- United States

- /

- Software

- /

- NasdaqCM:BTDR

Evaluating Bitdeer Technologies Group (NasdaqCM:BTDR) Valuation Following Debt Repayment and Power Plant Acquisition

If you are holding or eyeing shares of Bitdeer Technologies Group (NasdaqCM:BTDR), this week’s string of announcements probably has you weighing your next move. The company is cleaning up its balance sheet by redeeming all outstanding 8.50% convertible senior notes, and it is actively preparing to boost its war chest through a newly filed shelf registration. At the same time, Bitdeer’s acquisition of a 101-megawatt gas-fired power plant in Alberta marks a tangible step toward vertical integration in crypto mining. The combination of debt reduction, access to new growth capital, and power infrastructure expansion is clearly intended to signal stronger financial footing and more control over costs in an unpredictable industry.

All these moves come after a year that has been anything but boring for the stock. Despite recent volatility, Bitdeer has actually delivered impressive annual returns, jumping 122% over the past year. That rally stands in sharp contrast to a much steeper decline year to date, as short-term momentum has cooled, even as management posts steep annual gains in both revenue and net income. The market’s shifting perception seems to reflect both excitement about long-term potential and concerns about near-term risks such as dilution and industry volatility.

So after this rollercoaster year and the company’s latest financial maneuvers, is Bitdeer a bargain that the market is overlooking, or is future growth already priced in?

Most Popular Narrative: 41.9% Undervalued

The prevailing narrative sees Bitdeer Technologies Group as significantly undervalued, with a calculated fair value far above the current share price. Proponents of this perspective point to the company's ambitious growth plans and improving operating metrics as key catalysts for a potential re-rating.

"Bitdeer's development of proprietary ASIC technology is expected to create cost advantages and open opportunities in selling machines to penetrate the $4 billion to $5 billion annual ASIC market, which could drive significant revenue and margin improvements."

Curious how Bitdeer's bold strategic moves add up to such a high target? The most-followed valuation narrative hinges on aggressive financial projections that few other companies in the space dare to target. Want to know which radical earnings and margin goals are built into this outlook? Just how high do those ambitions run for the years ahead? The answers may challenge your expectations.

Result: Fair Value of $21.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower revenue growth and persistently high R&D costs could quickly challenge forecasts and unsettle even the strongest bull case for Bitdeer.

Find out about the key risks to this Bitdeer Technologies Group narrative.Another View: Multiples Paint a Different Picture

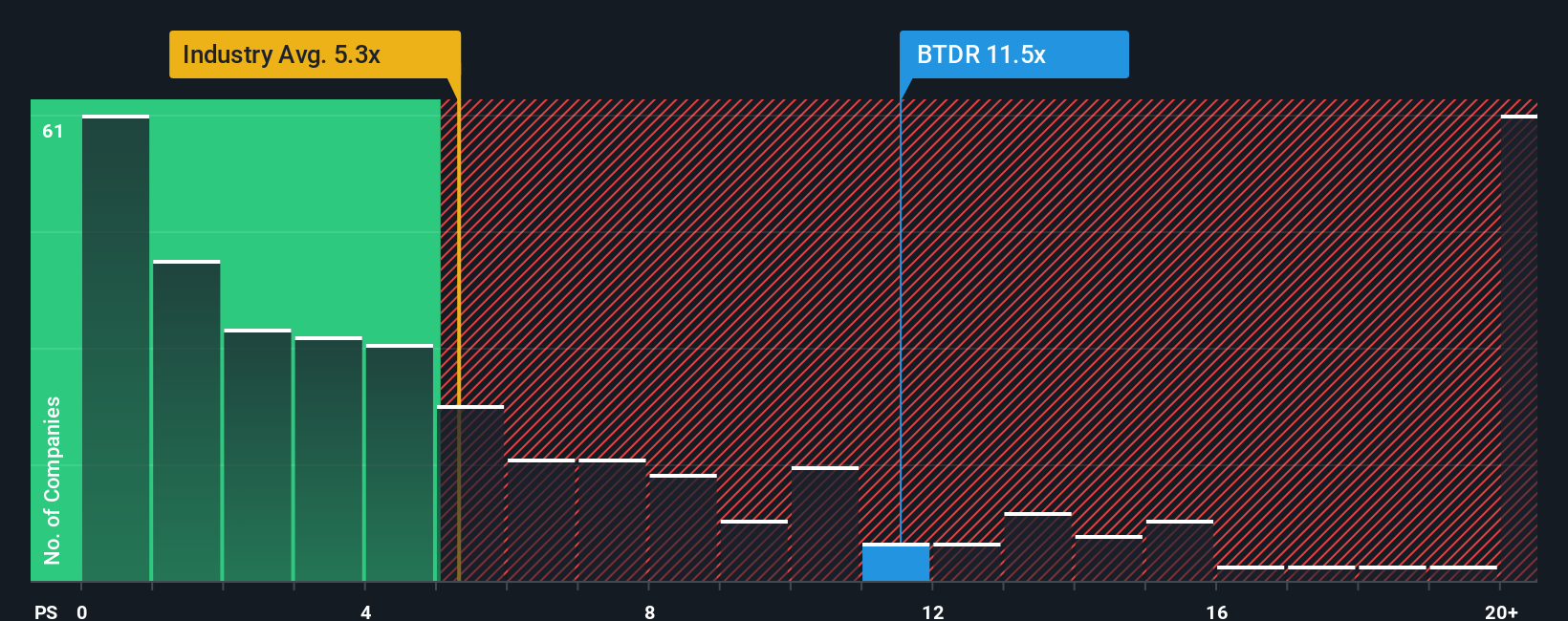

While fair value models suggest Bitdeer is seriously undervalued, a look at its revenue ratio compared to the broader software industry tells a more cautious story. Can multiple-based valuations reveal something the bulls are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bitdeer Technologies Group Narrative

If you think there’s another angle or want to dig deeper into the numbers yourself, it’s quick and easy to shape your own view in just a few minutes. Do it your way.

A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio by checking out some high-potential stock opportunities you may not have considered. Don’t let these standout sectors and emerging trends pass you by. See what else could be driving the next wave of returns.

- Boost your income with reliable picks offering robust yields by searching among hand-picked dividend stocks with yields > 3%.

- Take advantage of undervalued gems that may be flying under the radar using our exclusive shortlist for undervalued stocks based on cash flows.

- Ride the AI momentum by targeting companies at the forefront of artificial intelligence breakthroughs via our expert-curated collection of AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Safaricom: Why I'm Holding Long

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.