- United States

- /

- Software

- /

- NasdaqCM:BTBT

Bit Digital, Inc.'s (NASDAQ:BTBT) P/S Is Still On The Mark Following 31% Share Price Bounce

Bit Digital, Inc. (NASDAQ:BTBT) shares have continued their recent momentum with a 31% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.7% over the last year.

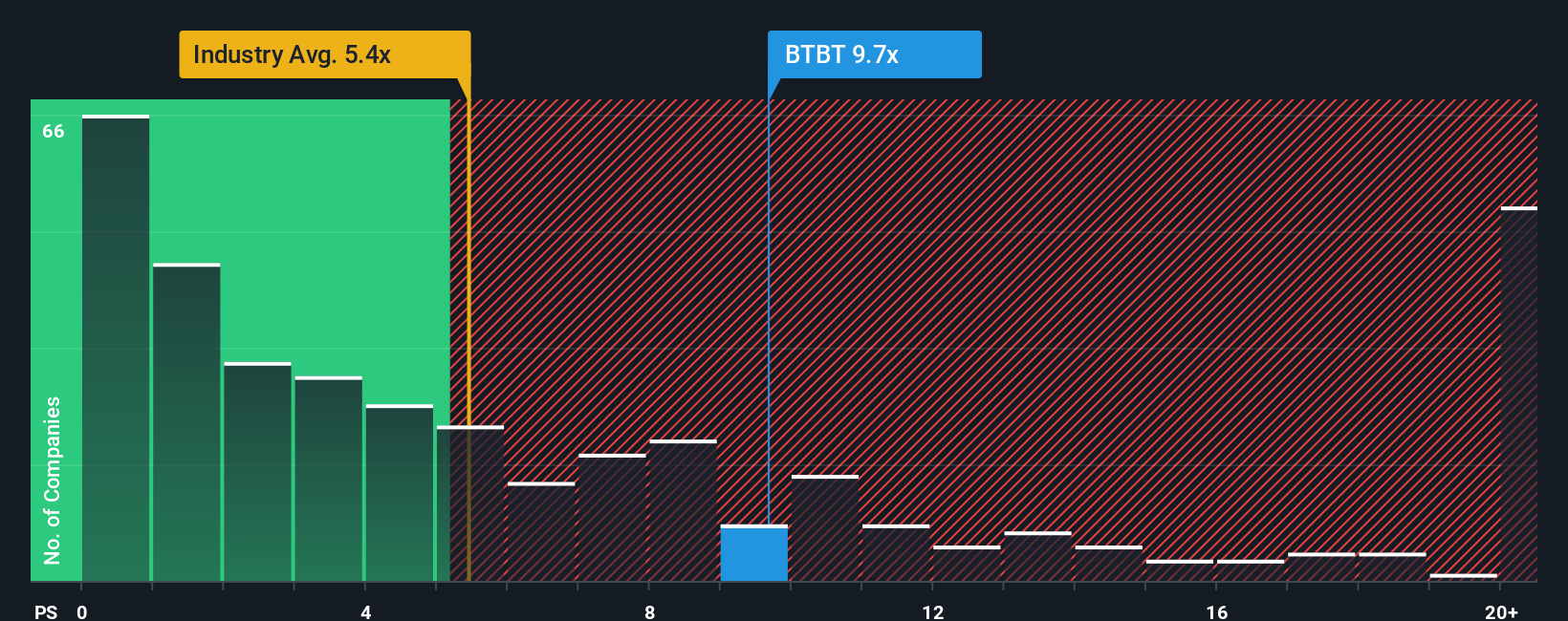

Since its price has surged higher, Bit Digital may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 9.7x, when you consider almost half of the companies in the Software industry in the United States have P/S ratios under 5.4x and even P/S lower than 2x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Bit Digital

How Has Bit Digital Performed Recently?

With revenue growth that's superior to most other companies of late, Bit Digital has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Bit Digital's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Bit Digital?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Bit Digital's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 52% last year. The latest three year period has also seen an excellent 68% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 37% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 16%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Bit Digital's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Bit Digital's P/S

Bit Digital's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Bit Digital maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Bit Digital (at least 1 which is concerning), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BTBT

Bit Digital

Engages in the institutional grade ethereum treasury and staking business.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives