- United States

- /

- Software

- /

- NasdaqCM:APPS

Will Digital Turbine’s (APPS) Revenue Growth Offset Ongoing Financial Strains After Q2 Results?

Reviewed by Sasha Jovanovic

- Digital Turbine announced in the past that it would report its Q2 2026 financial results on November 4, 2025, at 4:00 PM US Eastern Standard Time, drawing attention from analysts and market participants.

- Anticipation ahead of the results was heightened by expectations for stable earnings per share and a 7% revenue rise, while ongoing financial pressure and a distressed Altman Z-Score highlighted risks to the company’s financial health.

- We will now explore how concerns over financial stability and expected revenue growth shape Digital Turbine's investment narrative following the Q2 announcement.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Digital Turbine Investment Narrative Recap

To be a shareholder in Digital Turbine, you need confidence in the company’s ability to grow platform revenues despite its current unprofitability and the continued tightening of industry and financial pressures. The Q2 2026 earnings event primarily draws focus to short-term revenue growth as the key catalyst, while financial health, evidenced by a distressed Altman Z-Score and lingering losses, remains the central risk, with the latest update having little material impact on those dynamics.

The announcement raising FY26 revenue guidance in September is especially relevant right now, as it reinforces analyst expectations for top line growth going into the Q2 results. While guidance upgrades offer optimism, the consistency of these alongside ongoing net losses underscores the balance between opportunity and caution for those following the company's near-term trajectory.

By contrast, the risk of losing key partnerships and device access is an issue investors should be aware of, as reliance on major channel partners remains high...

Read the full narrative on Digital Turbine (it's free!)

Digital Turbine's outlook forecasts $651.7 million in revenue and $85.3 million in earnings by 2028. This is based on a 9.0% annual revenue growth rate and a $166.3 million increase in earnings from the current -$81.0 million.

Uncover how Digital Turbine's forecasts yield a $6.75 fair value, a 7% upside to its current price.

Exploring Other Perspectives

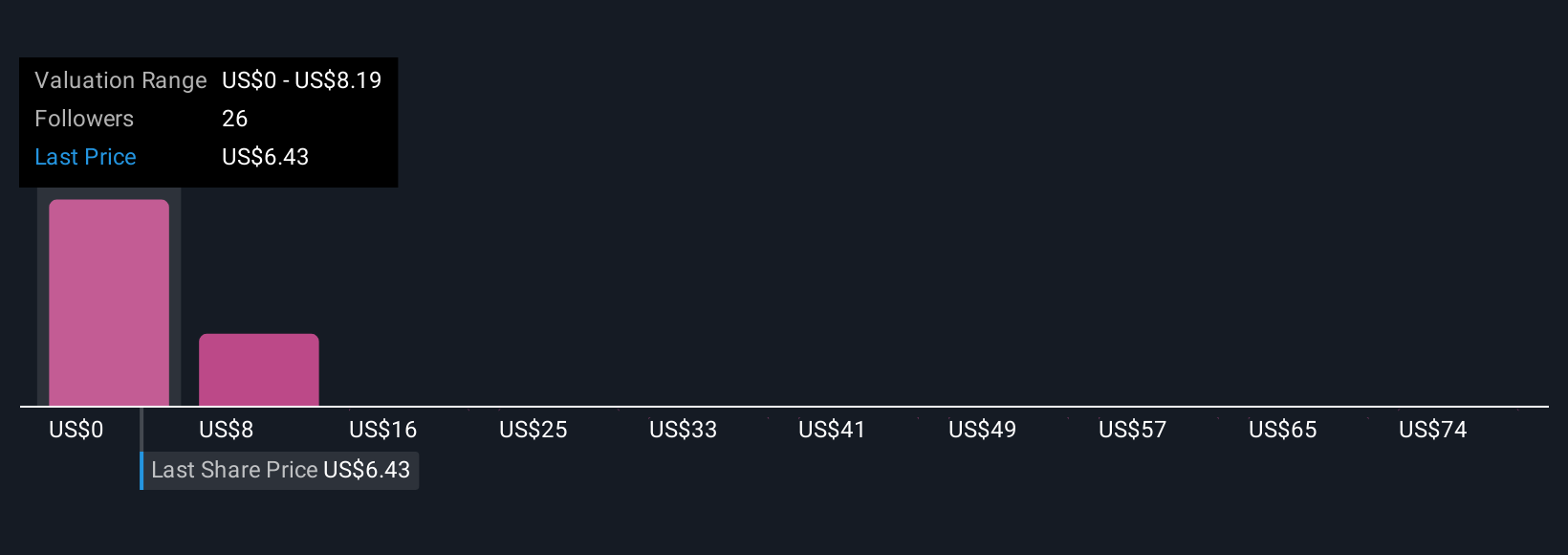

Sixteen fair value estimates from the Simply Wall St Community range from US$8.19 to US$81.85 per share. In the context of upbeat revenue guidance, these wide-ranging perspectives reveal how much opinions differ on the company’s ability to sustain growth amid ongoing financial risks.

Explore 16 other fair value estimates on Digital Turbine - why the stock might be worth just $8.18!

Build Your Own Digital Turbine Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Digital Turbine research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Digital Turbine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Digital Turbine's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:APPS

Digital Turbine

Through its subsidiaries, operates a mobile growth platform for advertisers, publishers, carriers, and device original equipment manufacturers (OEMs).

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives