- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

High Growth Tech Stocks In The US For November 2025

Reviewed by Simply Wall St

The U.S. stock market has recently experienced significant volatility, with major indices like the Nasdaq and S&P 500 posting substantial losses despite strong earnings reports from companies like Nvidia. This turbulent environment highlights the importance of identifying high-growth tech stocks that can withstand market fluctuations and capitalize on emerging trends, making them potentially attractive options for investors seeking growth opportunities in an unpredictable landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Palantir Technologies | 27.16% | 29.98% | ★★★★★★ |

| Sanmina | 31.01% | 33.24% | ★★★★★☆ |

| Workday | 11.16% | 32.14% | ★★★★★☆ |

| Pelthos Therapeutics | 47.44% | 126.65% | ★★★★★☆ |

| Circle Internet Group | 26.05% | 84.56% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.80% | 40.68% | ★★★★★☆ |

| Procore Technologies | 11.61% | 116.48% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

ADMA Biologics (ADMA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ADMA Biologics, Inc. is a biopharmaceutical company that focuses on developing, manufacturing, and marketing specialty plasma-derived biologics for treating immune deficiencies and infectious diseases globally, with a market cap of approximately $4.09 billion.

Operations: ADMA Biologics generates revenue primarily through its ADMA Biomanufacturing segment, contributing $481.64 million, and its Plasma Collection Centers, which add $6.77 million. The company operates within the biopharmaceutical sector, focusing on plasma-derived biologics for immune deficiencies and infectious diseases across both domestic and international markets.

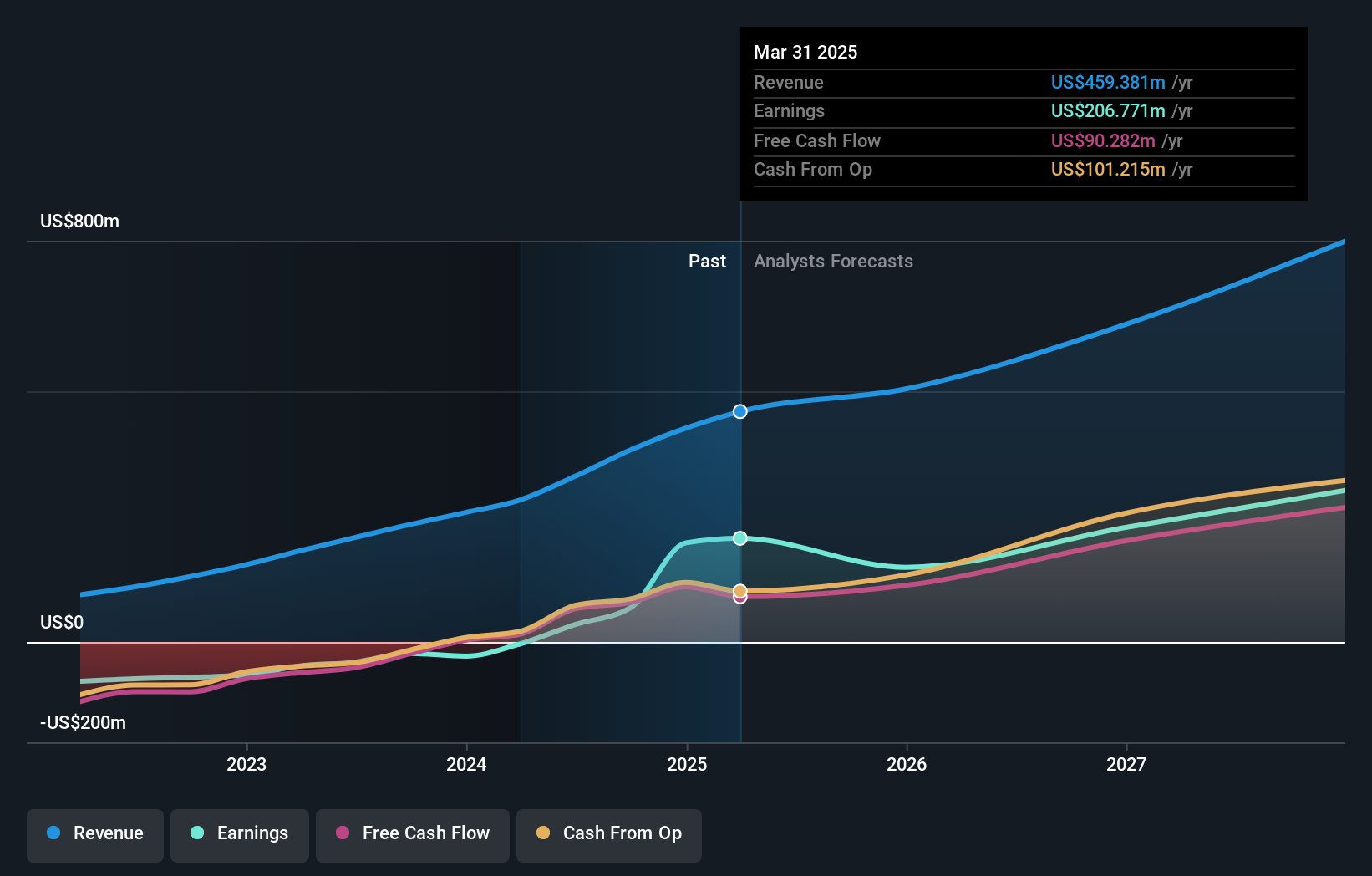

ADMA Biologics, a player in the biotech sector, has demonstrated robust financial performance with a notable 20% annual revenue growth and an impressive 207.4% surge in earnings over the past year. Recent corporate guidance anticipates revenues reaching $1.1 billion by 2029, reflecting strong operational momentum and market confidence. Additionally, ADMA's commitment to innovation is evident from its strategic share repurchases totaling $23.01 million, underscoring its proactive approach to capital management and shareholder value enhancement amidst dynamic industry challenges.

- Delve into the full analysis health report here for a deeper understanding of ADMA Biologics.

Assess ADMA Biologics' past performance with our detailed historical performance reports.

CarGurus (CARG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CarGurus, Inc. operates an online automotive platform facilitating the buying and selling of vehicles both in the United States and internationally, with a market capitalization of approximately $3.30 billion.

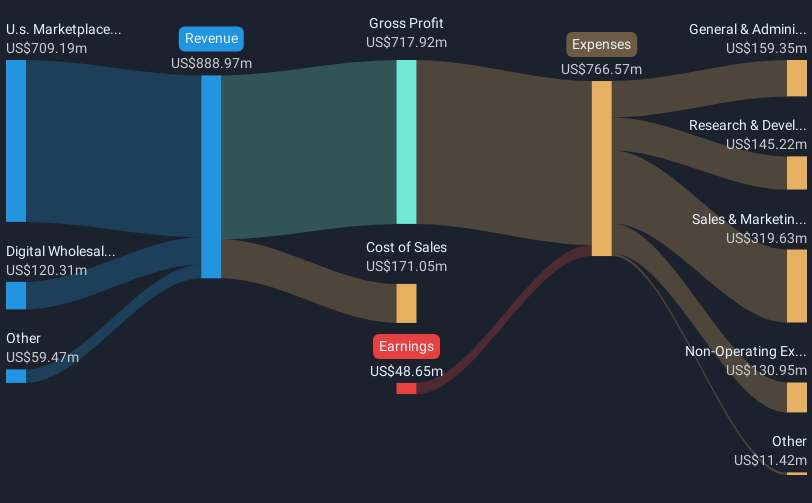

Operations: The company's primary revenue stream comes from its U.S. Marketplace segment, generating $801.72 million, while the Digital Wholesale segment contributes $50.35 million.

CarGurus has recently shown a promising turnaround, transitioning from a net loss to reporting a net income of $106.11 million over the past nine months, reflecting an impressive earnings growth of 21.9% per year. This performance is bolstered by strategic share repurchases totaling $295.23 million, enhancing shareholder value and demonstrating confidence in its financial health. Despite its revenue growth rate of 6.3% trailing the US market average, CarGurus's focused investment in R&D and market expansion strategies suggest potential for sustained growth within the competitive Interactive Media and Services sector.

- Unlock comprehensive insights into our analysis of CarGurus stock in this health report.

Explore historical data to track CarGurus' performance over time in our Past section.

Cellebrite DI (CLBT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cellebrite DI Ltd. provides digital intelligence solutions for legally sanctioned investigations across various global regions, with a market cap of $4.13 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $455.90 million. Operating across Europe, the Middle East, Africa, the Americas, and Asia-Pacific regions, it focuses on digital intelligence solutions for investigations.

Cellebrite DI's strategic positioning in the tech sector is underscored by its robust annual revenue and earnings growth projections of 14.9% and 19.8%, respectively, outpacing the US market averages. The company's commitment to innovation is evident from its R&D spending trends, which have consistently aligned with or exceeded industry norms, ensuring it remains at the forefront of technological advancements. Recent executive appointments and aggressive guidance for upcoming financial periods reflect a clear strategy aimed at leveraging legal expertise and compliance to foster global expansion and enhance product offerings in critical areas like cybersecurity and cloud platforms. This approach not only solidifies Cellebrite DI's market position but also enhances its capability to meet evolving customer needs effectively.

Key Takeaways

- Discover the full array of 72 US High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, develops, manufactures, and markets specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives