- United States

- /

- Software

- /

- NasdaqGS:APP

How AppLovin's (APP) AI Ad Tech Pivot and Gaming Exit May Reshape Its Investment Appeal

Reviewed by Sasha Jovanovic

- In recent days, AppLovin announced a strategic shift to become a pure advertising technology company after divesting its mobile gaming division for US$900 million, while expanding its AI-powered advertising platform into sectors such as e-commerce and automotive.

- This move reflects strong confidence from analysts and investors, with positive sentiment fueled by the company's advancements in artificial intelligence and successful expansion beyond the gaming industry.

- We'll examine how AppLovin's sharpened AI ad tech focus and sector expansion may shape the company's investment narrative going forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

AppLovin Investment Narrative Recap

To be a shareholder in AppLovin, you have to believe in its transformation into a pure-play advertising technology provider, fueled by AI and expanding well beyond its mobile gaming roots. The recent US$900 million divestment of its gaming business further cements this vision, directly addressing dependence on gaming and enhancing the company’s near-term growth catalyst, sector diversification through AI ad tech, while diminishing one of its biggest historical risks. Any continued regulatory scrutiny or tightening of data privacy rules remains a potential headwind, though this shift does not materially alter that risk in the short term.

Among recent developments, AppLovin’s major rollout of its AI-powered, self-service platform targeting e-commerce advertisers is particularly relevant. This move is expected to broaden its advertiser base and support growth beyond gaming, tying directly to the company’s efforts to diversify revenue streams, a key near-term catalyst highlighted by analysts following these announcements.

However, investors should be aware that, despite strong momentum, heightened regulatory risk around data privacy ...

Read the full narrative on AppLovin (it's free!)

AppLovin's narrative projects $10.5 billion in revenue and $6.2 billion in earnings by 2028. This requires a 22.2% yearly revenue growth and a $3.7 billion increase in earnings from $2.5 billion today.

Uncover how AppLovin's forecasts yield a $649.96 fair value, in line with its current price.

Exploring Other Perspectives

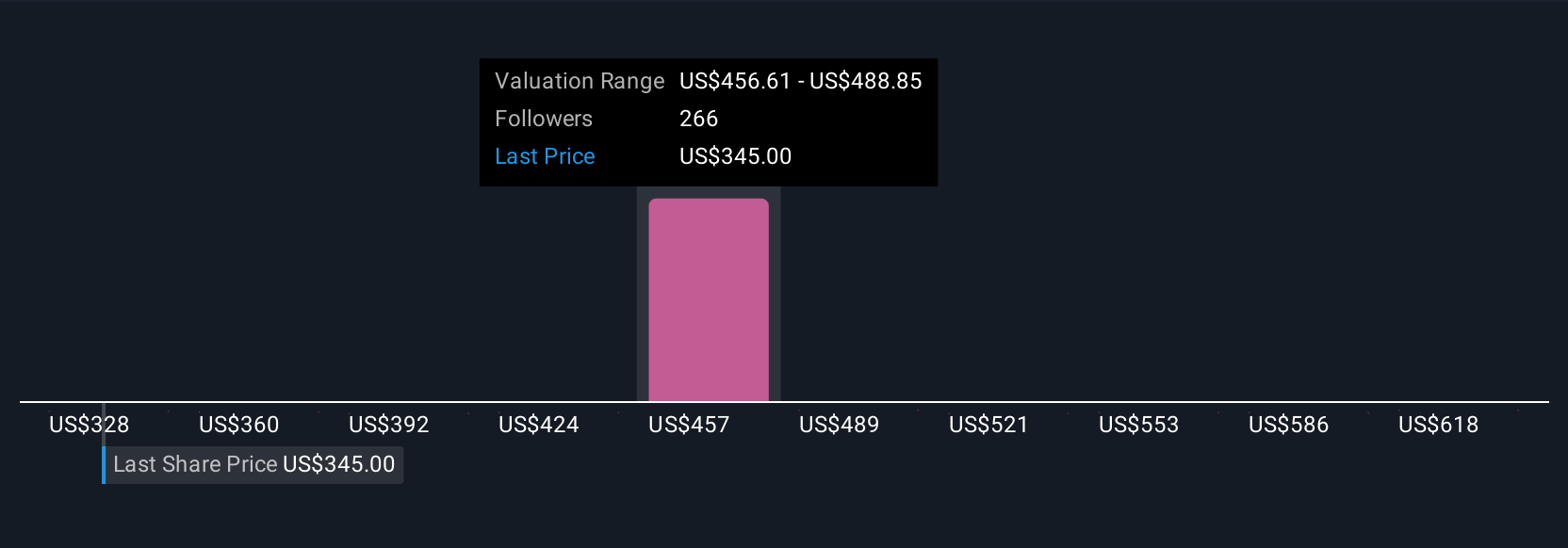

Simply Wall St Community members provided 26 unique fair value estimates for AppLovin, ranging widely from US$318 to US$663 per share. Opinions are equally split, but many view sector expansion as a catalyst for future revenue, so it’s important to consider how privacy regulation could affect returns.

Explore 26 other fair value estimates on AppLovin - why the stock might be worth as much as $663.26!

Build Your Own AppLovin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AppLovin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AppLovin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AppLovin's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives