- United States

- /

- Software

- /

- NasdaqGS:CIFR

Cipher Mining (CIFR): Assessing Valuation After Major Output Gains and AI Expansion in August 2025 Update

If you’ve been watching Cipher Mining (CIFR), the company’s recent operational update probably caught your eye. August 2025 was a milestone month, with Cipher unveiling strong Bitcoin production stats and revealing that its Black Pearl Phase I site now contributes nearly 40% of monthly output. The buzz isn’t just about mining, though. Cipher’s expansion into AI hosting and a string of large-scale partnership deals have begun to change the narrative, driving fresh investor attention and putting its multi-pronged growth plan in the spotlight.

This momentum is showing up in the share price, too. Cipher Mining’s stock has powered up by 85% over the past three months and is sitting on a remarkable 155% gain for the year. It’s a noticeable turnaround, considering the stock has had its fair share of ups and downs with Bitcoin’s volatility. Each operational milestone, such as new facilities, better hashrates, and diversification into tech infrastructure, has built a case for long-term value and growth.

So, the question facing investors now is whether this run is just the start or if the market has already priced in all the future growth?

Most Popular Narrative: 2.7% Undervalued

The prevailing view sees Cipher Mining as slightly undervalued based on its rapid growth projections and evolving business model.

Industry-wide demand for large-scale, flexible, and energy-rich data center sites, driven by accelerating institutional and mainstream adoption of digital assets and AI, aligns with Cipher's strategy to develop infrastructure that can quickly pivot between Bitcoin mining and high-performance computing (HPC). This creates upside potential for both revenue diversification and earnings stability.

Want to see what’s behind this narrative’s bullish tone? The real story is hidden in the numbers—consider explosive revenue growth and ambitious margin gains. Curious how these optimistic forecasts could justify a premium tech valuation? There is more under the surface fueling this price target.

Result: Fair Value of $7.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on Bitcoin prices and uncertainty around new ventures mean that prolonged downturns or slow tenant demand could quickly challenge this upbeat outlook.

Find out about the key risks to this Cipher Mining narrative.Another View: Multiples Suggest Overvaluation

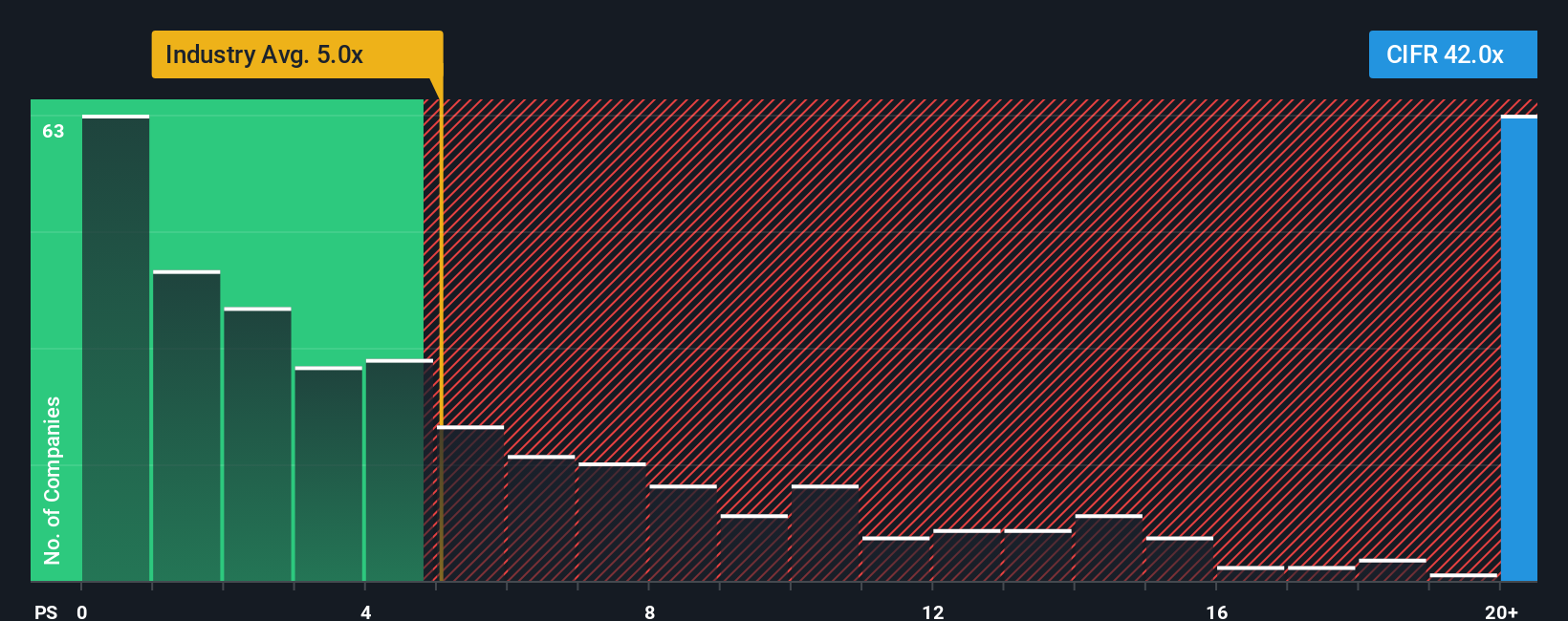

While forecasts hint at upside, looking at how the stock trades relative to its sales points to a much richer valuation than the industry average. This second approach raises the question of how much optimism is already priced in. What if future results disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Cipher Mining to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Cipher Mining Narrative

If you prefer to dig into the numbers yourself or have a different perspective, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give yourself an edge with some of the most promising opportunities Simply Wall Street has uncovered. Don’t let these stand-out investment themes pass you by.

- Capture untapped value with stocks that shine on fundamental strength by checking out undervalued stocks based on cash flows. Use it as your go-to guide for hidden gems with serious upside potential.

- Tap into future growth by following the trail of AI penny stocks, which highlights innovative companies at the forefront of artificial intelligence advancements and digital transformation.

- Unlock long-term rewards through reliable income streams by exploring dividend stocks with yields > 3%, where you’ll find stocks offering attractive yields for next-level portfolio resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:CIFR

Cipher Mining

Develops and operates industrial-scale data centers in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.