- United States

- /

- Software

- /

- NasdaqGS:AUR

Aurora Innovation (AUR): Evaluating Valuation as Self-Driving Trucking Network Expands With New Fort Worth–El Paso Route

Reviewed by Simply Wall St

Aurora Innovation (AUR) is making headlines as it opens a major commercial self-driving trucking route between Fort Worth and El Paso. This signals accelerated scaling in the autonomous transport space.

This move comes alongside news that the company will integrate its next-generation Aurora Driver hardware, which aims to lower costs and support safe operation in challenging weather.

See our latest analysis for Aurora Innovation.

Momentum has been choppy for Aurora Innovation, with the 1-day share price return up 2.1% but the 30-day share price return still down 16.3% and the year-to-date figure off by 29.2%. Despite product launches and new trucking partnerships boosting long-term optimism, persistent financial losses have weighed on sentiment. Over three years, though, the total shareholder return is an impressive 140%, which serves as a reminder that the company’s bold bets have sparked periods of real outperformance, even as risks remain elevated.

If this kind of technology-driven progress piques your interest, it might be time to see who else is gaining ground. Check out See the full list for free..

Yet with earnings still deep in negative territory and a share price that has struggled all year, the decisive question now is whether Aurora Innovation's rapid operational progress means the market is overlooking hidden value, or if all future growth is already priced in.

Price-to-Book Ratio of 3.6x: Is it justified?

Aurora Innovation’s stock is currently trading at a price-to-book ratio of 3.6x, below both its direct peer average of 4.4x and the broader US Software industry average of 3.7x. With a last close share price of $4.32, this measure suggests investors are valuing the business just under its peer group benchmarks, hinting at a discount in the current market narrative.

The price-to-book ratio compares a company's market value to its book value. For a technology innovator like Aurora Innovation, this metric is particularly telling, as it offers insight into how much investors are willing to pay for every dollar of net assets, even before the company achieves significant profitability or revenue scale.

Despite Aurora's limited revenues and ongoing losses, the stock is cheaper than both peer and industry averages on this multiple. This could signal that the market remains cautious about Aurora's growth path, or it may be undervaluing the potential for future commercial traction. If market sentiment shifts or tangible revenue progress accelerates, there is room for this ratio to close the gap with peers.

Given that analysts do not provide a fair ratio benchmark and our own fair ratio is not available, this trading level could present an opportunity, especially for those anticipating improved fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.6x (UNDERVALUED)

However, persistent net losses and slow revenue growth raise uncertainty for Aurora Innovation. These trends could potentially limit near-term upside if they continue.

Find out about the key risks to this Aurora Innovation narrative.

Another View: Discounted Cash Flow Perspective

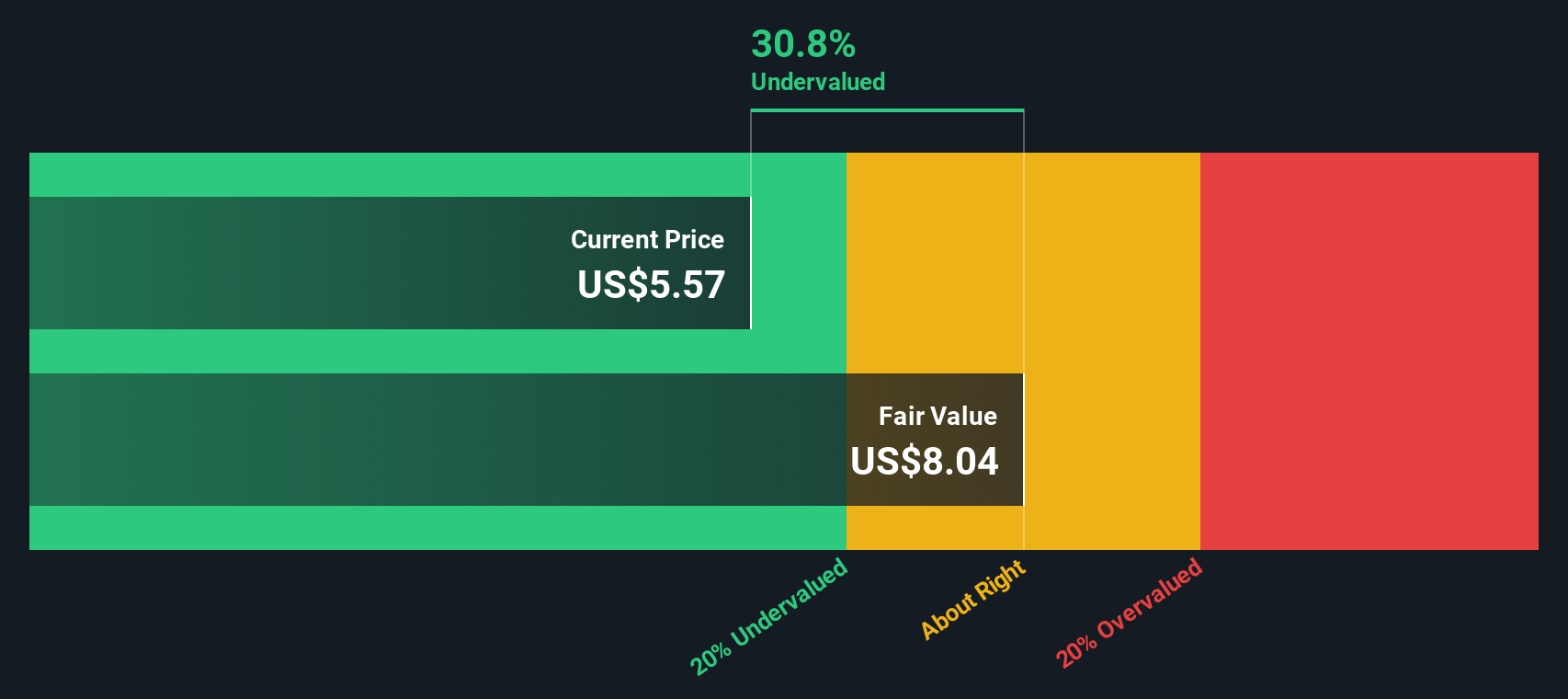

Looking at Aurora Innovation with a different lens, our DCF model suggests the company is trading about 31% below its estimated fair value. This implies the market is undervaluing the business based on future cash flow potential. Still, it is worth considering whether that optimism is justified or if risk remains the dominant factor in the story.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aurora Innovation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aurora Innovation Narrative

If you see things differently or want to dig into the details yourself, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your Aurora Innovation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Now is a great time to tap into smarter investing by uncovering companies with unique growth potential, solid fundamentals, or steady income for your portfolio.

- Boost your search for the next big breakthrough by targeting tech innovators through these 25 AI penny stocks with advances in automation and machine learning.

- Find stocks offering generous yields by browsing these 16 dividend stocks with yields > 3%, perfect for investors who want to strengthen their passive income streams.

- Seize opportunities in digital finance with these 82 cryptocurrency and blockchain stocks, featuring leaders in cryptocurrency and blockchain positioned for potential future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUR

Aurora Innovation

Operates as a self-driving technology company in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives