 Read the full Digimarc Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Digimarc on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? You can share your own perspective and shape the narrative in just a few minutes. Do it your way.

A great starting point for your Digimarc research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Digimarc’s high valuation, recurring losses, and revenue instability present ongoing risks for investors who are seeking more consistent growth and greater profit visibility.

If you want more reliable opportunities, discover stable growth stocks screener (2103 results) that consistently deliver stable earnings and outpace uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DMRC

Digimarc

Provides digital watermarking solutions in the United States and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives