- United States

- /

- Software

- /

- NasdaqGS:BSY

Bentley Systems (BSY): Exploring Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Bentley Systems (BSY) has captured the attention of investors lately as its shares have shown some volatility over the past month. After a recent dip, many are weighing its long-term performance in relation to its current valuation.

See our latest analysis for Bentley Systems.

While Bentley Systems’ share price recently dipped, its longer-term momentum remains intact, with a year-to-date share price return of 9.31% and a one-year total shareholder return of 5.59%. Investors are watching closely to see if confidence continues to build after these moves, as the company’s multi-year total shareholder return of 56.02% over three years still stands out.

If you’re exploring new opportunities beyond software, now is the perfect time to discover fast growing stocks with high insider ownership.

Yet with recent volatility and substantial long-term gains, the question remains: is Bentley Systems actually undervalued right now, or has the market already factored in all of its future growth potential?

Most Popular Narrative: 14% Undervalued

Despite some recent share price declines, the prevailing narrative values Bentley Systems at $59.08 per share, implying notable upside from the last close at $50.83. This valuation assumes trends and opportunities in the industry will play out in Bentley’s favor and fuel growth beyond current market expectations.

Sustained global investment in infrastructure, driven by government initiatives in the US, UK, EU, and high-growth regions like India and the Middle East, continues to expand Bentley's addressable market. This supports durable double-digit ARR and revenue growth. Large-scale productivity challenges (such as the shortage of skilled engineers) are forcing the sector to accelerate digital transformation. This elevates demand for Bentley's AI-driven, cloud-based, and digital twin solutions, which could drive both revenue expansion and higher-margin product mix.

Curious about the numbers? The fair value hinges on projections of fast-rising profits and a profit multiple more often seen in growth tech. Want to discover the specific financial bets and the single metric driving this narrative? See what lies behind the headline valuation that could surprise even seasoned investors.

Result: Fair Value of $59.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, adoption of disruptive AI tools or intensifying competition in cloud-based engineering software could threaten Bentley’s earnings growth assumptions and long-term profitability.

Find out about the key risks to this Bentley Systems narrative.

Another View: Market Multiples Paint a Different Picture

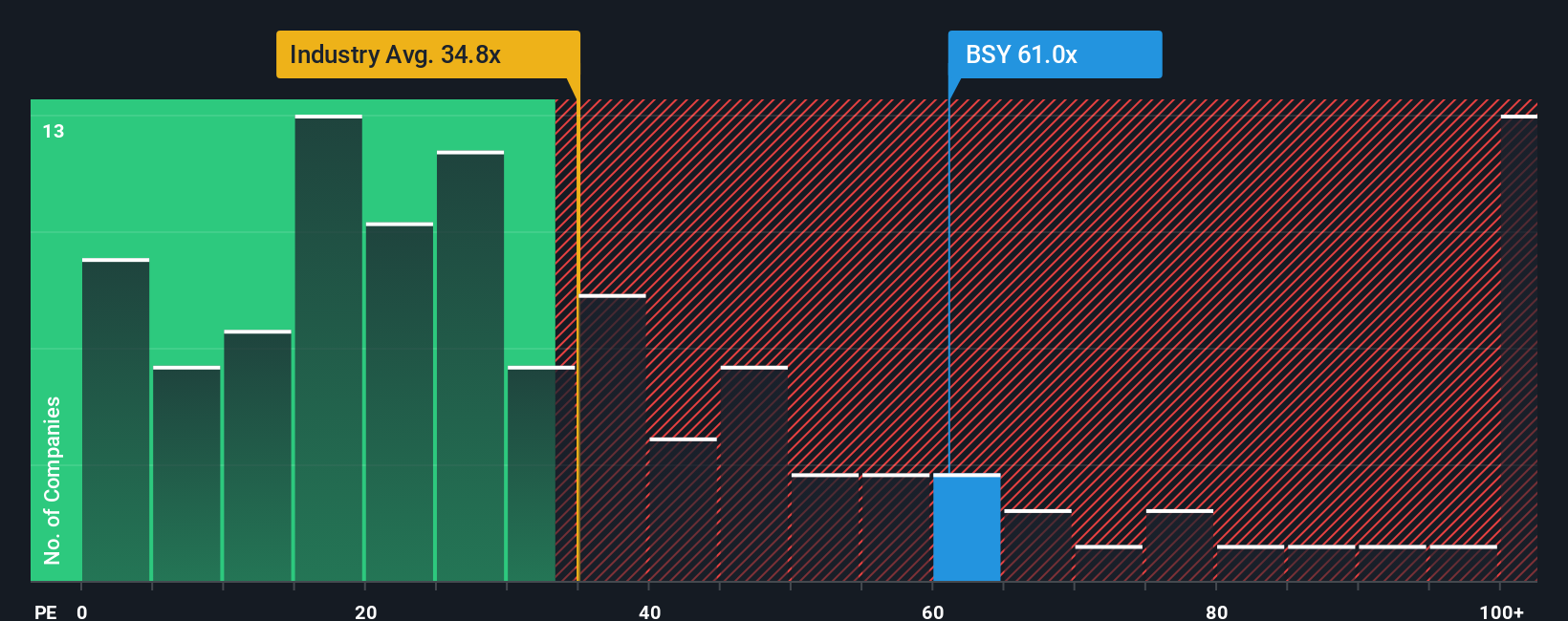

When looking at Bentley Systems through the lens of price-to-earnings, there is a stark difference compared to earlier optimism. The company trades at 62.9x earnings, which is much richer than both its peers and the broader software sector, and almost double its fair ratio of 35.3x. This suggests the market is baking in a lot of future success, so the current price could carry major downside risk if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bentley Systems Narrative

If you have a different perspective or want to dive into the details yourself, you can put together your own story in under three minutes. Do it your way.

A great starting point for your Bentley Systems research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Lots of investors overlook unique opportunities hiding in plain sight. Give yourself an edge by uncovering stocks with the fundamentals, upside, or innovations the crowd is missing. Miss out and you could leave big potential on the table.

- Tap into the future of medicine and tech breakthroughs by catching the leaders driving innovation in healthcare with these 33 healthcare AI stocks.

- Cash in on reliable income by targeting the most consistent yield generators in these 22 dividend stocks with yields > 3%.

- Seize rapid growth prospects in emerging technology by focusing on trailblazing companies in these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives