- United States

- /

- Software

- /

- NasdaqGS:APP

Why AppLovin (APP) Is Up on Record Revenue Surge and $3.2 Billion Buyback Expansion

Reviewed by Sasha Jovanovic

- Earlier this week, AppLovin reported a 68% year-over-year revenue increase to US$1.41 billion and expanded its share repurchase authorization by US$3.2 billion, attributing these gains to the success of its AI-powered AXON 2.0 engine and rapid adoption of the Axon Ads Manager platform.

- This strong performance highlights AppLovin's ability to leverage advanced machine learning technology to achieve significant revenue growth, improve operating margins, and generate robust cash flow, setting the company apart from competitors in the digital advertising space.

- We'll examine how AppLovin's record-breaking revenue and cash flow are reshaping its investment narrative and long-term growth outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

AppLovin Investment Narrative Recap

To be a shareholder in AppLovin today, you need to believe in its ability to successfully expand beyond its historic mobile gaming roots by leveraging AI and new self-serve ad tools to capture a larger share of the global digital advertising market. The recent earnings report with its strong revenue and operating margin numbers reinforces this growth narrative, but it does not materially change the immediate focus: AppLovin's core short-term catalyst remains growth in self-serve ad platform adoption, while platform risk from Apple and Google policy changes continues to be the biggest risk.

The most relevant recent announcement is the expansion of AppLovin's share buyback authorization by an additional US$3.2 billion, bringing the total to nearly US$8 billion. This reflects the company's consistent capital return to shareholders, and may support the investment thesis if robust cash flow growth from new products like the Axon Ads Manager persists as a key catalyst.

However, investors should also be aware that, in contrast to the upbeat revenue news, AppLovin's high dependence on third-party mobile platforms still leaves it exposed to the possibility that...

Read the full narrative on AppLovin (it's free!)

AppLovin's outlook forecasts $10.5 billion in revenue and $6.2 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 22.2% and an increase in earnings of $3.7 billion from current earnings of $2.5 billion.

Uncover how AppLovin's forecasts yield a $718.71 fair value, a 38% upside to its current price.

Exploring Other Perspectives

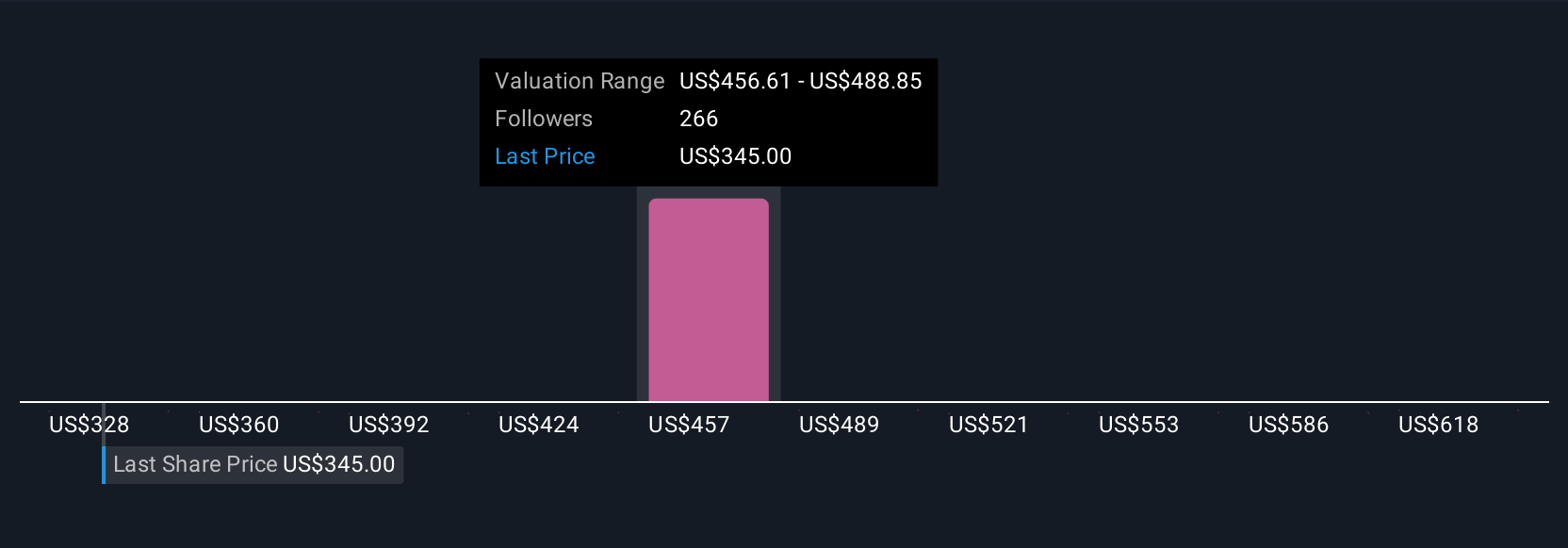

Simply Wall St Community members offered 28 fair value estimates for AppLovin stock from US$327.69 to US$718.71. While differences are striking, many focus on how regulatory, privacy or platform changes could reshape returns, see how other investors assess the risk of a shifting digital advertising market.

Explore 28 other fair value estimates on AppLovin - why the stock might be worth as much as 38% more than the current price!

Build Your Own AppLovin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AppLovin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AppLovin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AppLovin's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives