- United States

- /

- Software

- /

- NasdaqGM:APPF

AppFolio (APPF) Valuation in Focus Following Raised 2025 Revenue Guidance and Q3 Growth Momentum

Reviewed by Simply Wall St

AppFolio (APPF) just raised its 2025 revenue guidance and is now aiming for up to $950 million in annual sales. This shift follows steady gains in the third quarter, as well as ongoing adoption of its higher-tier products.

See our latest analysis for AppFolio.

AppFolio’s upbeat revenue outlook and solid Q3 results sparked a swift market response, with the share price jumping nearly 8% in a single day. While momentum has cooled since midsummer, the one-year total shareholder return sits at an impressive 20%. The last three years have delivered a remarkable 127% for investors, which underscores the company’s longer-term growth story.

If you’re curious about what other dynamic software players are gaining notice, this is the perfect time to discover fast growing stocks with high insider ownership

But with shares now trading about 25% below consensus analyst targets and strong revenue gains fueling optimism, the big question is whether AppFolio’s upside is just beginning or if the market has already priced in future growth.

Most Popular Narrative: 22.9% Undervalued

With the most followed narrative setting AppFolio's fair value at $330.20 and the last close at $254.43, the implied upside is substantial, fueling debate about whether today's price fully captures the fundamentals.

Expansion of integrated ecosystem partnerships (such as AppFolio Stack, fintech solutions, and third-party partner integrations) provides customers with more seamless, end-to-end experiences. This increase in platform stickiness, ARPU, and recurring revenue potential supports long-term growth.

Elevated labor shortages and ongoing economic pressures in real estate are driving property management customers to adopt technology for cost reduction and efficiency. This trend supports consistent customer acquisition and minimizes churn, which can positively impact revenue and retention rates.

Curious what's behind the boldest fair value estimate yet? Find out which growth drivers the narrative is banking on and what financial assumptions imply a potential re-rating for AppFolio. Do the numbers match the hype? Unlock the answers and see what sets this forecast apart.

Result: Fair Value of $330.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising innovation costs and heavy reliance on the U.S. market could challenge AppFolio’s growth trajectory if industry conditions or competition shift.

Find out about the key risks to this AppFolio narrative.

Another View: What the Market Multiples Say

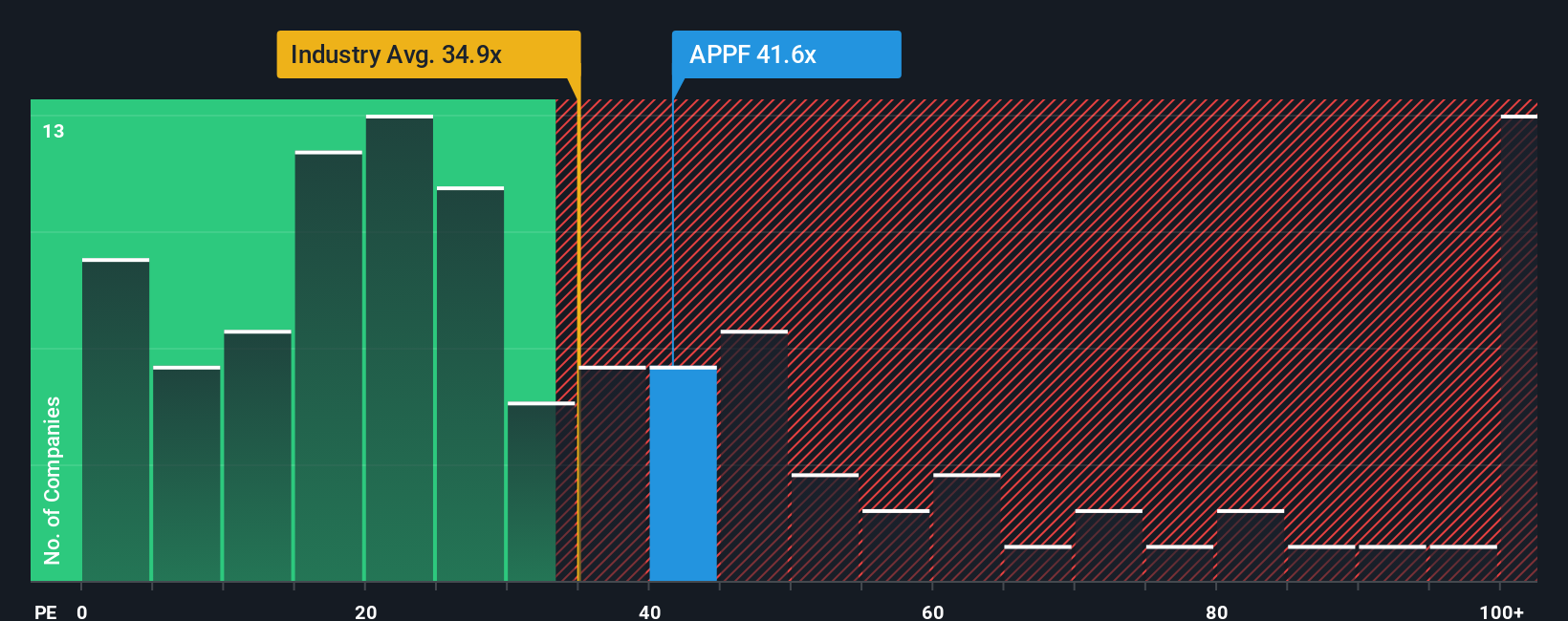

While the fair value narrative points to upside, the market tells a more cautious story. AppFolio is currently trading at a price-to-earnings ratio of 44.8x, which is significantly higher than the US Software industry average of 34.9x and the peer group average of 34.1x. Compared to the fair ratio of 28.2x, this suggests investors are paying a steep premium for expected growth and quality. This premium may indicate belief in sustained outperformance, or it could reflect that buyers are taking on more valuation risk than they realize.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AppFolio Narrative

If the consensus view or expert opinions aren't quite your style, dive into the data and craft your own take in just a few minutes. Do it your way

A great starting point for your AppFolio research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let smart opportunities slip by; unlock your next winning stock by leveraging these powerful tools that help you stay a step ahead.

- Maximize your dividend income and put your money to work by checking out these 18 dividend stocks with yields > 3% with yields above 3%.

- Spot market mispricings quickly and target true value plays instantly with these 843 undervalued stocks based on cash flows based on actual cash flows.

- Tap into tomorrow’s megatrends by pinpointing standouts in artificial intelligence with these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APPF

AppFolio

Provides cloud-based platform for the real estate industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives