- United States

- /

- Software

- /

- NasdaqGS:CIFR

Assessing Cipher Mining (CIFR) Valuation As AI Data Center Deals And HPC Expansion Gain Traction

Cipher Mining (CIFR) is reshaping its business beyond crypto mining, anchored by a US$3b, 10-year Fluidstack partnership for AI focused data centers and a US$2b private placement backing its Black Pearl high performance computing facility.

See our latest analysis for Cipher Mining.

At a share price of US$16.42, Cipher Mining has seen momentum swing around its news flow, with an 11.47% 7 day share price return and a 14.43% 90 day share price return sitting alongside a 1 year total shareholder return of 170.96%. This suggests recent AI and data center announcements and the Black Pearl financing are still feeding through to how investors view its growth potential and risk profile.

If Cipher’s AI and high performance computing push has caught your attention, this could be a good moment to see what else is emerging across 34 AI infrastructure stocks.

With Cipher trading at US$16.42 against an average analyst target of about US$28.23, the market clearly sees upside on paper. However, after a 1-year return of 171%, investors may question whether there is still a genuine opportunity here or if future growth is already priced in.

Most Popular Narrative: 38.5% Undervalued

At US$16.42, the most followed valuation narrative for Cipher Mining points to a fair value of about US$26.68, putting a spotlight on how much future AI and data center economics are embedded in that gap.

The analyst fair value estimate for Cipher Mining has edged down from US$27.25 to about US$26.68 as analysts factor in higher Street price targets tied to the Amazon Web Services AI infrastructure lease, along with emerging views on earnings visibility and valuation multiples in high density data centers.

Curious what has to happen for that higher value to stack up? The narrative leans on rapid revenue expansion, shifting margins and a future earnings multiple that assumes Cipher can evolve well beyond a pure Bitcoin miner. The details behind those assumptions are what really matter.

Result: Fair Value of $26.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story can crack if Bitcoin mining economics weaken for an extended stretch or if the huge AI and HPC build outs end up underused.

Find out about the key risks to this Cipher Mining narrative.

Another Angle On Valuation

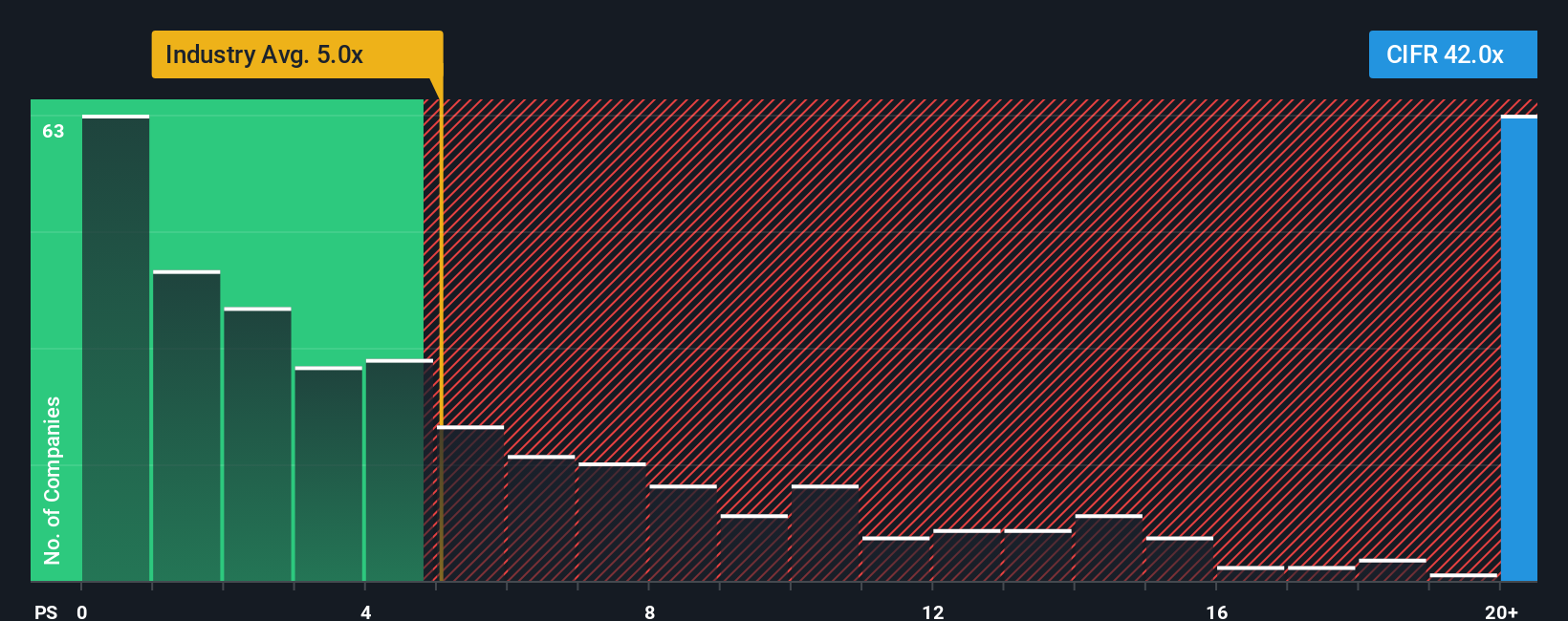

That 38.5% gap to the US$26.68 fair value looks interesting, but the P/S ratio tells a tougher story. Cipher trades on 31.4x sales, compared with 17.4x for peers and 3.6x for the wider US Software group, while the fair ratio is 7.5x. That kind of premium can either shrink quietly or reset sharply. Which outcome do you think the market is leaning toward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cipher Mining Narrative

If this take does not fully match your view, or you prefer to weigh the numbers yourself, you can build a custom thesis in minutes. Start with Do it your way.

A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Cipher has you thinking more broadly about your portfolio, this can be a sensible time to scan for other opportunities that fit your style and risk tolerance.

- Target potential mispricings by reviewing companies our screener flags as 53 high quality undervalued stocks that might warrant a closer look.

- Prioritise resilience by checking businesses highlighted in our 84 resilient stocks with low risk scores that score well on fewer identified risk factors.

- Hunt for early stage opportunities using the 29 elite penny stocks with strong financials that combine smaller market caps with more accessible share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CIFR

Cipher Mining

Develops and operates industrial-scale data centers in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Sogeclair's Outlook Will See a 18x Future PE in Five Years

The Grid Modernizer: Leidos and the $2.4 Billion Bet on Sovereign AI and Energy

EU#6 - From Political Experiment to Global Aerospace Power

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.