- United States

- /

- Software

- /

- NasdaqGS:BSY

Bentley Systems (BSY) Margin Decline Sparks Debate Over Valuation Premiums and Growth Narratives

Reviewed by Simply Wall St

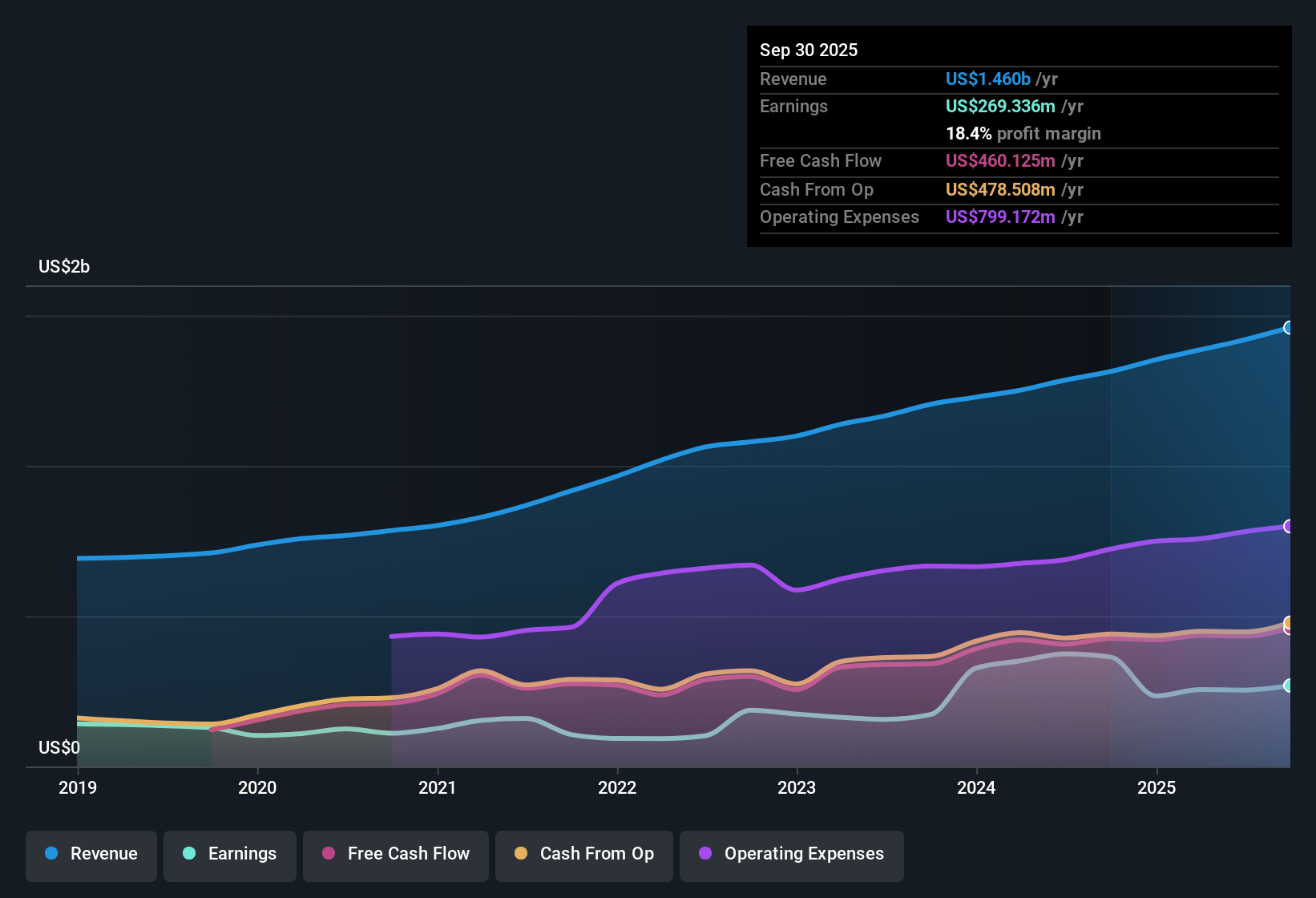

Bentley Systems (BSY) posted a net profit margin of 17.9%, down from last year’s 29.2%, with the company’s earnings showing negative growth relative to the prior year after averaging 24.2% annual growth over the past five years. The share price currently stands at $48.48, which is above some fair value estimates. Ongoing forecasts suggest earnings will grow 14.9% per year and revenue will grow 8.6% per year, both trailing the broader US market. Margins compressed during this period, but analysts still mark earnings quality as high and expect profit and revenue growth to continue. However, valuation premiums and recently declining profitability create a mixed sentiment for investors.

See our full analysis for Bentley Systems.Next up, we’ll see how these reported numbers stack up against the prevailing narratives and expectations from the Simply Wall St community, highlighting where the data backs up the story and where the outcomes might surprise.

See what the community is saying about Bentley Systems

Profit Margins Rebound Expected

- Analysts forecast Bentley Systems’ profit margin to climb back from 17.9% today to 23.6% within three years, reversing the recent year-over-year contraction and aiming closer to historical averages.

- According to the analysts’ consensus view, this supports confidence in Bentley’s ability to stabilize profitability despite near-term margin compression.

- Sustained global infrastructure investment is expected to expand the addressable market, with ongoing digital transformation driving higher-margin product adoption.

- Integration of advanced AI, cloud solutions, and expansion into subscription models is highlighted as a lever for both recurring revenue and margin recovery. This provides a buffer against competitive and operational challenges.

Valuation Stays at a Premium

- Bentley trades at a Price-To-Earnings ratio of 60x, well above the US Software industry’s 35.2x average, and its $48.48 share price stands above the DCF fair value of $37.63 but significantly below the analyst price target of $58.93.

- Analysts’ consensus notes this premium is justified by expectations for high-quality earnings and durable growth.

- Heavy adoption of subscription and consumption-based models, now exceeding 92% of revenues, is cited as increasing revenue stability and supporting a higher valuation multiple.

- The gap between current share price, fair value, and target suggests investors are weighing both near-term margin weakness and long-term growth potential relative to the broader software sector.

Growth Outlook Trails the Market

- Revenue is projected to grow at 8.6% per year, and earnings at 14.9%, both trailing the broader US market where the average growth rates are higher (10.5% for revenue).

- Analysts’ consensus narrative highlights that while these growth rates are robust for infrastructure software, they may limit multiple expansion and expose Bentley to heightened scrutiny if expectations fall short.

- Ongoing global investment in infrastructure and digital transformation form the foundation of future growth. However, exposure to cyclical markets and competition from newer SaaS rivals raise questions about sustaining outperformance.

- Analysts point out that despite the slower growth outlook, recurring revenues and a broader customer base help underpin earnings predictability and buffer some of the market’s tougher challenges.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bentley Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the figures tell another story? Put your own spin on the results and craft your perspective in just a few minutes with Do it your way.

A great starting point for your Bentley Systems research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Bentley’s premium valuation and slowing growth rates mean its shares may struggle to outperform if profit recovery takes longer, or if broader market trends shift.

If you want alternatives with stronger upside for both price and fundamentals, check out these 838 undervalued stocks based on cash flows that could offer a better entry point right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives