- United States

- /

- Software

- /

- NasdaqGS:APP

AppLovin (APP): Assessing Valuation After Analyst Upgrades and Strong Earnings Back Industry-Leading Ad Tech Growth

Reviewed by Simply Wall St

AppLovin (APP) has grabbed investor attention after a series of upbeat analyst comments and a new buy rating, due to its leading presence in mobile game advertising and progress into eCommerce. The company's strong quarterly results and advancements in ad tech continue to support a growth narrative.

See our latest analysis for AppLovin.

AppLovin’s share price momentum has been hard to ignore. After surging more than 63% in the past 90 days, the stock is now up 81.6% year to date and boasts a staggering 266% total shareholder return over the past year. This remarkable run comes on the back of robust quarterly results, high-profile analyst endorsements, and growing market confidence in AppLovin’s leadership across mobile gaming and AI-powered ad tech.

If AppLovin's rapid rise has you thinking bigger, now is a great time to uncover other tech and AI-driven movers with our handpicked list: See the full list for free.

But with shares at all-time highs, the big question remains: is AppLovin still trading at a discount to its future potential, or are investors already pricing in every bit of growth ahead?

Most Popular Narrative: 4% Undervalued

AppLovin's fair value, according to the most widely followed narrative, sits at $646.30, just above the last close of $620.62. This narrows the gap between the current price and upside potential, prompting closer scrutiny of the underlying assumptions driving the bullish outlook.

Expanded rollout of the self-service AXON ads manager and Shopify integration is expected to open AppLovin's platform to a massive new base of small and mid-sized advertisers globally, dramatically increasing advertiser count and driving sustained uplift in topline revenue.

What astonishing forecast powers this valuation? The narrative’s foundation is rapid topline expansion, untapped advertiser pools, and a bold new profit margin target. Want to uncover just how aggressive these growth ambitions are? Dive in for the full details; there is more to this fair value than meets the eye.

Result: Fair Value of $646.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory scrutiny or slower adoption outside gaming could quickly challenge today's bullish outlook and change the direction of AppLovin's growth trajectory.

Find out about the key risks to this AppLovin narrative.

Another View on AppLovin's Valuation

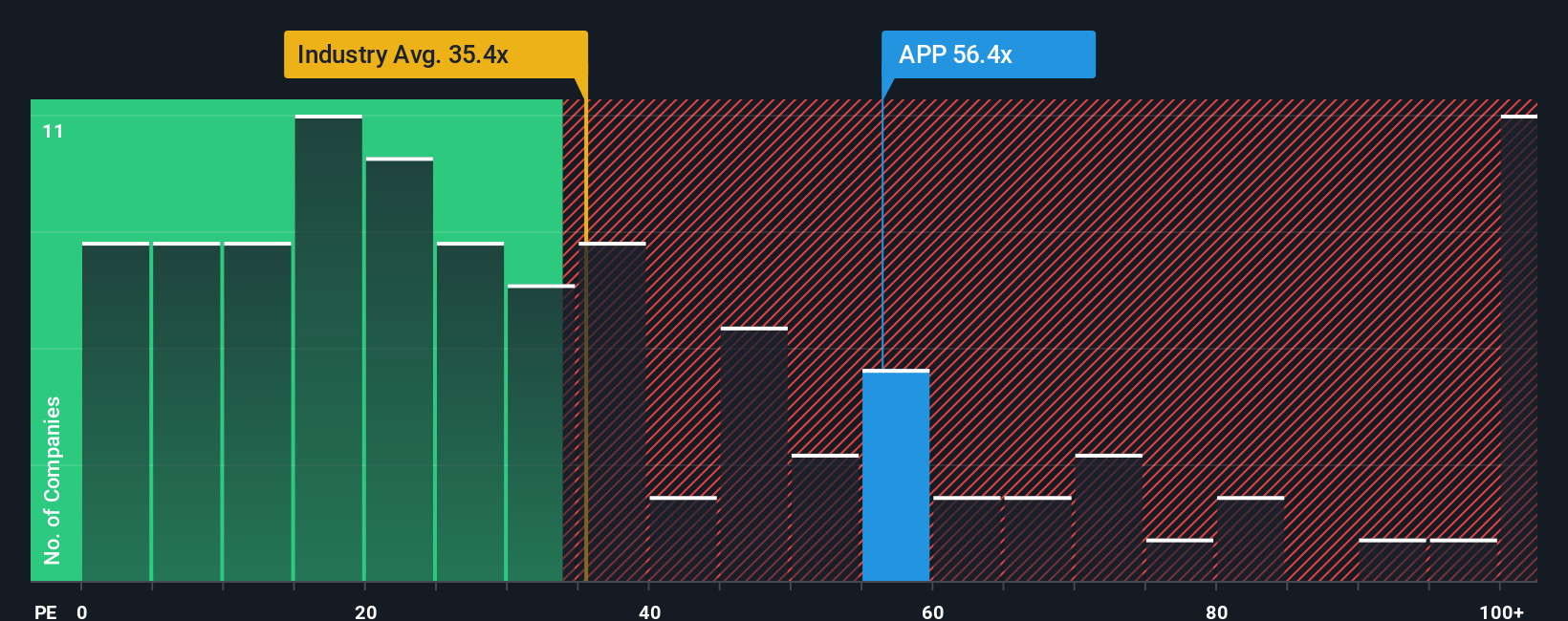

Looking from a different angle, AppLovin’s current market price reflects a price-to-earnings ratio of 83.5x, which is considerably higher than the US Software industry average of 34.1x, its peer group at 47.7x, and the estimated fair ratio of 58.4x. That signals a valuation premium. Could investors be overestimating the company’s growth trajectory, or is this premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AppLovin Narrative

If you'd rather chart your own course or examine the numbers directly, you can build a unique take on AppLovin's story in just minutes with our tools. Do it your way.

A great starting point for your AppLovin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Secure your edge by acting on the latest market trends. Our screeners highlight high-potential stocks you could miss if you wait. Here are three standout ways to spot your next mover:

- Tap into strong income with these 24 dividend stocks with yields > 3%, offering reliable yields above 3% for portfolio stability and long-term growth.

- Catch early momentum as these 26 AI penny stocks surge on the back of AI innovation and sector-wide excitement.

- Uncover value plays among these 848 undervalued stocks based on cash flows that analysts believe are trading below their true worth based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives