- United States

- /

- Software

- /

- NasdaqCM:BTDR

Bitdeer Technologies Group Second Quarter 2025 Earnings: Revenues Beat Expectations, EPS Lags

Bitdeer Technologies Group (NASDAQ:BTDR) Second Quarter 2025 Results

Key Financial Results

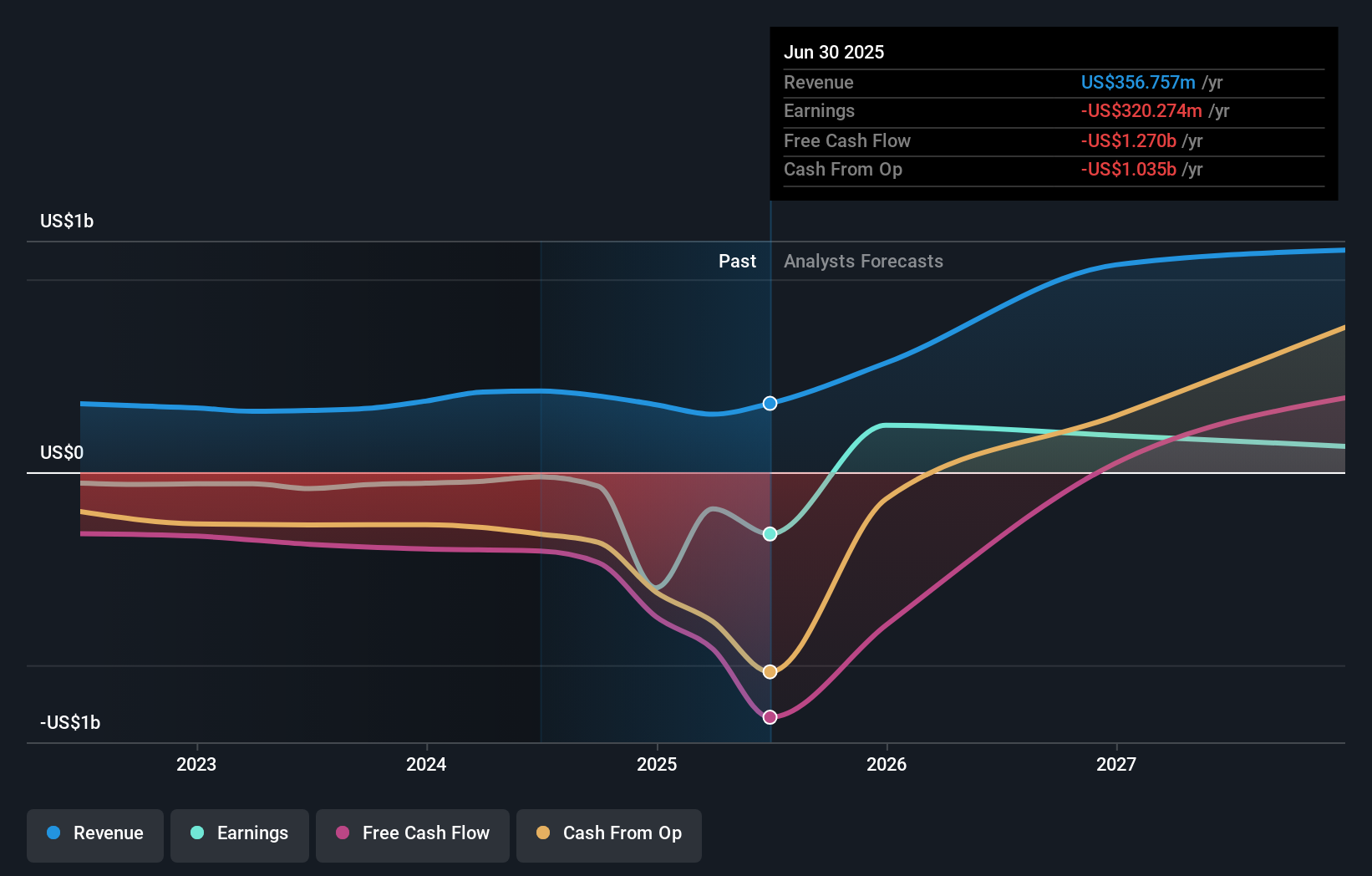

- Revenue: US$155.6m (up 57% from 2Q 2024).

- Net loss: US$147.7m (loss widened by US$130.0m from 2Q 2024).

- US$0.76 loss per share (further deteriorated from US$0.14 loss in 2Q 2024).

All figures shown in the chart above are for the trailing 12 month (TTM) period

Bitdeer Technologies Group Revenues Beat Expectations, EPS Falls Short

Revenue exceeded analyst estimates by 42%. Earnings per share (EPS) missed analyst estimates significantly.

Looking ahead, revenue is forecast to grow 52% p.a. on average during the next 3 years, compared to a 13% growth forecast for the Software industry in the US.

Performance of the American Software industry.

The company's shares are down 2.1% from a week ago.

Risk Analysis

It is worth noting though that we have found 3 warning signs for Bitdeer Technologies Group (1 can't be ignored!) that you need to take into consideration.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Safaricom: Why I'm Holding Long

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.