- United States

- /

- IT

- /

- NasdaqGS:CRWV

Can CoreWeave’s Valuation Shift After Its Major Cloud Partnership Announcement?

Reviewed by Bailey Pemberton

- Thinking about whether CoreWeave is a smart buy right now? Let’s break down what you need to know before sizing up the company’s true value.

- CoreWeave’s shares have rocketed up 79.1% year-to-date, though the last 30 days have been choppy with a sharp -45.9% decline and a drop of -4.9% this week, all pointing to shifting sentiment and possible opportunity.

- The stock’s wild moves come on the heels of headline-making partnerships and expansions. Recently, CoreWeave announced a new collaboration with a major cloud provider and rolled out fresh infrastructure upgrades, signaling its intention to capture a bigger piece of the AI market. These developments have kept the company in the spotlight, sparking both optimism and debate among investors.

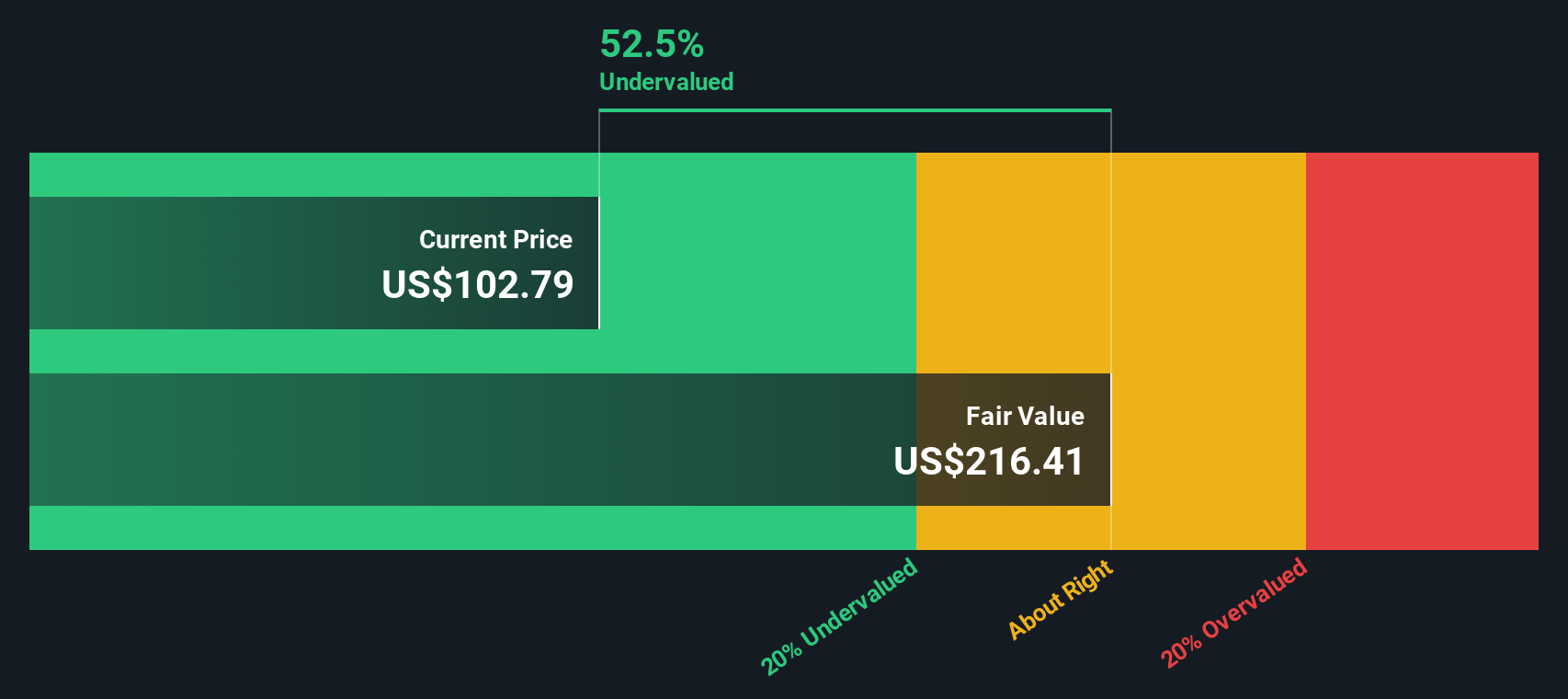

- Currently, CoreWeave scores a 2 out of 6 on our valuation checks, meaning it only looks undervalued on a couple of fronts. We’ll unpack what traditional models say about CoreWeave’s worth and share a smarter way to look at valuation by the end of this article.

CoreWeave scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CoreWeave Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a valuation approach that estimates a stock's intrinsic value by projecting future dividends and discounting them back to reflect today’s value. The core idea is that a company's worth is the sum of all future dividend payments shareholders expect to receive, adjusted for the time value of money.

For CoreWeave, the DDM uses a projected annual dividend per share of $0.0078. It also takes into account a negative return on equity (ROE) of -87.97% and an extremely low (negative) payout ratio of -7.45%. These inputs result in a deeply negative expected dividend growth rate of about -94.5%. This means dividends are not only unsustainable, but are projected to decline sharply over time. This calls into question the company’s ability to generate and distribute profits to shareholders in the foreseeable future.

Based on the DDM calculation, CoreWeave’s estimated intrinsic value is effectively $0.01 per share. When compared with its current trading price, this represents a jaw-dropping implied discount of 959785.4%. The stock is dramatically overvalued using this traditional dividend-focused approach.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests CoreWeave may be overvalued by 959785.4%. Discover 926 undervalued stocks or create your own screener to find better value opportunities.

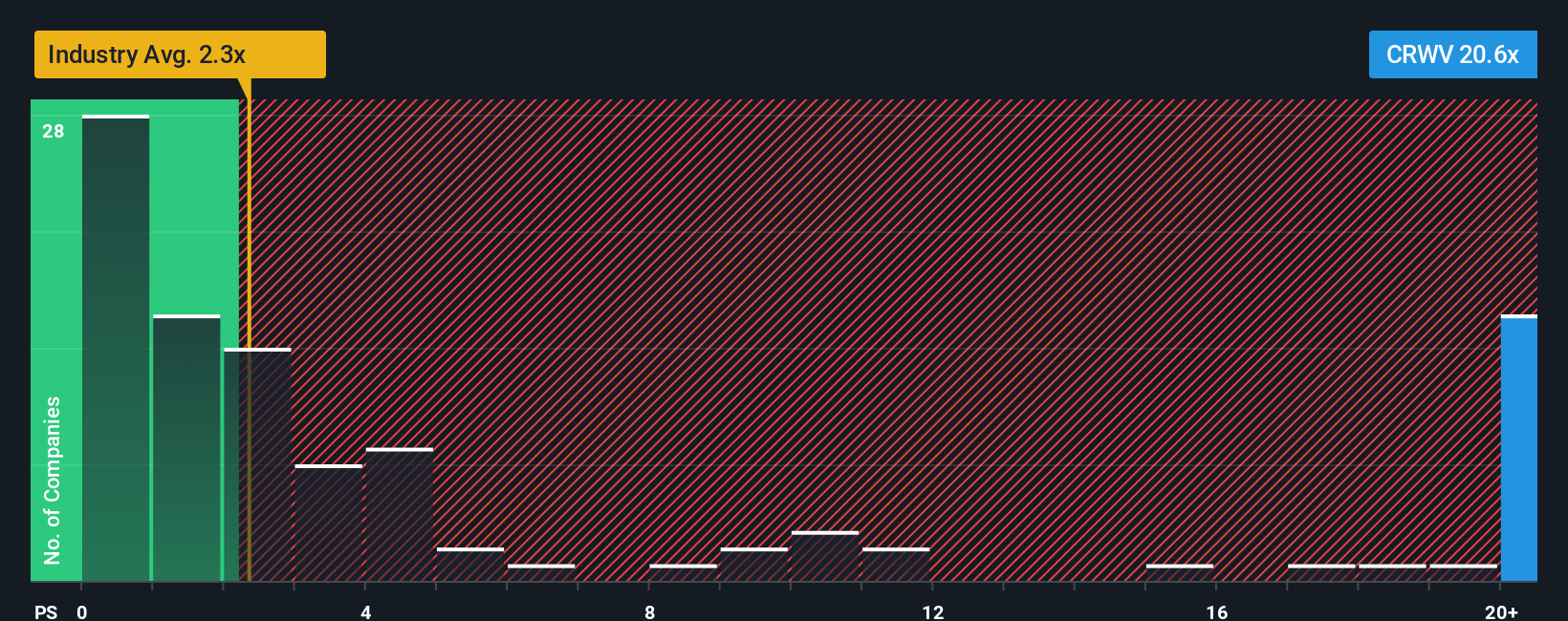

Approach 2: CoreWeave Price vs Sales (P/S) Analysis

For rapidly growing technology companies like CoreWeave, the Price-to-Sales (P/S) ratio serves as a strong valuation tool, especially when profits are minimal or negative. Unlike earnings-based metrics, P/S focuses on top-line revenue, making it useful for companies that are investing heavily for future growth.

Growth expectations and business risks both impact what investors consider a “normal” P/S ratio. Fast-growing companies with clear paths to profitability typically trade at higher P/S multiples, while those facing uncertainty or industry headwinds command a discount.

Currently, CoreWeave trades at a P/S ratio of 8.29x. For context, the average P/S across industry peers is 19.45x, and the broader IT sector average is just 2.40x. By these measures, CoreWeave appears to be priced below its closest peers but above the wider industry standard.

Simply Wall St’s “Fair Ratio,” a proprietary metric, offers a more tailored benchmark by considering not just sales growth and industry, but also factors like profit margins, company risks, and market cap. For CoreWeave, the Fair Ratio is 44.57x, reflecting the company’s robust revenue outlook and risk profile more accurately than generic peer or sector multiples.

When comparing CoreWeave’s actual P/S of 8.29x with the Fair Ratio of 44.57x, the stock looks significantly undervalued on this basis and this may indicate investors are underestimating its growth potential.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CoreWeave Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company, translated into numbers like future revenue, earnings and margins, and used to create a personalized fair value estimate. Narratives bridge the gap between what is happening in CoreWeave’s business and your own financial forecast, giving you a clear view of why you think the stock should be worth more or less.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy, accessible tool that let you connect your unique perspective with data. Compare your Fair Value to the current Price to guide your buy or sell decisions, and rest easy knowing that Narratives automatically update when new information, such as news or earnings, comes in. For example, some investors believe CoreWeave is worth as high as $24.10 per share, while others estimate a much lower fair value around $0.10, each based on their own expectations and analysis.

Do you think there's more to the story for CoreWeave? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives