- United States

- /

- Software

- /

- NasdaqCM:BTBT

A Closer Look at Bit Digital (BTBT) Valuation Following Bitcoin’s Surge and Renewed Institutional Interest

Reviewed by Simply Wall St

Bit Digital (BTBT) shares caught attention as Bitcoin surged past the $111,000 mark, fueling optimism across crypto-linked stocks. The rally followed news that MicroStrategy expanded its bitcoin holdings. In addition, Japan weighed more favorable crypto regulations.

See our latest analysis for Bit Digital.

Bit Digital’s momentum has picked up sharply following Bitcoin’s latest rally, with a 1-day share price return of 15.62% and a 35.26% jump over the past month. While momentum can be volatile in the crypto sector, the company’s three-year total shareholder return of 270% indicates that long-term investors have been well rewarded.

If this surge in digital assets has sparked your interest, consider broadening your search and discover fast growing stocks with high insider ownership

But is Bit Digital’s surge purely a reaction to Bitcoin's bull run, or do the fundamentals hint at further upside? With recent momentum and a sizeable discount to analyst targets, is there still a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 26% Undervalued

Bit Digital’s last close was $4.22, while the most popular narrative pegs fair value at $5.70. That gap highlights potential upside if the underlying logic of the narrative plays out as forecasted. Below, discover one of the biggest drivers behind this bullish perspective.

The company's structural pivot to become a dedicated Ethereum treasury and staking platform positions it to capitalize on the growing acceptance of Ethereum among institutional investors and asset managers. This is expected to drive future revenue growth through larger scale ETH holdings and increased staking yields.

Wondering what bold assumptions justify that lofty price target? The thesis hinges on eye-catching growth rates, margin turnarounds, and a profit multiple normally reserved for dominant tech names. Get the full picture to see what’s fueling this high-conviction narrative.

Result: Fair Value of $5.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could quickly shift if Ethereum prices tumble for an extended period, or if regulatory setbacks delay broader institutional adoption.

Find out about the key risks to this Bit Digital narrative.

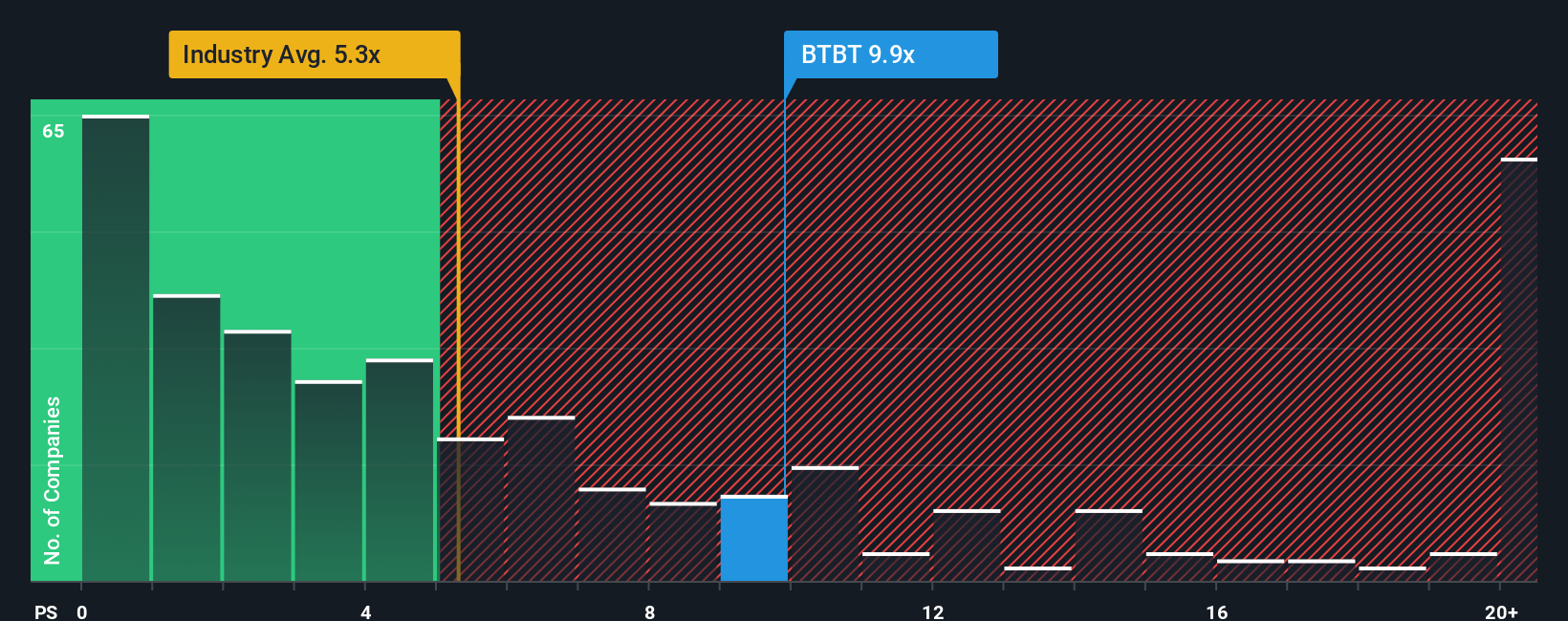

Another View: Multiples Tell a Different Story

While the narrative and analyst targets point to upside, market-based valuation multiples offer a reality check. Bit Digital’s price-to-sales ratio of 13.8x sits well above its industry average of 5.1x, its peer group at 3.8x, and even the fair ratio of 11.4x. This wide gap suggests investors are pricing in substantial future growth. Could that leave little room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bit Digital Narrative

If you see things differently or want to put the story together from your own perspective, it's quick and easy to build your own take in just a few minutes. Do it your way

A great starting point for your Bit Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Press your advantage by uncovering powerful trends in the market. If you want to stay ahead, don’t miss these handpicked opportunities shaping tomorrow’s portfolio winners:

- Unlock value and pursue impressive returns by checking out these 872 undervalued stocks based on cash flows, driven by strong earnings and positive cash flows.

- Tap into future-defining healthcare by researching these 33 healthcare AI stocks, powering breakthroughs in diagnostics, patient care, and medical technology.

- Position yourself at the edge of technological innovation and discover these 26 quantum computing stocks, for exposure to pioneering advancements in quantum computing and its real-world applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTBT

Bit Digital

Engages in the institutional grade ethereum treasury and staking business.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives