- United States

- /

- IT

- /

- NasdaqGM:CMRC

Assessing Commerce.com (CMRC) Valuation Following Embedded Payments Partnership with Fortis

Commerce.com (CMRC) is drawing fresh attention after announcing a strategic partnership with Fortis to integrate advanced embedded payments technology for BigCommerce customers. This move stands out, as it directly targets the operational headaches many online sellers face by streamlining checkout, simplifying reconciliation, and enabling faster access to funds. For investors weighing what to do next, the tangible benefits of this collaboration could signal the start of a new direction for the company, especially as eCommerce players look for scalable and unified solutions.

Despite this promising integration, Commerce.com’s share price has moved sideways in the past year, reflecting skepticism about its slower revenue growth compared to the broader industry. Shares are roughly 11% below where they started last year and the stock has yet to regain positive momentum, even with a modest 7% rise over the past month. This ambivalent pattern stands in contrast to broader expectations for high growth in software and eCommerce, raising questions about how much future upside is already factored in.

With the Fortis partnership in play and expectations reset, does recent price action offer a genuine buying opportunity, or has the market already accounted for any growth Commerce.com might achieve?

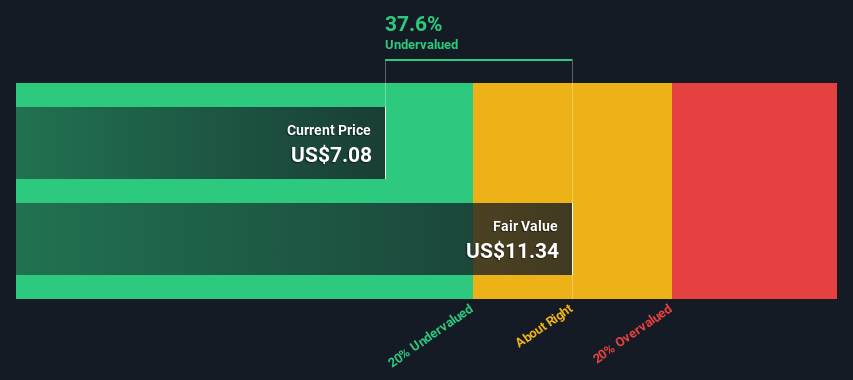

Most Popular Narrative: 31.3% Undervalued

The prevailing narrative sees Commerce.com as significantly undervalued, with its current share price trading well below consensus fair value estimates informed by growth and profitability assumptions.

The company has recruited top leaders with extensive experience in SaaS and commerce. This is expected to enhance its strategic execution and potentially increase revenue growth. The reorganization of sales, marketing, strategic partnerships, and customer success is anticipated to improve sales efficiency and effectiveness. These changes may drive revenue growth while maintaining a focus on profitable operations.

Want to know why industry insiders think this company is poised for a sharp rerating? The widely followed narrative projects bold improvements in margins and outsized growth assumptions. What big improvements must materialize for this stock to meet such a high bar? The full story behind these bullish calculations might surprise you.

Result: Fair Value of $7.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if Commerce.com fails to hit revenue targets or if restructuring drags on, the anticipated turnaround could stall and put further pressure on shares.

Find out about the key risks to this Commerce.com narrative.Another View: Discounted Cash Flow Stands Out

While market watchers focus on valuation based on sales, our DCF model looks deeper at future cash flows and also finds the shares undervalued. When two methods align like this, is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Commerce.com Narrative

If you think the story looks different or prefer doing your own analysis, it takes just a few minutes to chart your own view and share a fresh perspective. Do it your way

A great starting point for your Commerce.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for average opportunities. Head to Simply Wall Street’s tools and target the next wave of winners before the crowd catches on. Some of tomorrow’s best-performing stocks could be hiding in plain sight.

- Tap into excitement around automation by spotting opportunities in companies poised to benefit from the rise of AI penny stocks and their transformative impact.

- Unlock the next generation of income streams and steady payouts with our selection of dividend stocks with yields > 3% that deliver attractive yield potential.

- Uncover overlooked gems the market has mispriced by zeroing in on undervalued stocks based on cash flows ready for a possible rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CMRC

Commerce.com

Operates a software-as-a-service e-commerce platform for brands and retailers in the United States, North and South America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.