- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

As the U.S. stock market reaches new highs following a tamer-than-expected inflation report, investors are closely watching the tech sector, which continues to be a significant driver of growth across major indices like the Nasdaq. In this buoyant environment, identifying high-growth tech stocks involves looking for companies with strong innovation potential and resilience in adapting to evolving economic conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 10.53% | 20.79% | ★★★★★☆ |

| ADMA Biologics | 20.61% | 23.30% | ★★★★★☆ |

| Palantir Technologies | 25.19% | 31.65% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Circle Internet Group | 27.55% | 82.33% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.92% | 73.80% | ★★★★★☆ |

| Zscaler | 15.74% | 40.97% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

ADMA Biologics (ADMA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ADMA Biologics, Inc. is a biopharmaceutical company that focuses on developing, manufacturing, and marketing specialty plasma-derived biologics for treating immune deficiencies and infectious diseases, with a market cap of $3.62 billion.

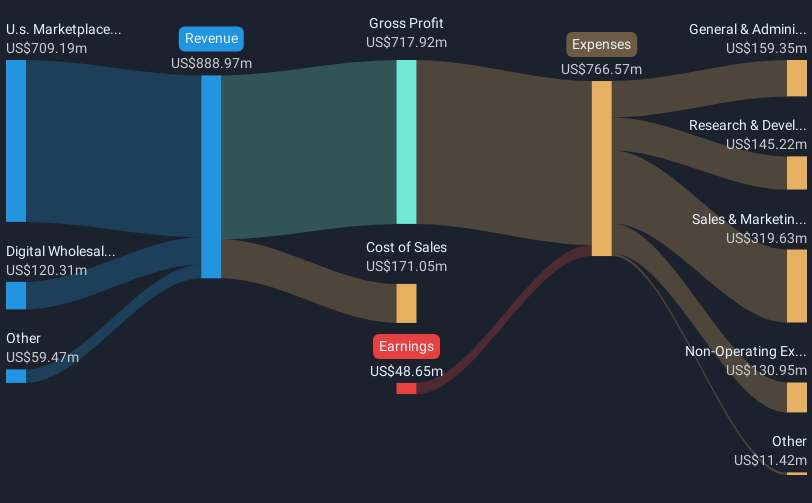

Operations: The company's primary revenue stream comes from ADMA Biomanufacturing, generating $465.17 million, while its Plasma Collection Centers contribute $8.86 million.

ADMA Biologics is distinguishing itself in the biotech sector with robust growth metrics, notably a 500.6% surge in past year earnings, outpacing the industry's 65.2%. This performance is underpinned by a revenue increase of 20.6% annually, exceeding the US market average of 10%. Moreover, recent strategic moves like securing a $300 million credit facility and aggressive share repurchases—816,237 shares for $14.98 million—signal strong management confidence in sustaining growth. These financial maneuvers coupled with reaffirmed earnings guidance projecting revenues upwards of $625 million by 2026 illustrate ADMA's proactive stance in capitalizing on biotechnological advancements and market opportunities.

- Unlock comprehensive insights into our analysis of ADMA Biologics stock in this health report.

Evaluate ADMA Biologics' historical performance by accessing our past performance report.

CarGurus (CARG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CarGurus, Inc. operates an online automotive platform for buying and selling vehicles both in the United States and internationally, with a market capitalization of approximately $3.59 billion.

Operations: The company generates revenue primarily from its U.S. Marketplace segment, contributing $778.53 million, and Digital Wholesale segment, which adds $70.64 million.

CarGurus has shown resilience and adaptability in the tech-driven automotive marketplace, evidenced by a robust 23.6% projected annual earnings growth over the next three years, significantly outpacing the broader US market's expectation of 15.5%. This growth trajectory is supported by a recent pivot away from its CarOffer Transactions Business, aligning more closely with AI-driven inventory insights and consumer vehicle sourcing platforms. Despite revenue growth projections slightly trailing at 5.7% annually compared to the industry average of 10%, CarGurus' strategic realignments and a $150 million increase in its share buyback program reflect a proactive approach to capital management and technological adaptation in an evolving market landscape.

- Click here to discover the nuances of CarGurus with our detailed analytical health report.

Explore historical data to track CarGurus' performance over time in our Past section.

Cellebrite DI (CLBT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cellebrite DI Ltd. provides solutions for legally sanctioned investigations across multiple regions, with a market cap of $4.35 billion.

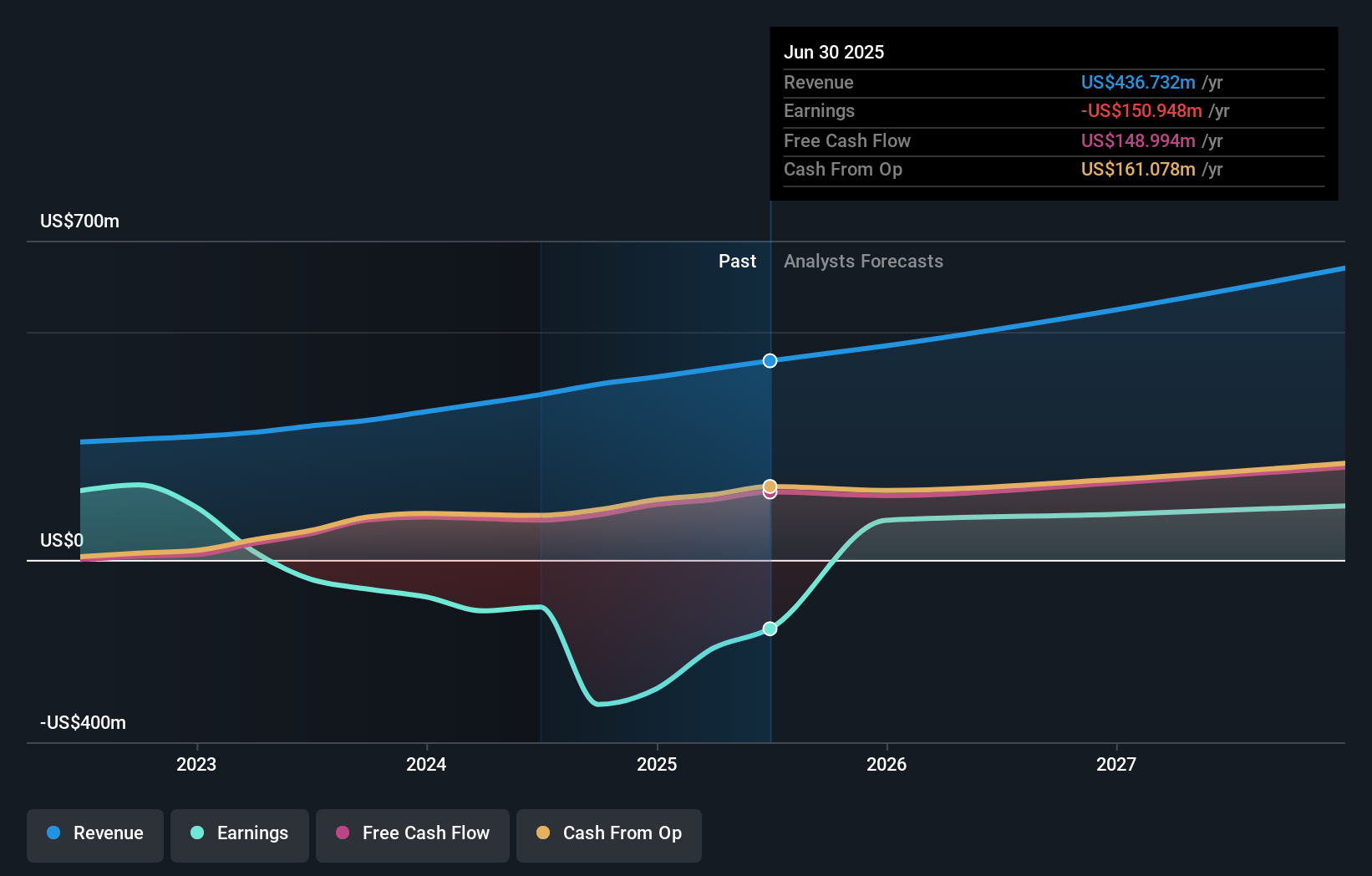

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $436.73 million. The solutions are developed for legally sanctioned investigations across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific regions.

Cellebrite DI, transitioning into profitability, projects an impressive 67.7% annual earnings growth over the next three years, outstripping broader market expectations. This growth is underpinned by a robust R&D commitment, with recent figures showing a significant investment amounting to 15% of its revenue—a clear indicator of its dedication to innovation and technological advancement in digital intelligence solutions. Recent presentations at high-profile conferences and a positive shift in financial guidance for 2025 underscore Cellebrite's strategic focus on expanding its market reach and enhancing product offerings, reflecting promising prospects for future growth.

Summing It All Up

- Investigate our full lineup of 73 US High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, develops, manufactures, and markets specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives