- United States

- /

- Software

- /

- NasdaqGS:DDOG

Assessing Datadog (DDOG) Valuation After Fresh Analyst Upgrades And AI Growth Optimism

Datadog (DDOG) is back in focus after a cluster of upbeat analyst calls, with Stifel’s upgrade and supportive views from TD Cowen, Guggenheim, and Bernstein tied to expectations for a strong upcoming quarter.

See our latest analysis for Datadog.

At a share price of US$140.56, Datadog has seen strong short term momentum with a 7 day share price return of 13.85%. Its 90 day share price return of a 10.51% decline and 1 year total shareholder return of a 3.54% decline show that enthusiasm has cooled compared to prior years, even as upbeat analyst commentary around AI monitoring and expected quarterly results has pulled the name back into focus.

If Datadog’s recent move has you watching cloud and AI names more closely, it could be a good moment to scan other high growth tech and AI stocks through high growth tech and AI stocks.

With Datadog trading at US$140.56, featuring a very high P/E and a price below analyst targets and intrinsic estimates, the key question is simple: is there real upside left here, or is the market already pricing in future growth?

Most Popular Narrative: 32.6% Undervalued

Datadog’s most followed narrative pegs fair value at about $208.49 per share, which sits well above the recent $140.56 close and instantly raises questions about what is baked into that gap.

Street research on Datadog has split into two clear camps, with some focusing on strong recent execution and AI related demand, and others more focused on competition, pricing pressure, and the valuation reset after the Palo Alto Networks and Chronosphere news.

Want to see what is driving that valuation jump? The narrative leans on robust revenue build, richer margins, and a future earnings multiple that many investors will scrutinize. Curious which assumptions really move the model and how they stack up against the current price? The full narrative lays those projections out in black and white.

Result: Fair Value of $208.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story can fray quickly if pricing pressure from cheaper rivals bites into growth, or if heavy R&D and expansion continue to squeeze profitability.

Find out about the key risks to this Datadog narrative.

Another View: High Price Tag On Sales

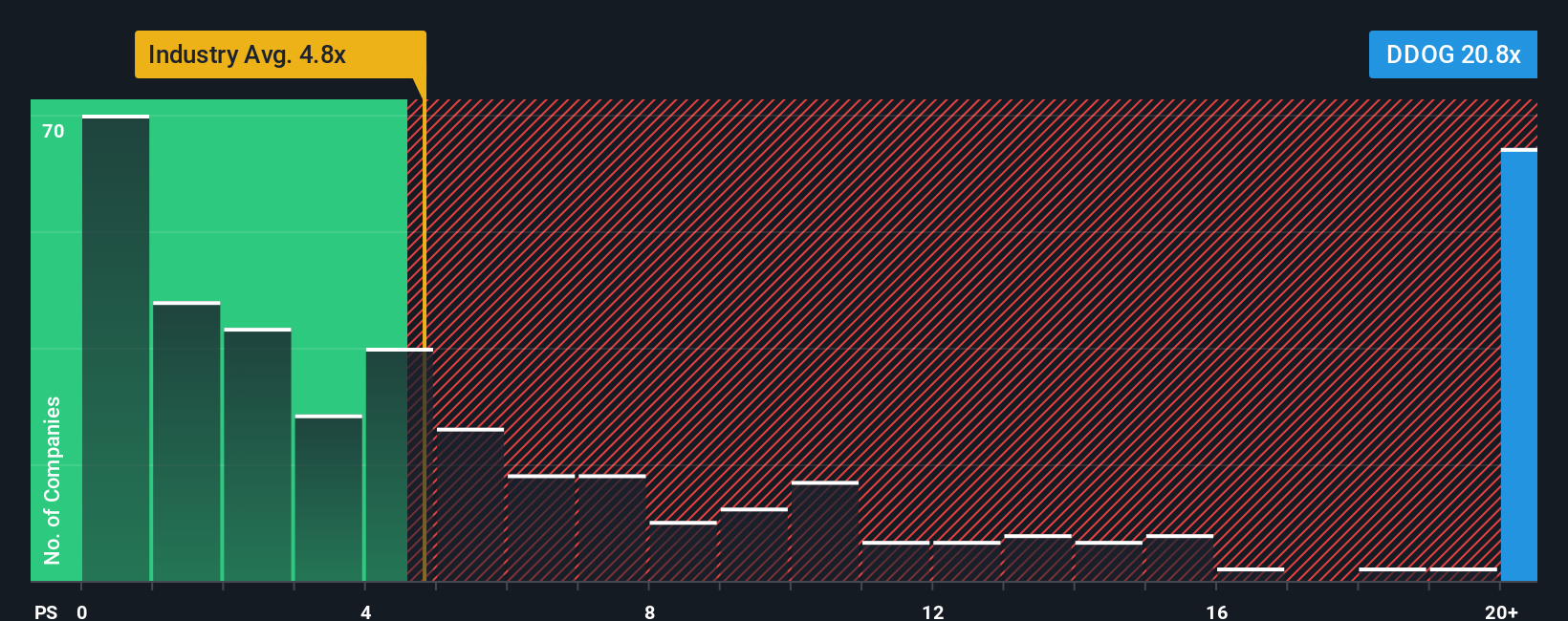

The SWS DCF model sees Datadog as undervalued, but the simple P/S check tells a different story. Datadog trades at 15.3x sales versus 4.5x for the US Software industry, 8.7x for peers, and a fair ratio of 13x, which implies less room for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Datadog Narrative

If you look at the same numbers and reach a different conclusion, or just prefer to test your own assumptions, you can build a custom Datadog view in a few minutes with Do it your way.

A great starting point for your Datadog research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Datadog is on your radar, do not stop there. Casting a wider net with a few targeted screens can surface opportunities you would otherwise miss.

- Spot potential value stories by checking out these 869 undervalued stocks based on cash flows that might offer more attractive pricing based on their underlying cash flows.

- Zero in on future facing themes by scanning these 23 AI penny stocks that are tied to artificial intelligence and related technologies.

- Strengthen your income playbook by reviewing these 14 dividend stocks with yields > 3% that could add consistent yield to your holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

DMCI Holdings will shine with a projected fair value of 68.43 in the next 5 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Czechoslovak Group - is it really so hot?

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion