- United States

- /

- Software

- /

- NasdaqGS:CYBR

AI Security Launch and Earnings Miss Could Be a Game Changer for CyberArk Software (CYBR)

Reviewed by Sasha Jovanovic

- On November 6, 2025, CyberArk Software announced its third quarter earnings, reporting revenue growth to US$342.84 million but a shift from net income to a net loss compared to the previous year.

- CyberArk also recently launched its Secure AI Agents Solution, introducing dedicated security controls for AI agent identities, an emerging priority as organizations expand adoption of autonomous systems.

- We'll explore how CyberArk's entry into AI agent security could shape its earnings outlook and long-term growth narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

CyberArk Software Investment Narrative Recap

To be a shareholder in CyberArk Software, you need confidence in the company’s ability to lead in identity security as businesses transition to cloud and AI-driven environments. The latest quarterly results show revenue growth to US$342.84 million but also highlight short-term margin pressure, with a net loss that could weigh on sentiment. While the recent loss is material, the most immediate catalyst remains CyberArk's potential to capture new demand for securing next-generation identities; the biggest risk centers on execution in platform expansion and integration.

CyberArk's recent launch of its Secure AI Agents Solution stands out as especially relevant given the market’s increasing focus on AI-driven automation. By addressing security controls for AI agent identities across cloud and SaaS environments, the company positions its platform to address the emerging identity needs that drive the current investment narrative and near-term catalysts. In contrast to the excitement of new product rollout, investors should be aware of the continued risks from integration complexity and the financial strain highlighted by...

Read the full narrative on CyberArk Software (it's free!)

CyberArk Software's narrative projects $2.1 billion in revenue and $96.6 million in earnings by 2028. This requires 19.9% yearly revenue growth and a $262 million increase in earnings from the current -$165.4 million level.

Uncover how CyberArk Software's forecasts yield a $473.55 fair value, a 8% downside to its current price.

Exploring Other Perspectives

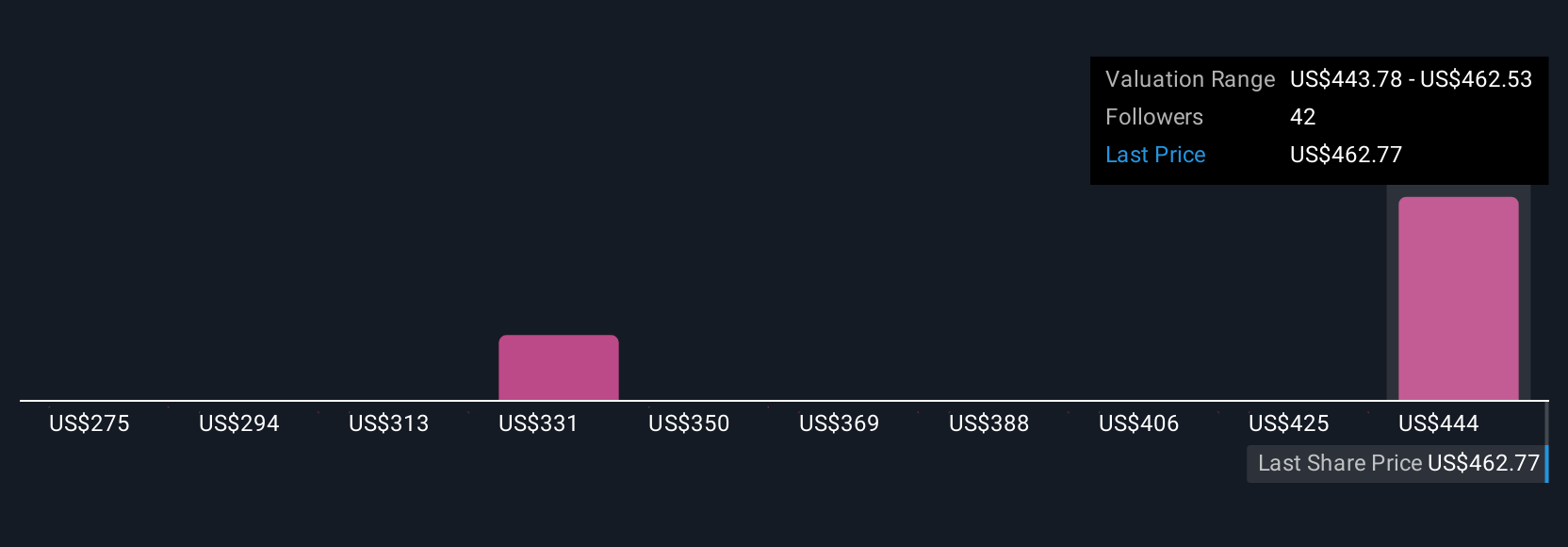

With four individual fair value estimates from the Simply Wall St Community ranging from US$275 to US$473.55, investor outlooks are highly varied. While a recent focus on next-generation identity security feeds optimism, ongoing losses may shape financial outcomes in ways these perspectives have yet to capture.

Explore 4 other fair value estimates on CyberArk Software - why the stock might be worth 46% less than the current price!

Build Your Own CyberArk Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CyberArk Software research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CyberArk Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CyberArk Software's overall financial health at a glance.

No Opportunity In CyberArk Software?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYBR

CyberArk Software

Develops, markets, and sells software-based identity security solutions and services in the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives