- United States

- /

- IT

- /

- NasdaqGM:CLPS

The CLPS Incorporation (NASDAQ:CLPS) Share Price Has Gained 30% And Shareholders Are Hoping For More

Passive investing in index funds can generate returns that roughly match the overall market. But investors can boost returns by picking market-beating companies to own shares in. For example, the CLPS Incorporation (NASDAQ:CLPS) share price is up 30% in the last year, clearly besting the market return of around 25% (not including dividends). That's a solid performance by our standards! CLPS Incorporation hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for CLPS Incorporation

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year CLPS Incorporation grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We think that the revenue growth of 38% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

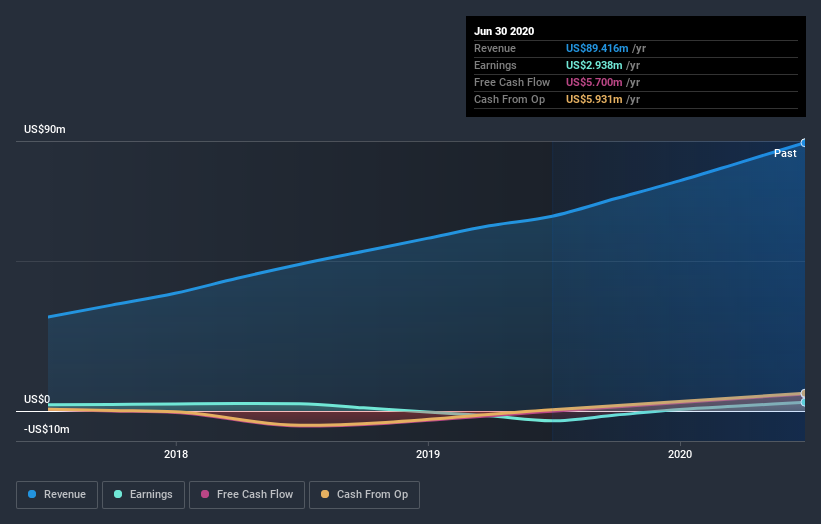

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of CLPS Incorporation's earnings, revenue and cash flow.

A Different Perspective

CLPS Incorporation shareholders should be happy with the total gain of 30% over the last twelve months. And the share price momentum remains respectable, with a gain of 29% in the last three months. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that CLPS Incorporation is showing 4 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade CLPS Incorporation, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:CLPS

CLPS Incorporation

Through its subsidiaries, provides information technology services and solutions in Mainland China, Singapore, Hong Kong, the United States, Japan, India, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives