- United States

- /

- Software

- /

- NasdaqCM:BTDR

Bitdeer Balances Bitcoin Mining Scale With Expanding AI Infrastructure Ambitions

- Bitdeer Technologies Group (NasdaqCM:BTDR) has become the largest public Bitcoin miner by self mining hash rate in 2026.

- The company is expanding into high performance AI infrastructure across Norway, Malaysia, and the U.S.

- Bitdeer plans to retrofit a hydropower facility to support AI workloads and GPU focused services.

- The business is building out GPU as a service and AI colocation offerings alongside its Bitcoin operations.

Bitdeer Technologies Group, traded as NasdaqCM:BTDR, sits at the intersection of Bitcoin mining and AI focused computing. The company now leads public miners by self mining hash rate and is putting capital and attention into AI ready data centers in several regions. For you as an investor, this creates a mixed profile that touches both digital assets and compute infrastructure.

The pivot toward GPU as a service and AI colocation could change how the market thinks about BTDR, from a pure miner to a broader compute provider. The hydropower retrofit plan also signals a focus on power efficient facilities that can host energy intensive AI workloads. As these projects scale, the balance between Bitcoin related revenue and AI infrastructure revenue will likely become a key point to watch.

Stay updated on the most important news stories for Bitdeer Technologies Group by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Bitdeer Technologies Group.

3 things going right for Bitdeer Technologies Group that this headline doesn't cover.

Quick Assessment

- ✅ Price vs Analyst Target: At US$10.08 versus a consensus target of US$22.96, the price sits about 56% below analyst expectations.

- ✅ Simply Wall St Valuation: Our model flags the shares as trading roughly 83.3% below estimated fair value.

- ❌ Recent Momentum: The 30 day return is about a 36% decline, so recent sentiment has been weak.

There is only one way to know the right time to buy, sell or hold Bitdeer Technologies Group. Head to Simply Wall St's company report for the latest analysis of Bitdeer Technologies Group's fair value.

Key Considerations

- 📊 This news links your thesis directly to both Bitcoin mining scale and the build-out of AI-ready infrastructure in Norway, Malaysia and the U.S.

- 📊 Monitor how AI-related revenues, the price-to-earnings (P/E) ratio versus the industry average of 26.4x, and hydropower utilization develop relative to the current 36.4x P/E.

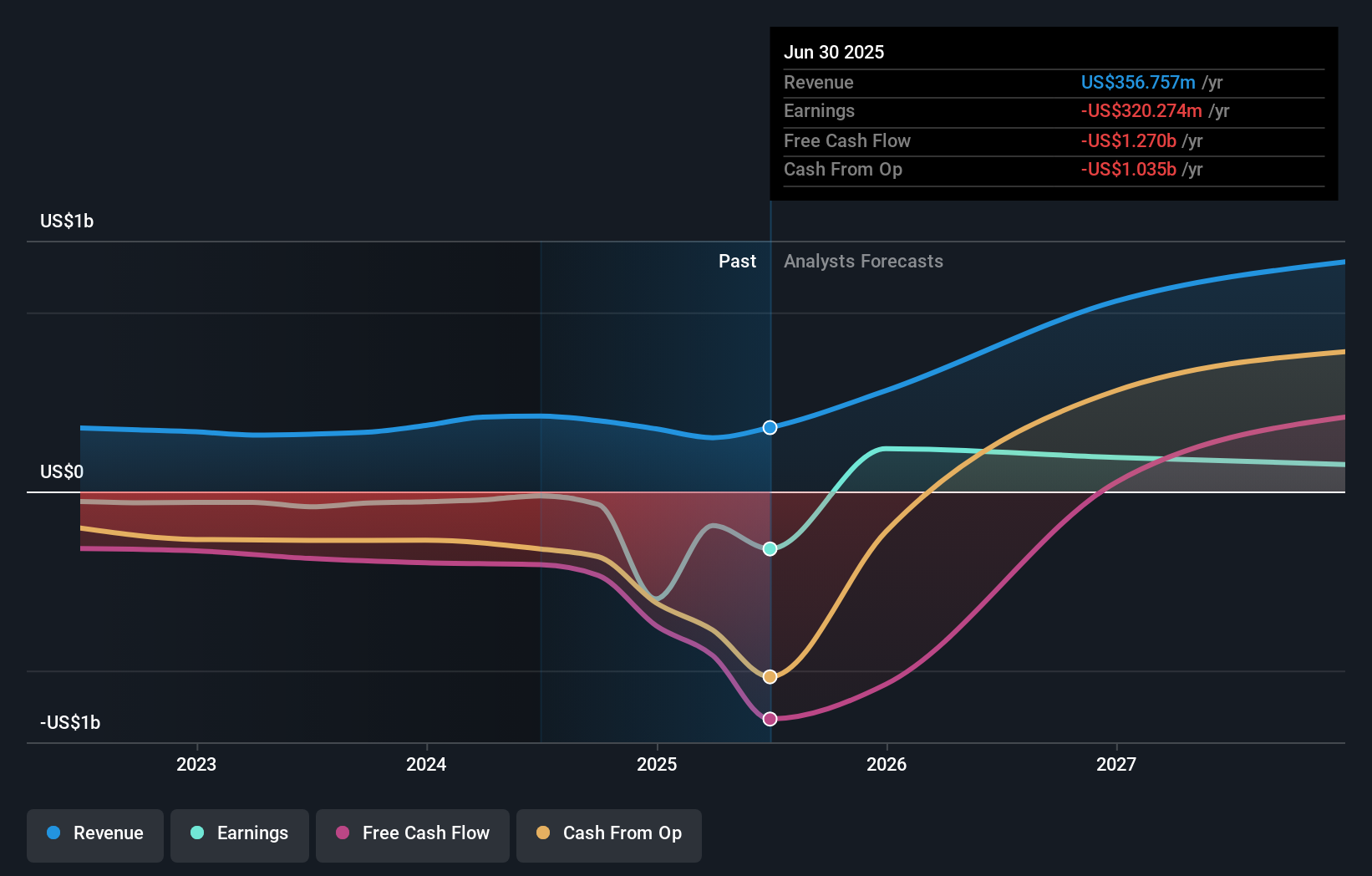

- ⚠️ Earnings are forecast to decline on average and interest coverage is flagged as weak, so balance sheet resilience is a key consideration as expansion spending rises.

Dig Deeper

For the full picture, including more risks and potential rewards, check out the complete Bitdeer Technologies Group analysis. Alternatively, you can visit the community page for Bitdeer Technologies Group to see how other investors think this latest news may affect the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Moderate risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

The Concentration Trap: Why the S&P 500 Is No Longer a 'Safe' Diversifier

Transformational Merger

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.