- United States

- /

- Software

- /

- NasdaqGS:DDOG

Datadog (DDOG): Is the Stock Undervalued After Recent Pullback?

Reviewed by Simply Wall St

See our latest analysis for Datadog.

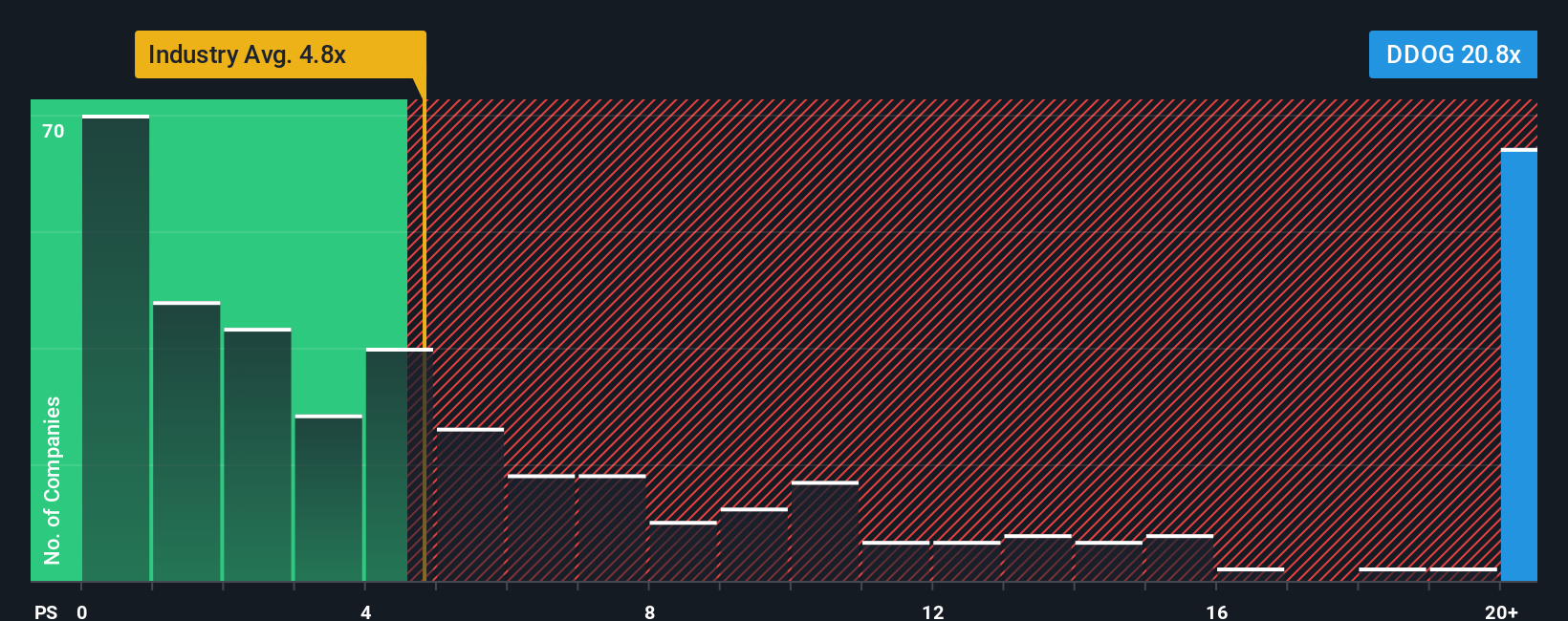

Datadog’s share price has given back some ground after a strong start to the year, but the big picture tells a story of momentum, with a 13.6% share price return over the last 90 days and a robust 20.8% total shareholder return for the past year. Despite minor fluctuations around recent software sector moves, investors seem to be weighing longer-term growth prospects against shifting sentiment in the broader tech market.

If you’re interested in opportunities beyond just Datadog, it could be the perfect moment to discover See the full list for free.

With Datadog trading close to analyst targets and showing robust fundamentals, the key question is whether the recent pullback leaves the stock undervalued or if all future growth has already been factored in by the market.

Most Popular Narrative: 8.2% Undervalued

Compared to Datadog’s last close of $154.98, the most widely tracked narrative sets a higher fair value, suggesting potential upside that’s catching investor attention.

Ongoing product innovation (e.g., autonomous AI agents, enhanced security modules, expanded log and data observability) is increasing platform breadth and relevance, providing cross-selling opportunities and driving higher average revenue per user and net retention rate. This, in turn, improves recurring revenue predictability and gross margins.

Want to discover what powers this bullish projection? The narrative hinges on some bold growth assumptions and ambitious profit targets, backed by aggressive expansion bets. Dive in to see the forecast driving this valuation.

Result: Fair Value of $168.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including heightened competition from cloud giants and persistent cost pressures. Any of these factors could quickly challenge Datadog’s growth narrative.

Find out about the key risks to this Datadog narrative.

Another View: Sliding Scales on Price Ratios

While the widely cited fair value suggests Datadog is undervalued, looking at its current price-to-sales ratio paints a different picture. Datadog trades at 17.9x sales, much higher than both its US software industry average of 5.1x and peer group average of 7.7x. The ratio also exceeds its own fair ratio of 14.5x, suggesting the market is pricing in a lot of optimism and leaving less margin for error if growth disappoints. So, is Datadog’s premium justified, or could expectations prove too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Datadog Narrative

If you have your own perspective or want to dig into the numbers independently, you can easily craft a narrative to fit your findings in just a few minutes. Do it your way

A great starting point for your Datadog research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Want Even More Investing Ideas You Can Act On?

Hundreds of standout stocks await, specifically matched to your style, so don’t let market opportunities slip by. Unlock your next smart move using these powerful tools below.

- Tap into market upswings by scanning for potential bargains using these 849 undervalued stocks based on cash flows. Strong cash flows may hint at hidden value just waiting to be found.

- Fuel your portfolio with cutting-edge innovation by jumping into these 26 AI penny stocks. This screener features pioneers harnessing artificial intelligence to shape tomorrow’s winners.

- Boost your income and stability by exploring these 20 dividend stocks with yields > 3%. Here, you can find companies with healthy yields topping 3% and a record of reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives