- United States

- /

- Software

- /

- NasdaqGS:BSY

Bentley Systems (NASDAQ:BSY) Might Be Having Difficulty Using Its Capital Effectively

To find a multi-bagger stock, what are the underlying trends we should look for in a business? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. However, after briefly looking over the numbers, we don't think Bentley Systems (NASDAQ:BSY) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Bentley Systems:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.092 = US$225m ÷ (US$3.2b - US$709m) (Based on the trailing twelve months to June 2023).

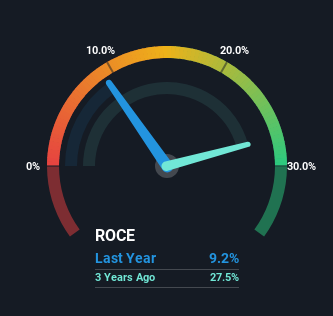

So, Bentley Systems has an ROCE of 9.2%. Even though it's in line with the industry average of 8.9%, it's still a low return by itself.

Check out our latest analysis for Bentley Systems

Above you can see how the current ROCE for Bentley Systems compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Bentley Systems.

What Can We Tell From Bentley Systems' ROCE Trend?

When we looked at the ROCE trend at Bentley Systems, we didn't gain much confidence. To be more specific, ROCE has fallen from 24% over the last four years. Meanwhile, the business is utilizing more capital but this hasn't moved the needle much in terms of sales in the past 12 months, so this could reflect longer term investments. It may take some time before the company starts to see any change in earnings from these investments.

On a related note, Bentley Systems has decreased its current liabilities to 22% of total assets. That could partly explain why the ROCE has dropped. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

The Bottom Line On Bentley Systems' ROCE

To conclude, we've found that Bentley Systems is reinvesting in the business, but returns have been falling. Although the market must be expecting these trends to improve because the stock has gained 39% over the last three years. But if the trajectory of these underlying trends continue, we think the likelihood of it being a multi-bagger from here isn't high.

One more thing, we've spotted 1 warning sign facing Bentley Systems that you might find interesting.

While Bentley Systems may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

The "Geopolitical Discount" vs. The Monopolistic Floor: The Two Narratives of TSM

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.