- United States

- /

- Software

- /

- NasdaqCM:BTDR

Bitdeer Technologies Group (BTDR): Reassessing Valuation After New Shareholder Class Action Lawsuit

Bitdeer Technologies Group (BTDR) is back in the spotlight after Holzer and Holzer announced a shareholder class action lawsuit alleging misleading disclosures around its next generation SEAL04 mining chip and A4 rig rollout.

See our latest analysis for Bitdeer Technologies Group.

The lawsuit lands after a tough stretch for Bitdeer, with a 1 day share price return of minus 9.13 percent adding to already weak year to date share price performance and a negative 1 year total shareholder return, suggesting momentum has been fading despite earlier gains over three years.

If this legal overhang has you rethinking your exposure to crypto and HPC names, it could be a good moment to scan other high growth tech opportunities via high growth tech and AI stocks for ideas beyond Bitdeer.

With shares down sharply over the past year but analysts still penciling in a sizable upside, is Bitdeer now trading at a steep discount to its long term potential, or is the market correctly pricing in growth and legal risk?

Most Popular Narrative Narrative: 69.4% Undervalued

With Bitdeer last closing at $10.65 against a narrative fair value near $35, the current share price reflects a stark disconnect in expectations.

The planned commercialization of SEALMINER ASICs, coupled with a high demand for energy efficient mining machines, represents a diversification of revenue streams and is likely to enhance revenue growth as Bitdeer becomes a key player in the ASIC market.

Curious how aggressive revenue expansion, margin recovery and a premium future earnings multiple combine to support that upside thesis? The full narrative unpacks the exact growth runway and profitability swing that underpin this ambitious fair value call.

Result: Fair Value of $34.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn revenue volatility and heavy capex for new power and ASIC projects could derail the margin recovery that underpins that bullish fair value case.

Find out about the key risks to this Bitdeer Technologies Group narrative.

Another Angle on Valuation

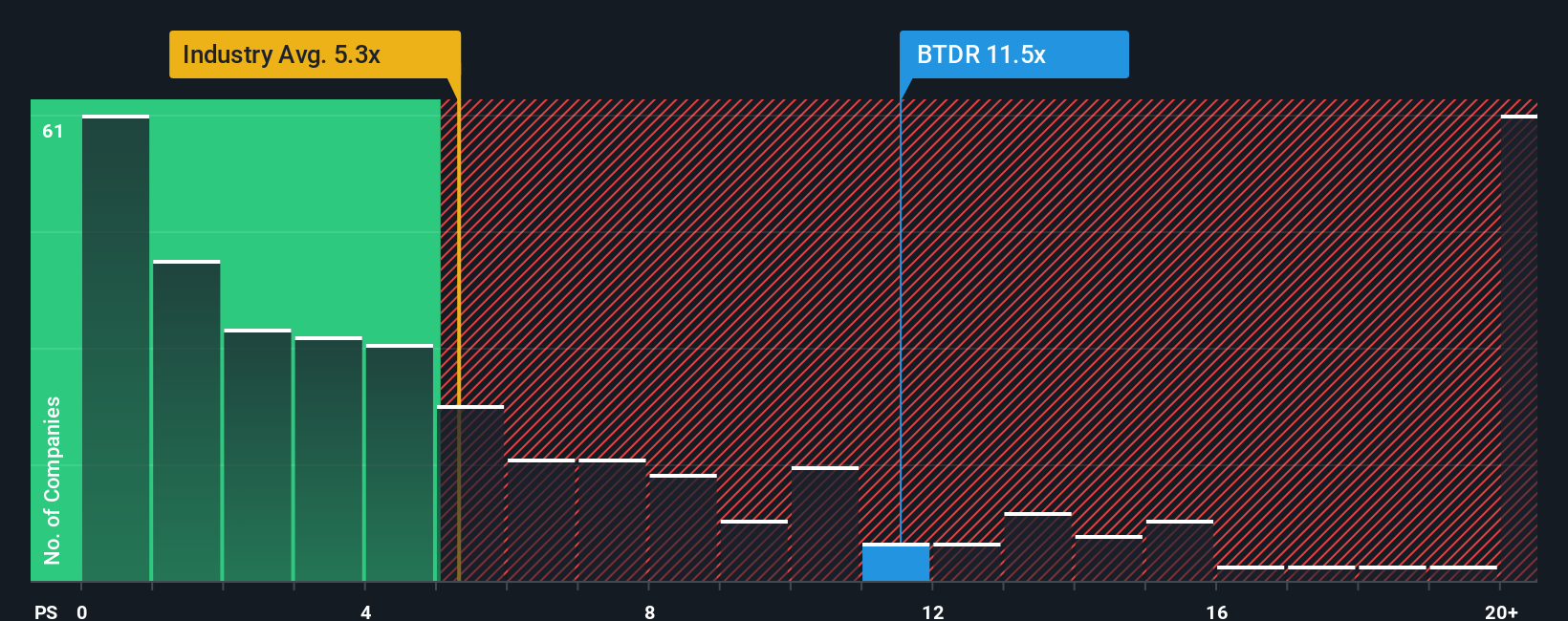

While the narrative fair value sees Bitdeer as deeply undervalued, the market is sending a mixed message. Bitdeer trades on a 5.4x price to sales ratio, richer than both the US Software industry at 4.9x and peers at 3.5x, yet below a fair ratio nearer 8.7x.

That gap hints at both upside if optimism returns and downside if sentiment sours. This leaves investors to ask whether Bitdeer is being priced for its future growth story or its current losses.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bitdeer Technologies Group Narrative

If this perspective does not quite fit your view, or you prefer to dive into the numbers yourself, you can construct a custom narrative in just a few minutes: Do it your way.

A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next potential opportunity by using the Simply Wall Street Screener to pinpoint stocks that better match your strategy and risk tolerance.

- Capitalize on overlooked bargains by scanning these 908 undervalued stocks based on cash flows that trade below their cash flow potential yet still show solid business fundamentals.

- Ride structural growth tailwinds by targeting these 30 healthcare AI stocks at the intersection of technology and medicine, where innovation can quickly translate into market share.

- Position yourself early in digital finance trends by tracking these 80 cryptocurrency and blockchain stocks that are building real businesses around blockchain, tokens, and next generation payment rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Moderate risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Beyond 2026, Beyond a Double

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.