- United States

- /

- Software

- /

- NasdaqCM:APPS

Digital Turbine, Inc. (NASDAQ:APPS) Stock Catapults 45% Though Its Price And Business Still Lag The Industry

Digital Turbine, Inc. (NASDAQ:APPS) shareholders are no doubt pleased to see that the share price has bounced 45% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 75% share price drop in the last twelve months.

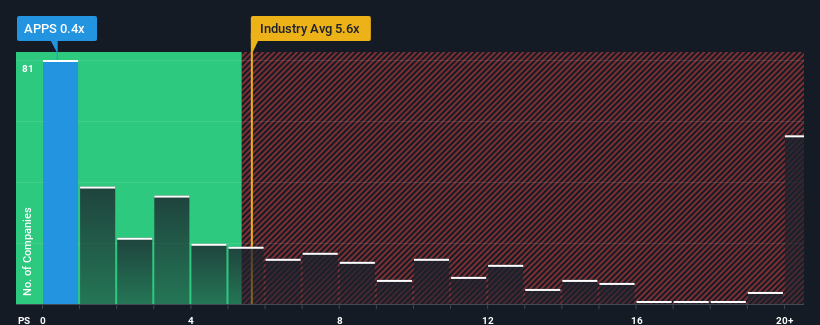

Even after such a large jump in price, Digital Turbine may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 5.3x and even P/S higher than 13x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Digital Turbine

What Does Digital Turbine's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Digital Turbine's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Digital Turbine's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Digital Turbine?

In order to justify its P/S ratio, Digital Turbine would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. The last three years don't look nice either as the company has shrunk revenue by 7.3% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 1.5% over the next year. That's shaping up to be materially lower than the 27% growth forecast for the broader industry.

In light of this, it's understandable that Digital Turbine's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Digital Turbine's P/S

Digital Turbine's recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Digital Turbine's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 4 warning signs for Digital Turbine (2 are a bit concerning!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:APPS

Digital Turbine

Through its subsidiaries, operates a mobile growth platform for advertisers, publishers, carriers, and device original equipment manufacturers (OEMs).

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives