- United States

- /

- IT

- /

- NasdaqCM:CXDO

Crexendo (CXDO): Earnings Growth Forecast of 27.3% Reinforces Bullish Narratives Despite Lower Margins

Reviewed by Simply Wall St

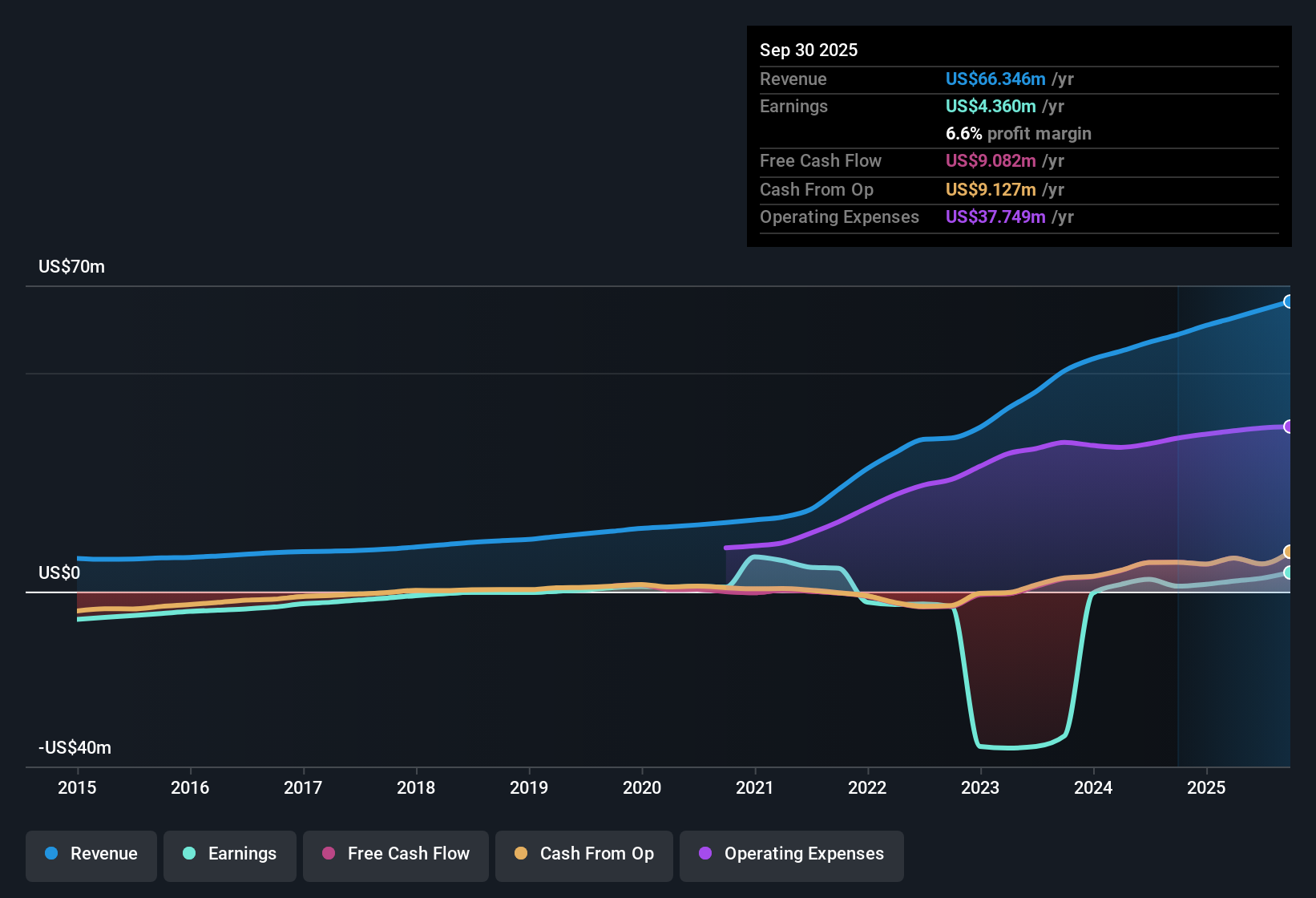

Crexendo (CXDO) is forecasting robust annual earnings growth of 27.33%, well ahead of the US market’s 16% pace. Revenue is expected to climb by 10.8% each year, outstripping the national average of 10.5%. However, net profit margins dipped slightly to 4.7% from last year’s 4.9%. This comes as the company reversed a five-year trend of earnings declines by posting 9.7% growth over the past twelve months. Investors will note that shares are trading below estimated fair value and analyst targets, with high-quality earnings and revenue momentum contributing to the outlook for future results.

See our full analysis for Crexendo.Next up, we will see how Crexendo’s numbers measure against the market's main narratives, and where the latest results might shift the story.

See what the community is saying about Crexendo

Margins Expected to Nearly Double

- Analysts expect profit margins to rise from 4.7% currently to 9.7% within three years. This signals anticipated gains in operating efficiency and earnings leverage over the medium term.

- Analysts' consensus view links this margin improvement to ongoing migration to Oracle Cloud Infrastructure and substantial investment in AI tools. These initiatives are expected to enhance cost savings and drive lasting earnings expansion.

- The consensus narrative notes that platform upgrades and greater recurring revenue predictability could further boost margins and support improved long-term profitability.

- There is some tension as consensus also highlights strong competitive pressures, which could make it harder for Crexendo to pass through costs or sustain its pricing power if rivals cut fees to capture share.

- While the current path looks positive, investors should keep an eye on whether cost-saving promises fully materialize in reported margins as competitive dynamics remain tough.

Share Dilution Set to Accelerate

- Analysts forecast Crexendo’s share count to rise 7.0% annually for the next three years. This increases the dilution risk for existing shareholders as more shares come into circulation.

- Analysts' consensus view flags dilution as a minor risk, emphasizing that while funding growth initiatives and potential acquisitions can support the top line, the associated rise in outstanding shares means per-share earnings growth may trail headline profit expansion.

- Consensus comments suggest that capital outlays for R&D, technology upgrades, and working capital could put upward pressure on the share count unless more of these investments are funded by internal cash flows.

- This dynamic is important for long-term investors because even as total earnings rise, value per share depends on how well growth keeps up with dilution.

Valuation Stays Above Industry Despite Discount

- Crexendo shares currently trade at $6.84, placing them below both DCF fair value ($6.85) and analyst consensus price target ($9.21). However, the forward PE ratio remains more aggressive than the US IT sector average (projected 46.2x vs. sector’s 29.0x by 2028).

- Analysts' consensus view acknowledges that while the stock appears undervalued by traditional measures, the premium valuation reflects anticipated profit growth and rising margins. If these material improvements slow or competitors compress margins, the premium could become harder to justify.

- Consensus commentary also points out that if revenue and margin estimates by 2028 are not met, current multiples could revert quickly to sector averages, limiting upside for late-arriving investors.

- Some of the most bullish analysts argue that if Crexendo fully delivers on its innovation and partner expansion, current prices could represent meaningful upside to fair value estimates.

- A surge in recurring revenue or strong margin beats could quickly influence this valuation debate, so monitoring quarterly execution versus 2028 projections is critical. See how both bullish and cautious analysts make their case in the full consensus narrative. 📊 Read the full Crexendo Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Crexendo on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? In just a few minutes, you can create and share your personal narrative: Do it your way

A great starting point for your Crexendo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Despite solid revenue growth and high-quality earnings, Crexendo’s premium valuation and rising share dilution could weigh on returns if profit growth falters or margins miss targets.

If you prefer stocks that trade at more compelling prices with future growth still on your side, start your search with these 838 undervalued stocks based on cash flows to target companies offering attractive value based on their cash flows and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CXDO

Crexendo

Provides cloud communication platform software and unified communications as a service in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives